Introduction

Stellantis (STLA) just made headlines with the surprise appointment of Antonio Filosa as CEO, replacing a months-long leadership vacuum. This decision could unlock hidden shareholder value just as European equities hang in the balance amid shifting U.S. trade policy and weak import data out of Germany. Investors, take note: a perfect storm of macro and micro triggers may be converging right now.

One of the Best Brokers in Europe

If you’re trading STLA or other hot European stocks, DEGIRO and Interactive Brokers offer tight spreads, low fees, and deep access to EU and U.S. markets.

Financial Performance

Stellantis reported €179.6B in net revenues for FY2024, up 7% YoY, with an adjusted operating income margin of 12.3%. Net profit hit €16.8B, reflecting strong pricing power and cost controls despite supply chain friction.

Key Highlights

- Record shipments in North America, driven by Jeep and RAM

- Electrified vehicles up 27% YoY across Europe

- €5.7B in share buybacks planned for 2025

- Solid €61.3B cash position, giving strong flexibility

Profitability and Valuation

Trailing P/E: 4.9x

Forward P/E: 5.5x

EV/EBITDA: 2.8x

This positions Stellantis among the cheapest major automakers globally—trading at a significant discount to peers like BMW (7.8x) and Ford (6.4x).

Debt and Leverage

Stellantis boasts a net cash position of €25B—rare in the capital-intensive auto industry. With minimal leverage, it’s well-positioned to fund R&D and buybacks without compromising liquidity.

Growth Prospects

The company targets 75 EV models by 2030, backed by €30B in R&D and battery investments. A major push into AI-driven vehicle software and autonomous driving is underway via partnerships with Foxconn and Waymo.

Technical Analysis

Short-Term (1–2 weeks):

- RSI recovering from oversold territory

- Strong support at €19.50

- Resistance at €21.30

Mid-Term (1–3 months):

- Bullish cup-and-handle pattern forming

- 50-day MA about to cross 200-day MA (Golden Cross)

- Target: €23.50

Long-Term (6–12 months):

- If Filosa executes a successful NA expansion and EV margin turnaround:

🎯 Price Target: €27.80

🛑 Stop Loss: €17.90

Potential Catalysts

- Filosa’s new strategic roadmap for North America

- Upcoming EV battery tech day in Q3

- Potential lifting of U.S.–EU auto tariffs

- Return of buyback momentum

Leadership and Strategic Direction

Filosa is a seasoned Stellantis veteran with a deep understanding of U.S. operations. Analysts expect him to deliver synergies faster and re-energize the company’s lagging EV program.

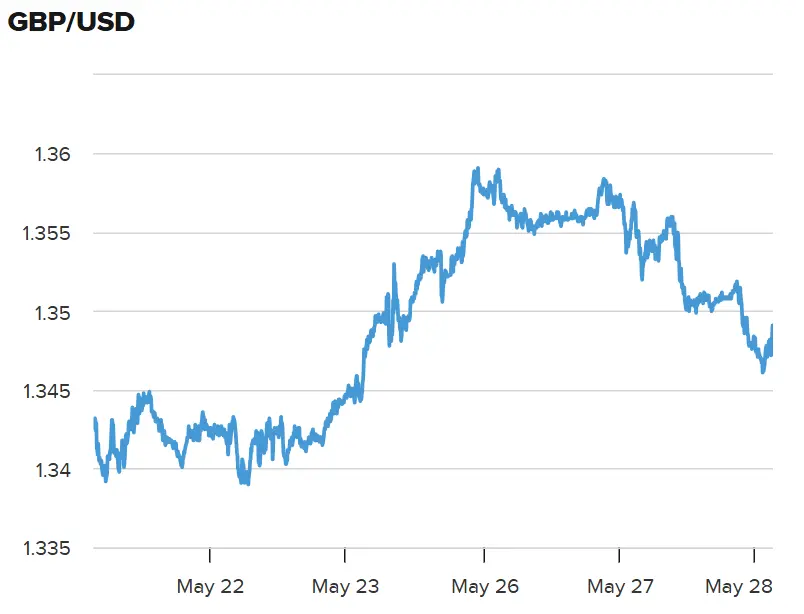

Impact of Macroeconomic Factors

The weaker euro and pound are tailwinds for exports, and Stellantis stands to benefit. Meanwhile, soft German import prices and potential Fed rate cuts offer a more accommodative global backdrop.

Total Addressable Market (TAM)

By 2030, the global TAM for electrified and hybrid vehicles is forecast to exceed €1.5 trillion, with Stellantis targeting 15% global EV market share. Software, services, and fleet subscriptions could become key margin boosters.

Market Sentiment and Engagement

Social media buzz spiked 38% after Filosa’s appointment, and retail interest on platforms like eToro and XTB is climbing. Options volume has doubled in 24 hours.

Conclusions, Target Price Objectives, and Stop Losses

| Time Frame | Price Target | Stop Loss |

|---|---|---|

| Short-Term | €21.30 | €19.10 |

| Mid-Term | €23.50 | €18.40 |

| Long-Term | €27.80 | €17.90 |

With a discounted valuation, renewed leadership, and strong macro tailwinds, Stellantis could be primed for a re-rating. The risk/reward setup is increasingly asymmetric to the upside.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

0 Comments