What is the Calmar Ratio?

The Calmar Ratio (short for California Managed Account Reports) is a risk-adjusted performance metric used to evaluate the return of an investment relative to its maximum drawdown. It provides investors with insights into how much return they are getting for every unit of downside risk. Unlike the Sharpe Ratio, which uses standard deviation as a measure of risk, the Calmar Ratio focuses specifically on capital loss risk, making it highly relevant in volatile markets.

Formula of the Calmar Ratio

The formula is straightforward:

Calmar Ratio = Annualized Rate of Return / Maximum Drawdown

Where:

- Annualized Rate of Return is the compounded return over a 1-year period.

- Maximum Drawdown is the greatest peak-to-trough decline in the value of the investment during the same period.

Why the Calmar Ratio Matters

Focus on Downside Risk

Unlike the Sharpe Ratio, which treats upside and downside volatility equally, the Calmar Ratio specifically penalizes strategies that suffer severe losses. This makes it a better tool for assessing how well a strategy performs when markets turn ugly.

Ideal for Trend-Following and Hedge Fund Strategies

Strategies like CTA (Commodity Trading Advisors), macro funds, and systematic trend followers often experience sharp drawdowns. The Calmar Ratio provides a more honest look at their performance by correlating it to real-world capital risks.

Better Indicator in Turbulent Markets

In highly volatile periods—such as during recessions, geopolitical tensions, or market corrections—the Calmar Ratio offers a clearer perspective on resilience than volatility-based metrics alone.

A Practical Example

Imagine two hedge funds:

- Fund A returns 20% annually with a maximum drawdown of 10%

- Fund B returns 25% annually with a maximum drawdown of 30%

Their Calmar Ratios are:

- Fund A: 20 / 10 = 2.0

- Fund B: 25 / 30 = 0.83

Even though Fund B offers higher returns, Fund A is significantly more efficient in balancing risk and reward. For every unit of capital risk, it delivers more value.

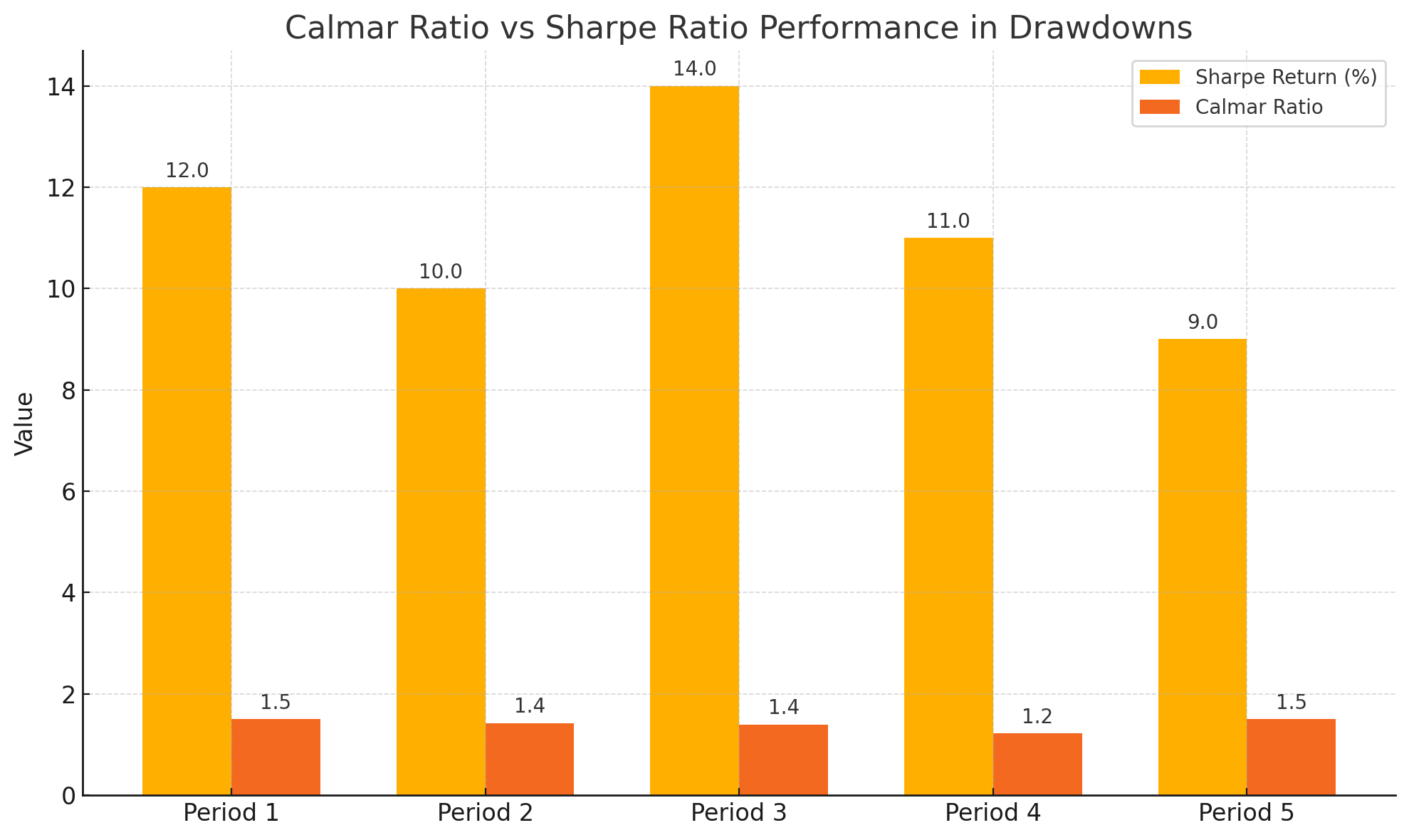

Comparing Calmar with Sharpe and Sortino Ratios

| Metric | Risk Focus | Best For |

|---|---|---|

| Sharpe Ratio | Total volatility | Stable returns, balanced risk |

| Sortino Ratio | Downside volatility | Asymmetrical risk, mild drawdowns |

| Calmar Ratio | Maximum drawdown | High-volatility, deep drawdown cases |

Limitations of the Calmar Ratio

- Not forward-looking: It uses historical drawdown data.

- Sensitive to timeframes: Drawdown and returns need to be matched to the same period.

- Less popular: Compared to Sharpe or Sortino, it’s not as widely known in retail circles.

When Should You Use the Calmar Ratio?

- When evaluating hedge funds or alternative strategies.

- During market crises or economic instability.

- To compare strategies with different volatility profiles.

- When maximum drawdown is a key constraint for your portfolio.

Final Thoughts

The Calmar Ratio is a powerful lens through which to view investment performance, especially when you’re concerned about capital preservation and drawdown sensitivity. While not a silver bullet, it complements other ratios to build a fuller risk picture.

Free Newsletter CTA

Get exclusive trading alerts, investment tips, and in-depth financial insights by joining our free newsletter.

Stay ahead of the market. Manage risk intelligently. Be part of the bullish side.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

0 Comments