📊 Market Analysis: Bitcoin (BTC) 🔹 1. Current Situation Price: $85,385.32 24h Change: +6.72% Market Cap: $1.7 Trillion (dominates the global market cap of $2.91T) 24h...

Master the Best Investment Strategies: Educational Insights and Expert Tips

What Does the CFA Teach? A Complete Guide to the CFA Curriculum (Levels I, II and III)

The CFA® Program provides one of the most comprehensive and respected educations in global finance. Across Levels I, II and III, candidates develop a deep understanding of financial analysis, valuation, economics, portfolio management and ethical decision-making.

Level I builds the foundation with essential tools: quantitative methods, financial reporting, economics, derivatives, and fixed income. Level II focuses on applying those tools to real-world valuation—studying equity, credit, alternatives, and complex financial statements using advanced analytical models. Level III brings everything together with a strong emphasis on portfolio management, wealth planning, risk control, and multi-asset allocation for both individual and institutional clients.

Throughout the program, the CFA curriculum reinforces ethical standards, practical investment skills, and a global perspective on financial markets. By the end of Level III, candidates can analyze businesses, value securities across asset classes, build diversified portfolios, and make strategic investment decisions with a disciplined professional framework.

This combination of depth, breadth, and ethical rigor is what makes the CFA a benchmark qualification in the investment industry.

The “Everything Bubble” and How to Protect Your Portfolio — A Simple Guide to Smart Option Strategies

Markets are flashing warning signs — record debt, inflated AI valuations, and stagflation risks. In this guide, we break down, in simple terms, how to protect your portfolio using smart option strategies like put spreads, collars, and covered calls. You don’t need to predict the crash — just prepare for it.

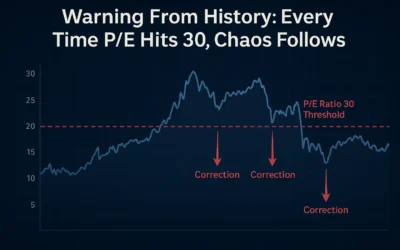

Warning From History: Every Time P/E Hits 30, Chaos Follows

Valuation Extremes as Predictors, Not Coincidence When equity markets reach a trailing price-to-earnings (P/E) ratio of 30× earnings, history reveals a pattern:...

Trump Sparks Outrage With Harsh New H1-B Restrictions

Former U.S. President Donald Trump has once again ignited a storm of controversy by backing new restrictions on H1-B visas, a program widely used by highly skilled...

Nikkei Pullback or Buying Opportunity? BOJ Holds Rates at 0.5% as Inflation Cools

Japan’s Nikkei 225 slipped after hitting fresh record highs as the Bank of Japan held rates at 0.5% and core inflation eased to 2.7%. With the yen strengthening and technical support near 44,000, this pullback could be the perfect buy-the-dip opportunity before the next rally. Our latest analysis reveals short-, medium-, and long-term targets on the Nikkei and USD/JPY, plus risk-managed trading strategies to seize the next move.

👉 Turn today’s volatility into tomorrow’s profits—get real-time trade alerts and actionable price levels now at BullishStockAlerts.com

.