Introduction

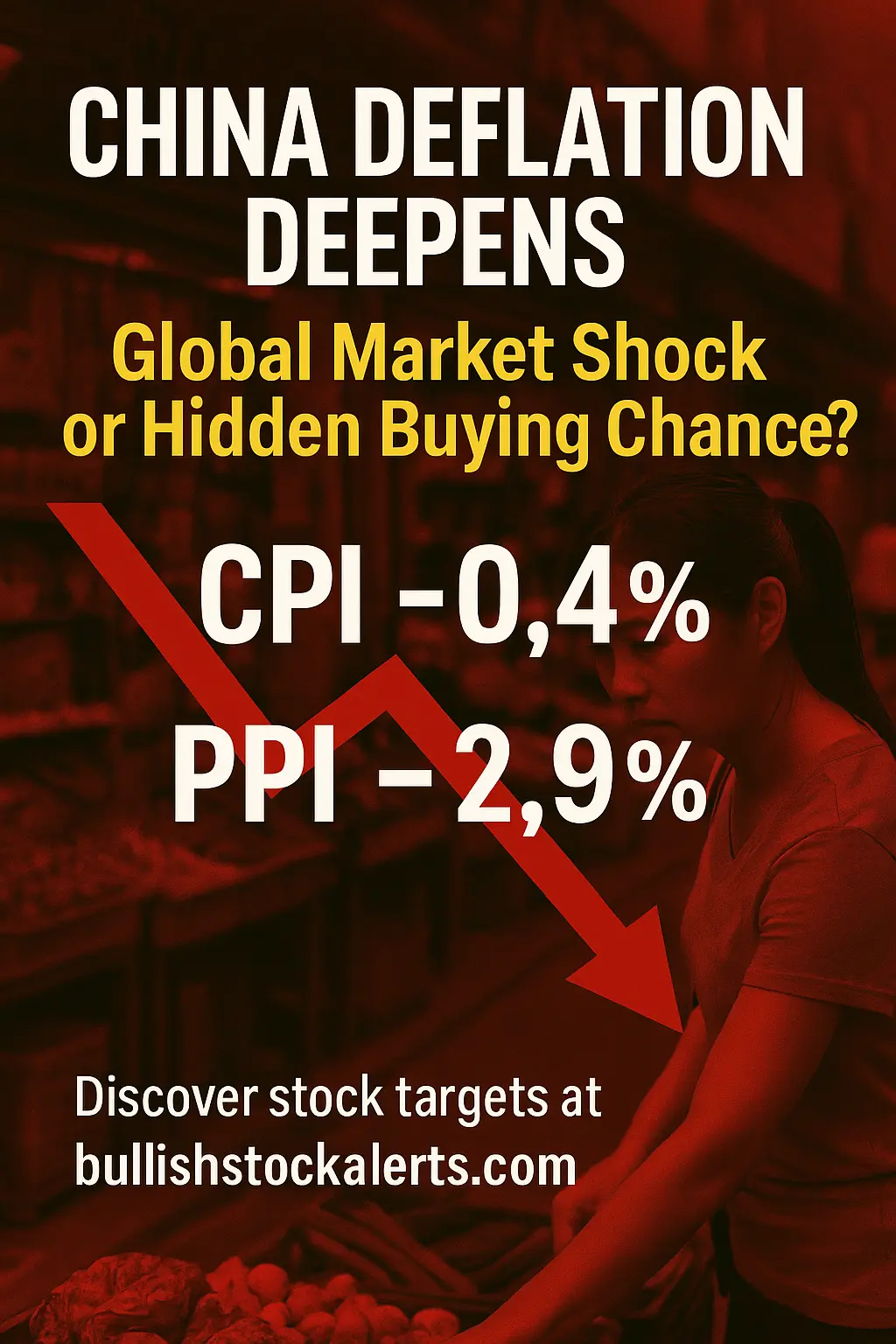

China’s economic engine is showing alarming cracks. The latest August data revealed a 0.4% dip in consumer prices, worse than economists’ forecast of -0.2%, while the producer price index (PPI) plunged 2.9% year-over-year. With deflation persisting, global investors are questioning whether Beijing’s limited stimulus measures can prevent a prolonged slowdown — and what this means for markets worldwide.

One of the Best Broker in Europe

Top-tier European brokers are now highlighting Chinese deflation as a systemic risk that could drag on commodities, industrials, and export-driven equities. For investors seeking to hedge against volatility, brokers recommend diversifying into defensive sectors and AI-driven growth markets.

Financial Performance

- CPI: -0.4% YoY (vs. -0.2% forecast).

- Core CPI: +0.9% YoY, the highest since Feb 2024.

- PPI: -2.9% YoY, now in its third year of declines.

Food prices, particularly pork and vegetables, collapsed further, amplifying consumer-level deflationary pressures.

Key Highlights

- Core strength in services: +0.6% YoY, showing resilience.

- Durables deflation: -3.7%, deeper than during the 2008 crisis.

- Global ripple effects: Deflation risks are spilling over into supply chains, putting pressure on export-oriented economies.

Profitability and Valuation

Chinese corporates, particularly in retail and manufacturing, face shrinking margins as price wars intensify. Foreign-listed Chinese ADRs trade at historically low forward P/E multiples, but investor confidence remains fragile.

Debt and Leverage

The property sector and local governments remain heavily indebted, limiting Beijing’s fiscal maneuvering. Any aggressive monetary easing risks exacerbating capital outflows.

Growth Prospects

Demand remains muted domestically, but exports to alternative markets (ASEAN, EU, Africa) continue to show resilience. Still, with U.S. tariffs tightening, long-term growth hinges on stronger domestic consumption — which is faltering under deflation.

Technical Analysis

- Shanghai Composite Index: Testing critical support at 2,950. A breakdown could trigger a slide toward 2,800.

- Hong Kong’s Hang Seng Index: Trading in oversold territory, suggesting a possible short-term bounce.

- Global spillover: Weak Chinese demand threatens commodity markets, particularly copper and oil.

Potential Catalysts

- Beijing rolling out new fiscal stimulus packages.

- Monetary easing via interest rate cuts.

- Rebound in global raw material demand.

Leadership and Strategic Direction

Chinese policymakers are prioritizing stability over aggressive stimulus. This cautious stance reflects fears of exacerbating debt bubbles, but it risks leaving deflation unchecked.

Impact of Macroeconomic Factors

Deflation in the world’s second-largest economy raises global risks:

- Lower demand for imports may weigh on European exporters.

- Commodity-linked currencies (AUD, CAD) could see heightened volatility.

- Global equities may experience risk-off rotations if Chinese data weakens further.

Total Addressable Market (TAM)

China’s consumer economy TAM remains enormous, but sustained deflation could shrink near-term opportunities for both domestic and foreign firms. Luxury goods, tech hardware, and commodities are most exposed.

Market Sentiment and Engagement

Global investors are jittery. Sentiment surveys show bearishness at multi-year highs, with many institutional investors shifting to cash or defensive allocations.

Conclusions, Target Price Objectives, and Stop Losses

- Short-term (1–3 months): Expect further downside for Chinese equities. Target: -8% from current levels.

- Medium-term (6–12 months): Stimulus-led rebound possible, with upside capped at +12–15%.

- Long-term (2–3 years): If Beijing successfully rebalances domestic demand, 20–25% upside remains feasible.

Stop-loss guidance: For China-exposed equities, consider setting stops 5–7% below key technical support.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter. Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter.

0 Comments