Introduction

China’s exports to the U.S. plunged 33% in August, dragging overall growth to a six-month low. The drop highlights the pressure from Trump’s tariff crackdown, weakening domestic demand, and fading benefits from temporary trade truces. With the U.S. still China’s largest single-country trading partner, markets are bracing for a new phase of volatility.

One of the Best Brokers in Europe

Investors looking to capture opportunities in global trade-sensitive stocks often turn to DEGIRO, Interactive Brokers Europe, and Saxo Bank, offering access to Chinese equities, U.S. indices, and commodities like copper and crude oil that move with trade flows.

Financial Performance

- Exports to U.S.: –33% YoY in August.

- Imports from U.S.: –16% YoY.

- Overall exports: +4.4% YoY (weakest since February).

- Imports: +1.3%, below forecasts.

Key Highlights

- Trump administration threatens 200% tariffs if China fails to deliver rare-earth exports.

- U.S. already imposes 40% tariffs on suspected transshipments.

- Exports to EU, ASEAN, and Africa surged double digits, offsetting part of the U.S. decline.

Profitability and Valuation

Export-heavy Chinese firms face margin pressure from tariffs and slowing demand. Meanwhile, U.S. retailers and manufacturers reliant on Chinese imports are grappling with higher costs. Valuation gaps may widen as global supply chains shift.

Debt and Leverage

China’s corporate debt remains elevated. Sluggish export earnings reduce cash flow buffers, adding to refinancing risks in a high-rate environment.

Growth Prospects

- Strong demand from Southeast Asia, Africa, and Latin America provides diversification.

- Domestic weakness persists, but policy easing could support recovery.

- If tariffs escalate, companies may accelerate supply-chain realignment to Vietnam, India, or Mexico.

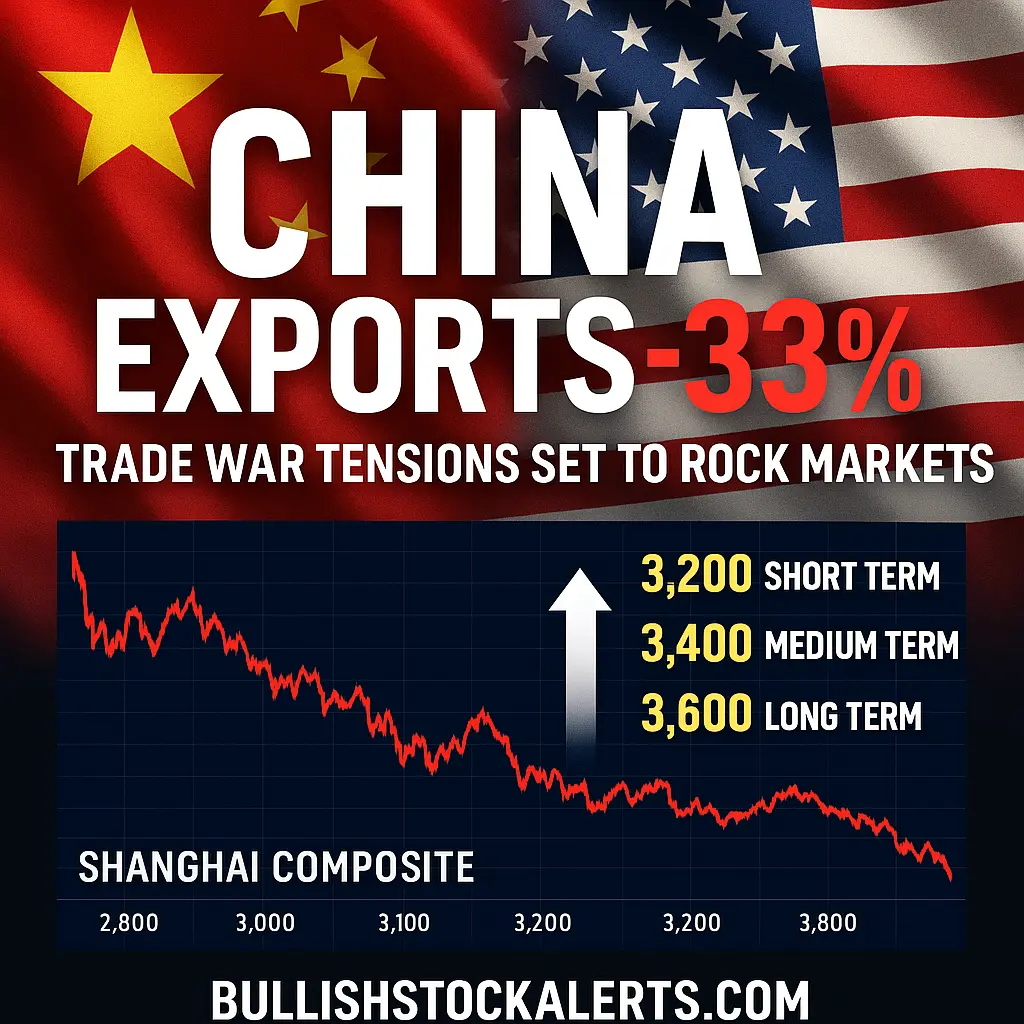

Technical Analysis (Shanghai Composite Index)

- Short-term (1–3 months): Support at 3,050; rebound potential to 3,150–3,200.

- Medium-term (6–12 months): If stimulus kicks in, target 3,350–3,400.

- Long-term (18–24 months): With sustained global demand, upside to 3,600+.

Stop Loss: 2,980

Potential Catalysts

- Beijing stimulus measures (rate cuts, subsidies).

- U.S.-China negotiations and tariff announcements.

- Rare-earth export dynamics.

- Domestic industrial output data.

Leadership and Strategic Direction

China’s policymakers are balancing stimulus with overcapacity control, prioritizing long-term industrial sustainability over short-term demand surges. This cautious approach is frustrating markets expecting aggressive easing.

Impact of Macroeconomic Factors

- Deflation risk: PPI –2.9% YoY, CPI negative.

- Global slowdown: Weighs on Chinese exports.

- Trade wars: Renewed friction with U.S. could depress shipments further.

Total Addressable Market (TAM)

China’s total exports exceed $3 trillion annually, with the U.S. still absorbing $283 billion YTD (Aug). Despite diversification, the U.S. remains irreplaceable as a single-country buyer.

Market Sentiment and Engagement

Sentiment is fragile. Investors see tariff headlines as trading catalysts, while institutions look to policy easing for sustained relief. Social media traders are eyeing rare-earth stocks as speculative plays amid escalating trade tensions.

Conclusions, Target Price Objectives, and Stop Losses

China’s export slump to the U.S. signals a deeper trade reset. While diversification is helping, risks of tariff escalation remain.

- Short-term target (Shanghai Comp): 3,150–3,200

- Medium-term target: 3,350–3,400

- Long-term target: 3,600+

- Stop Loss: 2,980

The setup offers high volatility trading opportunities across commodities, equities, and currencies.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter. Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter.

0 Comments