Introduction: Why CVaR Matters More Than You Think

Most investors have heard of Value at Risk (VaR), a popular measure used to estimate the maximum expected loss over a given time frame with a specific confidence level. But VaR only tells part of the story. It tells you how bad things could get up to a point. But what if things get worse?

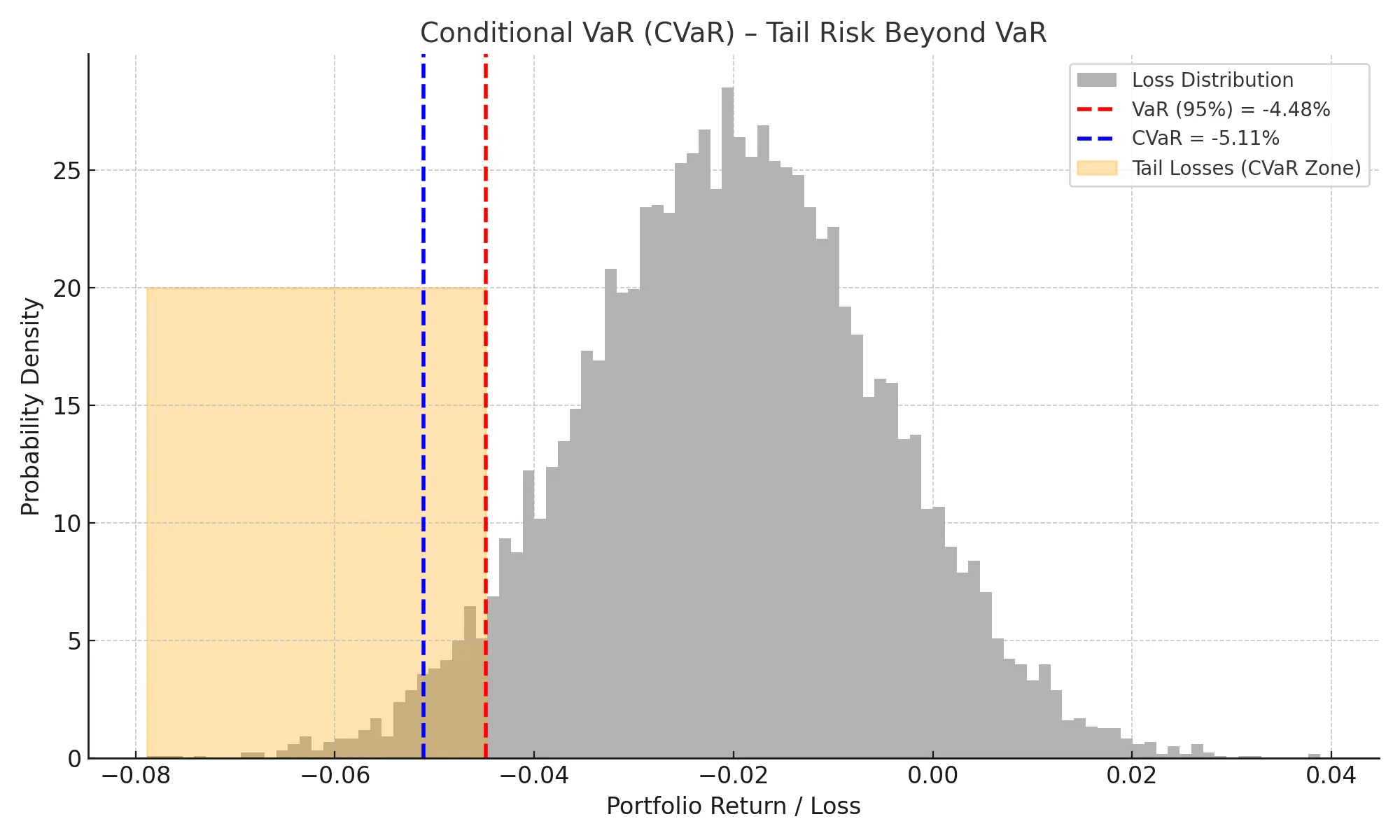

This is where Conditional Value at Risk (CVaR) comes in. Also known as Expected Shortfall, CVaR estimates the average loss in the worst-case scenarios beyond the VaR threshold. It’s one of the most important tools in modern risk management, especially in times of financial stress and market turmoil.

What Is Conditional Value at Risk (CVaR)?

Conditional VaR is a tail risk metric that captures the expected loss given that a loss exceeds the VaR. In simple terms, if your portfolio goes beyond the ‘worst-case’ loss defined by VaR, CVaR tells you how much worse the average loss will be in that tail.

The Formula:

If VaR at a confidence level α is defined as:

VaR_α = inf{ x ∈ ℝ : P(X ≤ x) ≥ α }

Then CVaR is:

CVaR_α = E[X | X ≤ VaR_α]

Why CVaR Is Better Than VaR

– VaR ignores tail losses: Once the threshold is crossed, VaR gives no information.

– CVaR captures extreme risk: It accounts for losses that happen in extreme market conditions.

– It is coherent: CVaR satisfies the properties of a coherent risk measure (monotonicity, sub-additivity, positive homogeneity, translation invariance), unlike VaR.

– Preferred by regulators and institutions: Basel III and other risk frameworks recommend or mandate CVaR in stress testing.

Real-Life Example: CVaR vs VaR

Suppose your portfolio has a daily VaR of $1 million at 95% confidence. This means there’s a 5% chance you could lose more than $1 million in a day.

But what if that 5% event occurs?

Your CVaR might tell you that, on average, when losses exceed that $1 million threshold, you actually lose $1.6 million.

So instead of preparing for a $1M worst-case, you’re actually looking at a much more severe average loss.

How CVaR Helps Portfolio Managers

– Stress Testing: Evaluates how portfolios behave during crises.

– Risk Budgeting: Allocates capital based on extreme downside expectations.

– Optimization: Modern portfolio theory can include CVaR as a constraint or objective.

– Asset Selection: Helps identify assets that contribute most to tail risk.

Limitations of CVaR

While CVaR offers deep insights, it’s not without challenges:

– Requires distributional assumptions: Often assumes normal or t-distributed returns.

– Sensitive to estimation errors in the tail.

– May overestimate or underestimate risk depending on the model used.

Still, CVaR remains one of the most robust risk indicators available for professional portfolio management.

Conclusion: Take Control of Your Tail Risk

In volatile markets, average losses aren’t enough. Smart investors need to prepare for what happens after the storm begins. CVaR goes beyond VaR to give you a fuller picture of downside risk.

Want more actionable insights like this?

👉 Join our free newsletter and get exclusive stock trading alerts, portfolio strategies, and risk management techniques directly in your inbox:

Because in markets, what you don’t see coming is what hurts the most.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

0 Comments