Discover how Cornish-Fisher VaR refines traditional risk assessment by accounting for skewness and kurtosis in financial returns.

Introduction

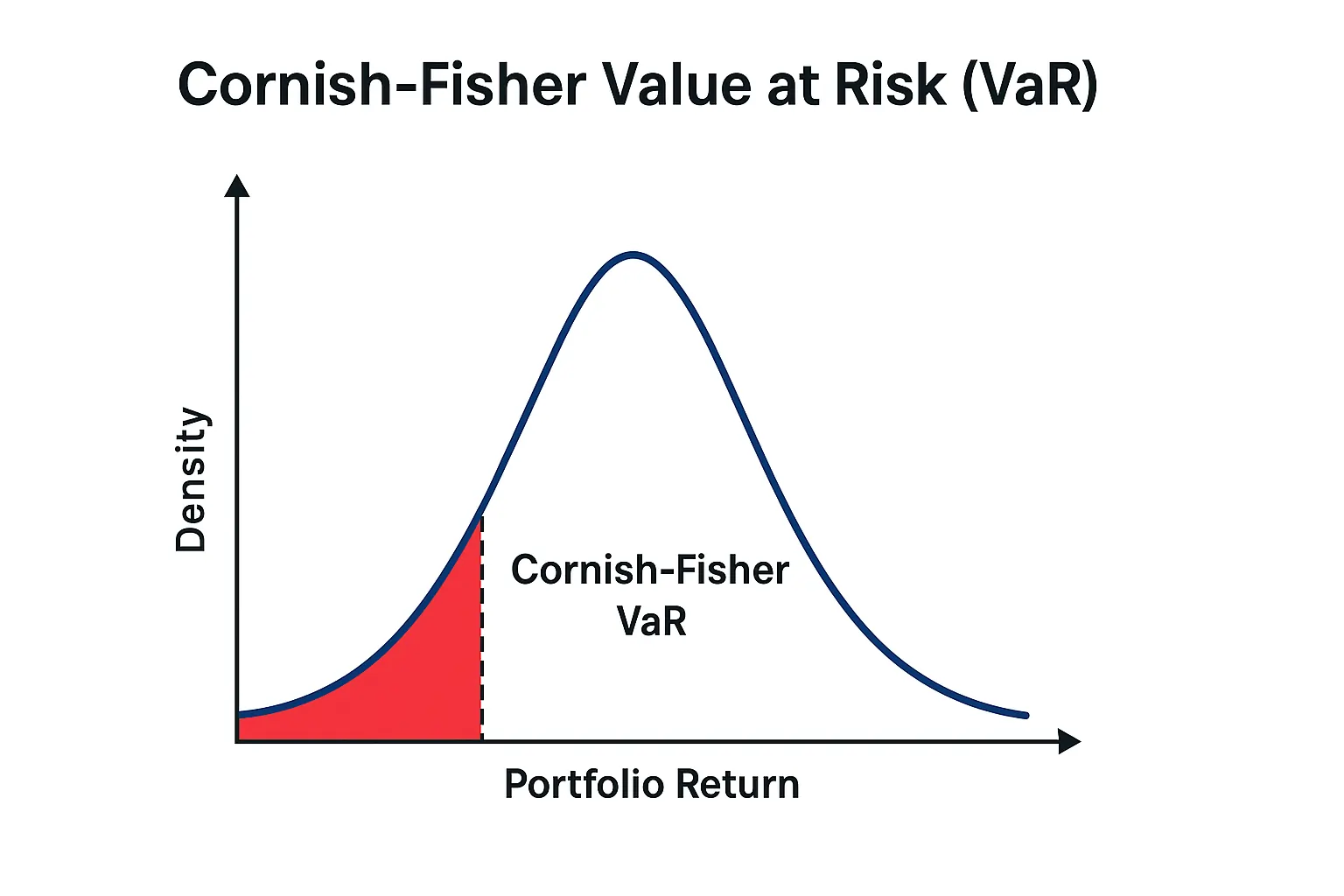

Value at Risk (VaR) is a fundamental metric used to estimate potential losses in a portfolio over a given time frame with a specified confidence level. However, the traditional approach assumes returns follow a normal distribution—a condition rarely met in real-world markets. This is where Cornish-Fisher VaR comes in, enhancing the model by incorporating skewness and kurtosis to more accurately reflect extreme events.

What Are Skewness and Kurtosis?

Skewness and kurtosis are statistical concepts that help describe the shape of a distribution — especially important when dealing with financial returns, which often deviate from the ideal bell curve (normal distribution).

Skewness – Measuring Asymmetry

Skewness tells us how symmetrical the distribution is:

- A skewness of 0 implies a perfectly symmetrical distribution.

- A positive skew (right-skewed) means the right tail is longer; extreme positive returns are more likely.

- A negative skew (left-skewed) means the left tail is longer; large losses are more probable.

In investing, a negative skew is concerning because it indicates a higher chance of extreme losses.

Kurtosis – Measuring Tail Thickness

Kurtosis measures the “tailedness” of the distribution — how much of the variance is due to extreme deviations.

- Normal distribution kurtosis = 3

- Excess kurtosis = Kurtosis – 3

- A high positive excess kurtosis indicates fat tails — more frequent extreme outcomes (both gains and losses).

- A low kurtosis suggests fewer extreme outliers than a normal distribution.

In practice, if returns have high kurtosis, there’s a greater chance of tail events — think market crashes or massive gains.

What Are Tail Events?

In finance, “tail events” refer to rare and extreme outcomes — either very large gains or (more often) very large losses — that occur in the tails of a probability distribution.

Why “Tail”?

Imagine a bell curve (normal distribution):

- The center represents the most common, average outcomes.

- The “tails” on the left and right represent extreme outcomes — far from the average.

- Tail events are in those extreme ends.

Examples of Tail Events in Real Life:

- A stock market crash like Black Monday (1987) or the 2008 financial crisis.

- A company’s stock plummeting 80% in one day due to a fraud revelation.

- A sudden 10x gain from a biotech firm after FDA approval (rarer, but possible).

These events are unlikely but impactful. Traditional models like standard VaR often underestimate their frequency and severity, because they assume returns follow a normal distribution (thin tails).

Why Tail Events Matter in Risk Management:

- Traditional VaR assumes normality → underestimates risk of extreme losses.

- Cornish-Fisher VaR adjusts for skewness (asymmetry) and kurtosis (fat tails), making it better at capturing tail risk.

So, tail events are at the heart of why Cornish-Fisher VaR is more realistic and useful than the basic VaR in many market environments.

What is Traditional VaR?

Traditional VaR (Variance-Covariance method) assumes normality and calculates potential loss as:

VaR = Z × σ × √t

Where:

– Z is the z-score for the confidence level (e.g., 1.65 for 95%)

– σ is the portfolio’s standard deviation

– t is the time horizon

Limitations of Traditional VaR

Financial returns often exhibit skewness (asymmetry) and excess kurtosis (fat tails), meaning extreme losses are more probable than a normal distribution suggests. Traditional VaR underestimates these risks.

Cornish-Fisher Expansion Explained

The Cornish-Fisher method adjusts the Z-score used in the VaR calculation to account for skewness (S) and kurtosis (K). The adjusted Z is calculated as:

Z_cf = Z + (Z² – 1)S / 6 + (Z³ – 3Z)(K – 3) / 24 – (2Z³ – 5Z)S² / 36

Then, the Cornish-Fisher VaR is:

VaR_CF = Z_cf × σ × √t

Practical Example

Assume:

– Portfolio value: €1,000,000

– Daily volatility: 2%

– Skewness: -1.2

– Kurtosis: 6

– Time horizon: 1 day

– Confidence level: 99% → Z = 2.33

Using Cornish-Fisher, the adjusted Z_cf ≈ 2.8

VaR_CF = 2.8 × 0.02 × √1 = 5.6% = €56,000

Compared to:

Traditional VaR = 2.33 × 0.02 = 4.66% = €46,600

Key Differences

– Traditional VaR assumes normal returns; Cornish-Fisher allows for non-normality

– Cornish-Fisher is more accurate under market stress

– Better tail-risk estimation

When to Use Cornish-Fisher VaR?

Use Cornish-Fisher when managing portfolios with significant skew/kurtosis, such as in hedge funds, options portfolios, or during periods of market turbulence.

Conclusion

Cornish-Fisher VaR gives investors a more nuanced view of risk in the presence of skewness and fat tails. While more complex, it delivers more realistic estimates of potential losses, especially in volatile markets.

→ Want more insights like this? Join our free newsletter and stay ahead of the curve.

Stay ahead of the market. Manage risk intelligently. Be part of the bullish side.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

0 Comments