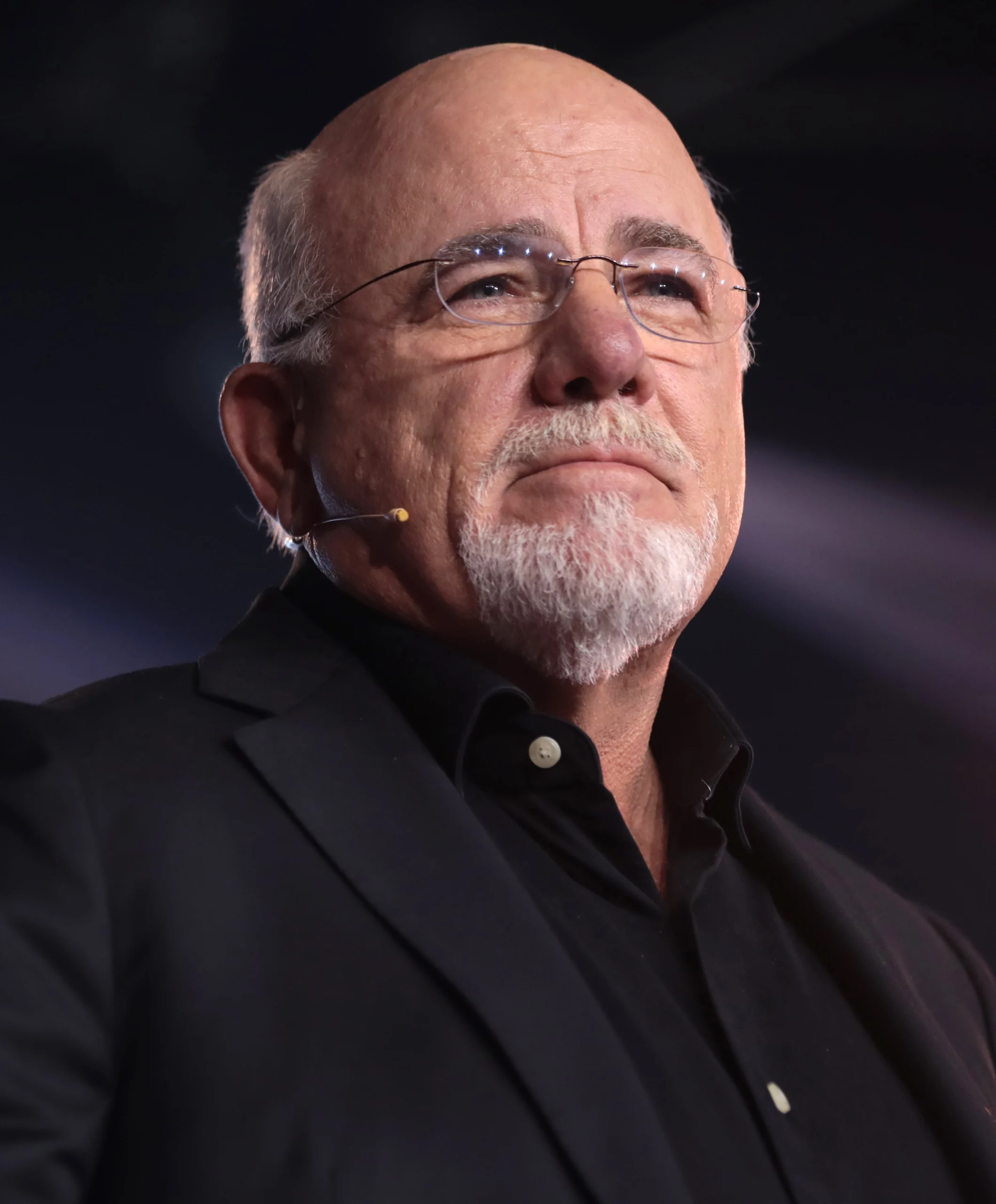

Managing money can feel stressful, especially with rising costs and endless bills. However, financial freedom is possible with the right plan. Dave Ramsey, a trusted personal finance expert, has helped millions achieve financial peace through simple, practical steps. His approach focuses on discipline and clear goals. In this post, we’ll explore Ramsey’s key principles and show you how to apply them.

Dave Ramsey’s Core Ideas

Ramsey’s advice is straightforward. He believes anyone can build wealth by making smart choices. His 7 Baby Steps offer a clear path, from paying off debt to saving for the future. For example, he emphasizes living within your means and avoiding debt. As a result, his methods are easy to follow and focus on changing your habits.

Steps to Take Control of Your Money

Here are Ramsey’s top tips, with simple ways to start:

A budget helps you control your spending. Ramsey suggests a zero-based budget, where every dollar has a job, like paying bills or saving.

Make a Budget and Follow It

How to Start:

- List your income and expenses.

- Assign every dollar to a category, such as rent or groceries.

- Track spending daily with apps like EveryDollar. For instance, check your budget before buying coffee to avoid overspending.

Pay Off Debt Fast

Debt holds you back. Ramsey’s Debt Snowball method focuses on paying off small debts first to build confidence.

How to Start:

- List debts from smallest to largest.

- Pay minimums on all but the smallest debt, which gets extra payments.

- Once it’s paid, move to the next debt. As a result, you’ll feel motivated by quick wins.

Save for Emergencies

An emergency fund protects you from surprises, like car repairs. Ramsey says to save $1,000 first, then build a larger fund later.

How to Start:

- Cut extras, like eating out, to save $1,000 fast.

- Keep it in a separate savings account.

- Later, aim for 3-6 months of expenses. This way, you’re ready for unexpected costs.

Spend Less Than You Earn

Ramsey’s motto is, “Live like no one else so you can live like no one else.” In other words, spend less now to save more later.

How to Start:

- Skip impulse buys, like new gadgets.

- Use cash for small purchases to avoid overspending.

- Save the extra money for your goals. Consequently, you’ll have more to invest or give.

Invest for Your Future

After clearing debt and saving, invest 15% of your income for retirement. This builds wealth over time.

How to Start:

- Open a 401(k) or Roth IRA.

- Choose mutual funds with good returns.

- Keep investing, even if markets dip. For example, steady contributions grow with compound interest.

Give Back

Giving makes you feel rich. Ramsey encourages donating, even a little, to causes you care about.

How to Start:

- Add giving to your budget.

- Support a local charity or church.

- Increase giving as your finances grow. Thus, you’ll make a difference and feel fulfilled.

Why Ramsey’s Plan Works

Ramsey’s steps are effective because they’re simple. For instance, the Debt Snowball builds momentum by focusing on small debts. Moreover, his budget system helps you stay mindful. Critics say paying high-interest debts first saves more, but Ramsey focuses on behavior. In fact, quick wins keep you motivated, which matters more than math.

Start Today

Taking control of your money is easy with these steps:

- Check Your Finances: List income, expenses, and debts.

- Set Goals: Decide if you want to clear debt or save.

- Save $1,000: Sell unused items or skip takeout to hit this goal.

- Learn More: Read The Total Money Makeover or listen to The Ramsey Show.

- Stay Accountable: Tell a friend your plan or join a finance class.

Final Thoughts

Dave Ramsey’s advice is a clear path to financial peace. By budgeting, paying off debt, saving, living frugally, investing, and giving, you can control your money. Therefore, start small, stay consistent, and watch your finances improve. Your future self will thank you!

Stay informed with our free investment strategies! Investment Blog.

0 Comments