A new chapter in the Israel–Iran conflict has ignited global markets. Recent military strikes have sent oil prices soaring. Investors are rushing to safe havens. This post breaks down the chaos, trading shifts, and what it means for the economy.

The Conflict Ignites

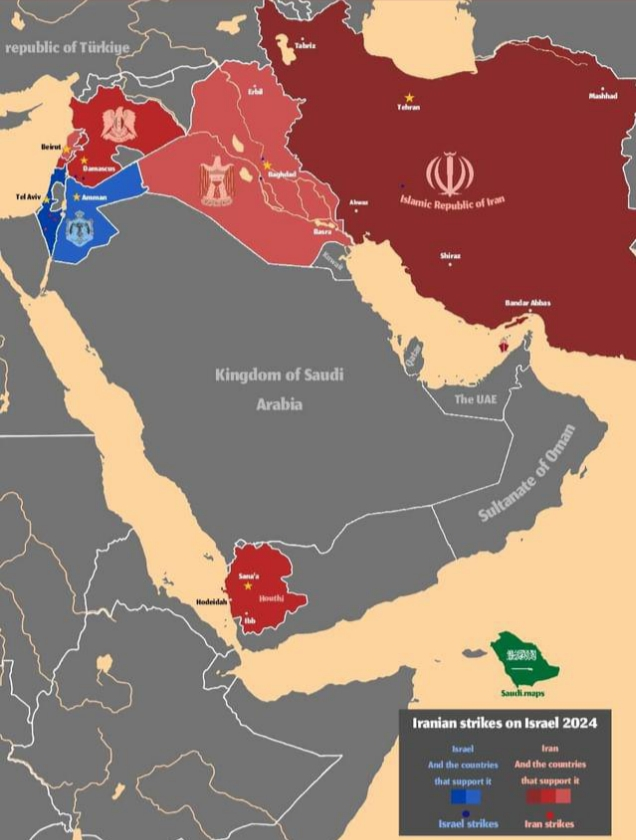

Israel launched strikes on Iran’s nuclear and military sites. This happened early Friday. Iran fired back with missiles and drones. Explosions rocked Tel Aviv and Jerusalem. The clash marks a sharp rise in tensions. It threatens stability in the oil-rich Middle East. Markets felt the shock instantly.

Oil Prices Soar

Oil prices jumped fast. Brent crude hit $74.23 a barrel, up 7%. U.S. crude rose to $72.98, a 7.3% gain. This is the biggest spike since 2022. Fears of disrupted supplies drive the rise. The Strait of Hormuz, key for 20% of global oil, faces risks. A closure could double prices. Yet, some say the jump may ease if the fight stays small.

Investor Panic Sets In

Stocks tumbled. The Dow fell 770 points, or 1.8%. The S&P 500 dropped 1.1%. Gold climbed to $3,431 an ounce, a safe haven. The U.S. dollar strengthened. Yields on 10-year Treasuries rose to 4.413%. Investors fear a wider war. They worry about inflation and higher energy costs. Panic could fade if talks calm things down.

Economic Ripple Effects

Higher oil prices hit consumers hard. Gas costs may rise 10-25 cents per gallon. Inflation could climb 1% if oil hits $100. This challenges central banks’ plans. Trump’s push for low energy prices faces pressure. Middle East oil flows are vital. A sustained cut could spark a recession. But spare capacity from OPEC+ might soften the blow.

Skepticism and Hope

The market reaction seems overblown to some. Past tensions didn’t always disrupt oil much. China’s demand drop and U.S. production growth limit the impact. Talks between the U.S. and Iran, set for Sunday in Oman, offer hope. Yet, Israel’s “lengthy operation” warning fuels doubt. The establishment sees a buying chance. Critics call it a risky bet.

What Lies Ahead

The conflict’s path is unclear. A short fight may stabilize markets. A broader war could push oil past $150. Iran’s retaliation hinges on U.S. involvement. Shipping routes like the Strait of Hormuz are at risk. Investors must watch closely. The outcome will shape energy costs and global growth in 2025.

Conclusion

The Israel–Iran conflict has erupted. Oil spikes and investor panic follow. Trading shows fear but also resilience. Economic stakes are high. Will peace talks work? Or will war deepen the crisis? The next days will tell. Stay alert as this unfolds.

Read more on our blog: Investment Blog.

0 Comments