Introduction: Why Maximum Drawdown Matters

When markets fall, emotions rise. Fear, uncertainty, and regret often take the wheel when portfolios experience a major decline. But how do we quantify this pain? Enter **Maximum Drawdown (MDD)** — one of the most powerful and underused tools in portfolio risk management. Whether you’re a retail investor or a portfolio manager, understanding your drawdown exposure is crucial to surviving and thriving in volatile markets.

What Is Maximum Drawdown?

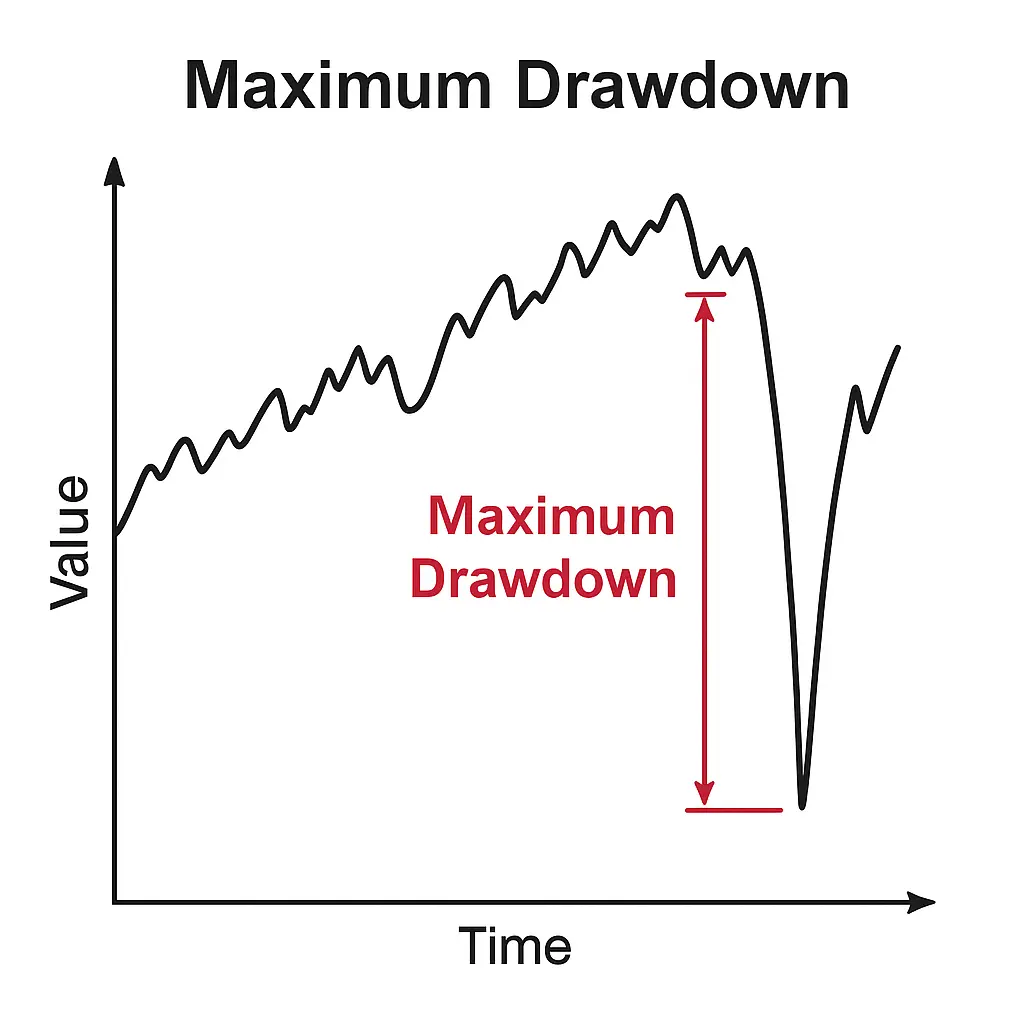

**Maximum Drawdown (MDD)** measures the largest peak-to-trough decline in the value of a portfolio, before a new peak is reached. It tells you how much your investment has fallen from its highest point during a specific period.

Formula:

MDD = (Trough Value – Peak Value) / Peak Value × 100

Example:

Let’s say your portfolio reached a high of $100,000 and then fell to $65,000 before recovering.

MDD = (65,000 – 100,000) / 100,000 × 100 = -35%

This means your maximum drawdown was **35%**.

Why Is Maximum Drawdown Important?

– Psychological Impact: Investors often panic-sell during drawdowns. Knowing your MDD tolerance helps prevent emotional decisions.

– Risk Management: MDD shows how much risk is being taken for a given return.

– Strategy Evaluation: A strategy that earns 10% with a 50% drawdown is not the same as one earning 10% with a 10% drawdown.

– Capital Recovery Time: The deeper the drawdown, the longer it takes to recover.

Recovery Rule of Thumb:

If your portfolio loses 50%, it needs to gain 100% just to break even.

Maximum Drawdown vs. Other Risk Metrics

| Metric | Measures | Best For |

|---|---|---|

| Volatility | Standard deviation of returns | Daily price fluctuations |

| VaR (Value at Risk) | Probabilistic worst-case loss | Short-term market risk |

| Sharpe Ratio | Risk-adjusted return | Comparing investments |

| Maximum Drawdown | Historical loss from peak | Emotional/strategic risk |

Maximum Drawdown offers a **real-world perspective** on what an investor might actually experience in a bear market, unlike purely statistical measures like volatility.

How to Reduce Maximum Drawdown

Diversification

Spread your assets across sectors, asset classes, and geographies.

Stop-Loss Strategies

Automated triggers to limit downside.

Hedging

Use options, inverse ETFs, or other instruments to offset potential losses.

Tactical Asset Allocation

Rebalance portfolios based on market trends and macro signals.

Quality Investing

Favor companies with strong balance sheets, cash flows, and durable advantages.

Tools to Track Maximum Drawdown

– Trading platforms like TradingView or MetaTrader

– Portfolio analytics tools (e.g., Morningstar, Portfolio Visualizer)

– Custom Excel sheets using rolling peak and trough logic

Final Thoughts: MDD as Your Financial Heart Rate Monitor

Maximum Drawdown doesn’t just show you a number — it tells a story. It’s your portfolio’s pain threshold, revealing how much loss you can endure and still stay in the game. Smart investors don’t just chase returns; they understand and respect drawdown risk.

🔔 Want More Insights Like This?

Join our free newsletter and receive exclusive stock trading alerts, risk management tips, and expert insights to grow your portfolio confidently.

No spam. Just high-value insights.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

Frequently Asked Questions (FAQ)

What is considered a “good” maximum drawdown?

It depends on your strategy. For conservative portfolios, <10% is ideal. For aggressive strategies, <20-25% might be acceptable.

Is maximum drawdown backward-looking?

Yes. It is based on historical performance. However, it helps inform future risk tolerance and decision-making.

Can MDD be predicted?

Not precisely. But stress-testing and scenario analysis can give you expectations under various conditions.

Is MDD relevant for long-term investors?

Absolutely. Even long-term investors must survive the short-term to realize long-term gains.

*Written by the Bullish Stock Alerts editorial team. Always remember: capital preservation is the foundation of compounding.*

0 Comments