In a world full of noise, volatility, and uncertainty, how do you know if your investment is truly performing well? Is a 10% annual return impressive — or is it just a reward for taking on excessive risk? Enter the Sharpe Ratio, one of the most essential tools in modern portfolio theory.

🔍 What Is the Sharpe Ratio?

Developed by Nobel laureate William F. Sharpe, the Sharpe Ratio is a metric that helps investors understand how much excess return they are earning for each unit of risk taken.

It’s not just about how much your investment grows — it’s about how consistently it grows relative to the risk involved.

📐 The Formula

Sharpe Ratio=Rp−Rff / σp

Where:

- Rp = Portfolio return

- Rff = Risk-free rate (e.g., 3-month Treasury bills)

- σp\sigma = Standard deviation of portfolio returns (i.e., volatility)

🧠 Why Does It Matter?

A higher Sharpe Ratio means you are being rewarded more efficiently for the risk you take. It tells you:

- Whether an investment’s returns are worth its volatility

- How well a portfolio performs compared to a “safe” investment

- Which of two portfolios with similar returns is actually better

📊 A Simple Example

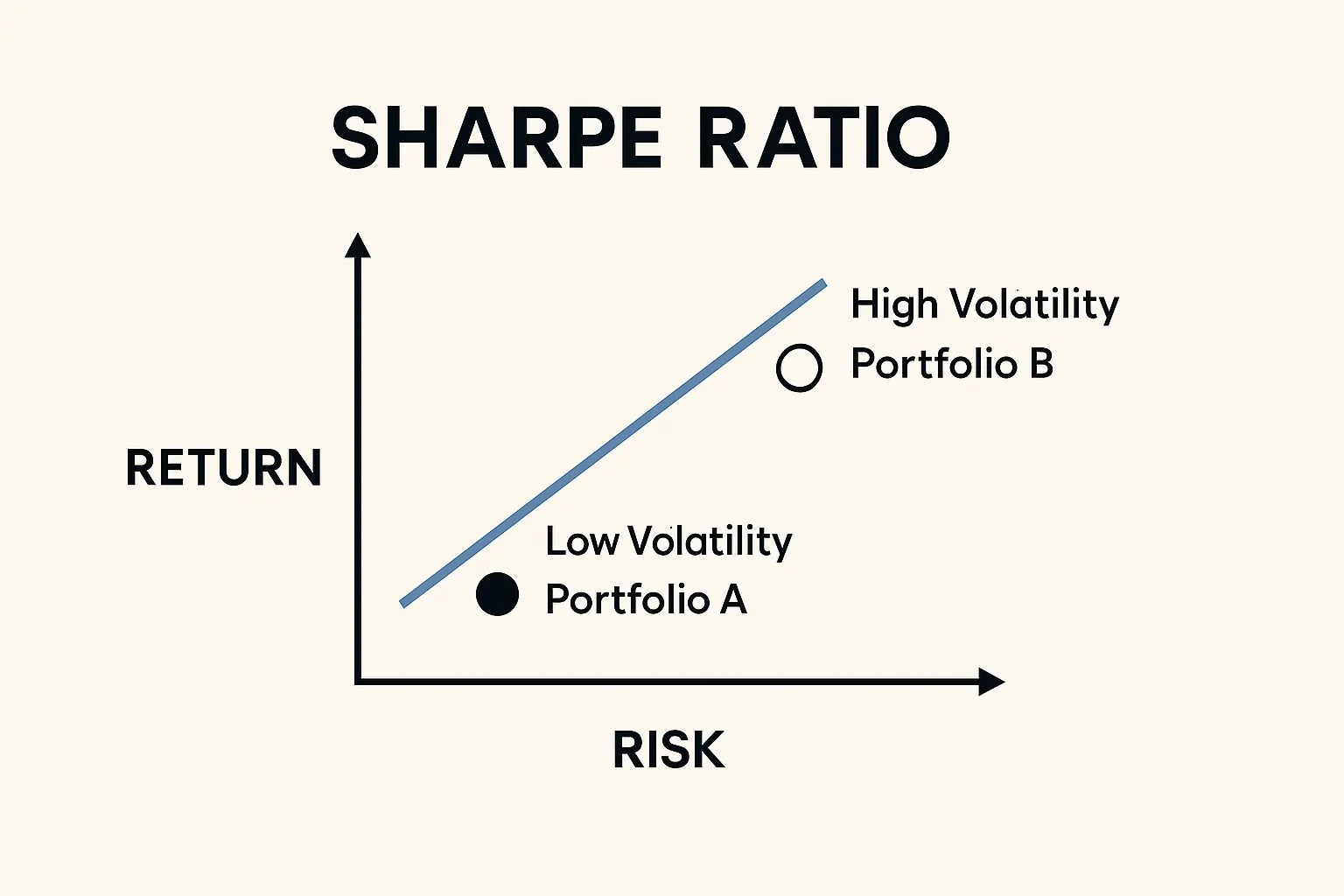

Let’s compare two portfolios:

| Portfolio | Return | Volatility | Sharpe (R_f = 2%) |

|---|---|---|---|

| A | 12% | 10% | 1.00 |

| B | 15% | 20% | 0.65 |

At first glance, Portfolio B looks better due to a higher return. But once risk is considered, Portfolio A clearly delivers more return per unit of risk.

📈 When to Use It

- Comparing mutual funds or ETFs

- Evaluating robo-advisors or fund managers

- Optimizing portfolios using Modern Portfolio Theory

- Filtering assets in a screener or backtesting engine

⚠️ Limitations to Keep in Mind

- Assumes normally distributed returns (not always realistic)

- Can be distorted by extreme values or skewed data

- Doesn’t differentiate between upside and downside volatility

→ If you care more about downside risk, check out the Sortino Ratio (coming in the next article).

🎯 Key Takeaway

The Sharpe Ratio is a simple yet powerful tool to evaluate whether your returns are worth the risk. Whether you’re a beginner or a professional, it should be a core metric in your decision-making toolbox.

Want more tools like this?

Subscribe to our newsletter to receive exclusive trading alerts, investment tips, and educational insights — for free.

0 Comments