by Fatih | Jun 2, 2025 | Investing Tools and Regulations

Introduction – Why Market Exposure Matters Every investor wants higher returns, but few understand the underlying risks they’re exposed to. Two key metrics that help you evaluate your portfolio’s sensitivity to the market are Beta and Volatility. These are directly...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

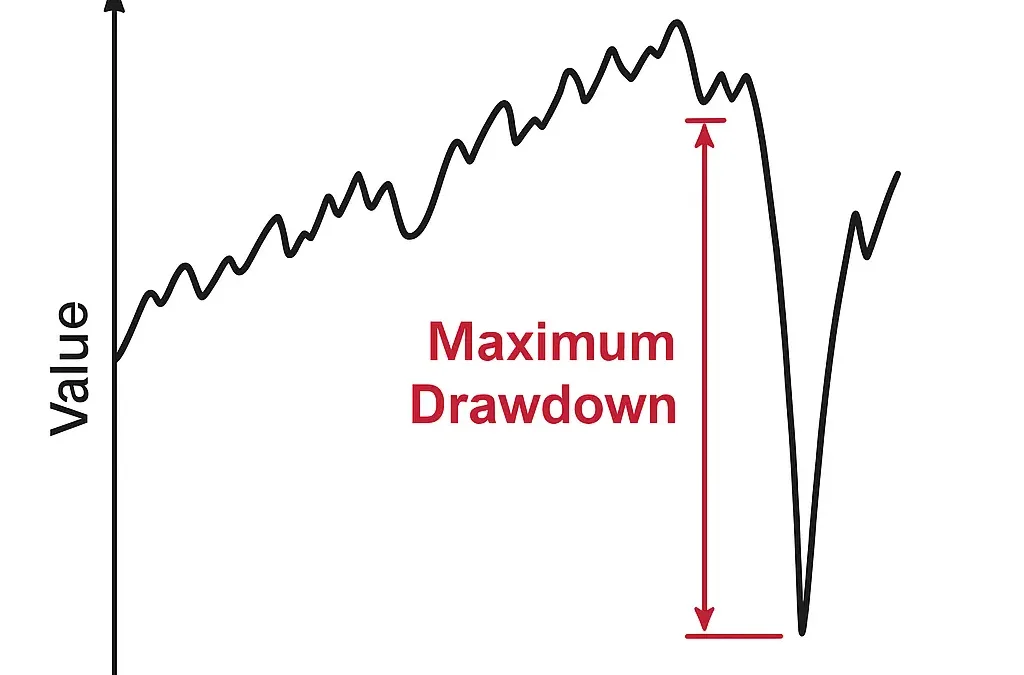

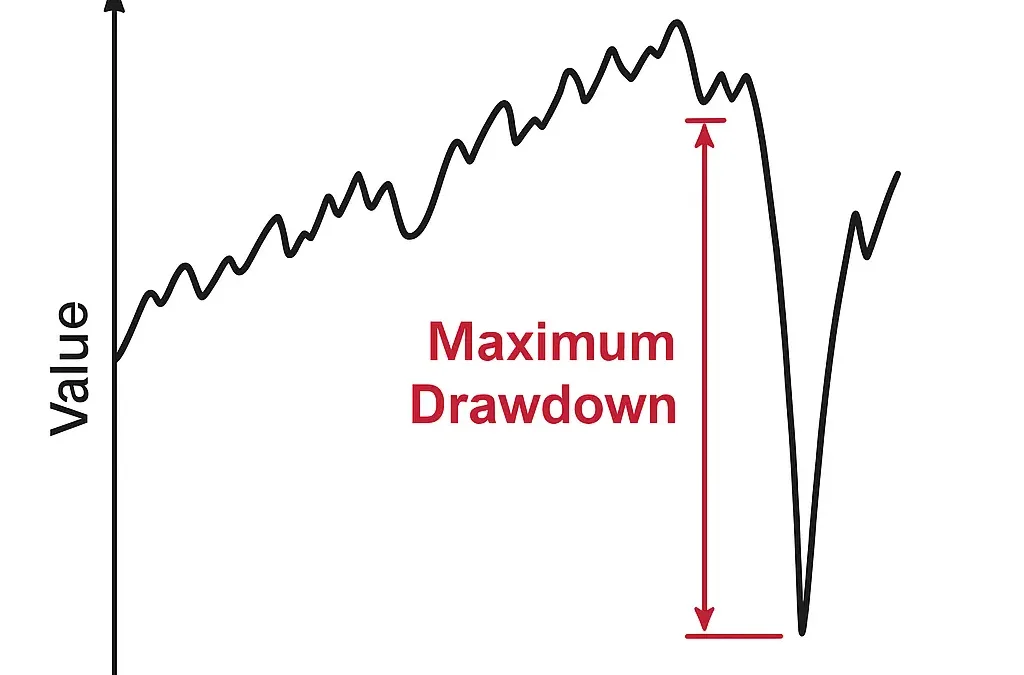

Introduction: Why Maximum Drawdown Matters When markets fall, emotions rise. Fear, uncertainty, and regret often take the wheel when portfolios experience a major decline. But how do we quantify this pain? Enter **Maximum Drawdown (MDD)** — one of the most powerful...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

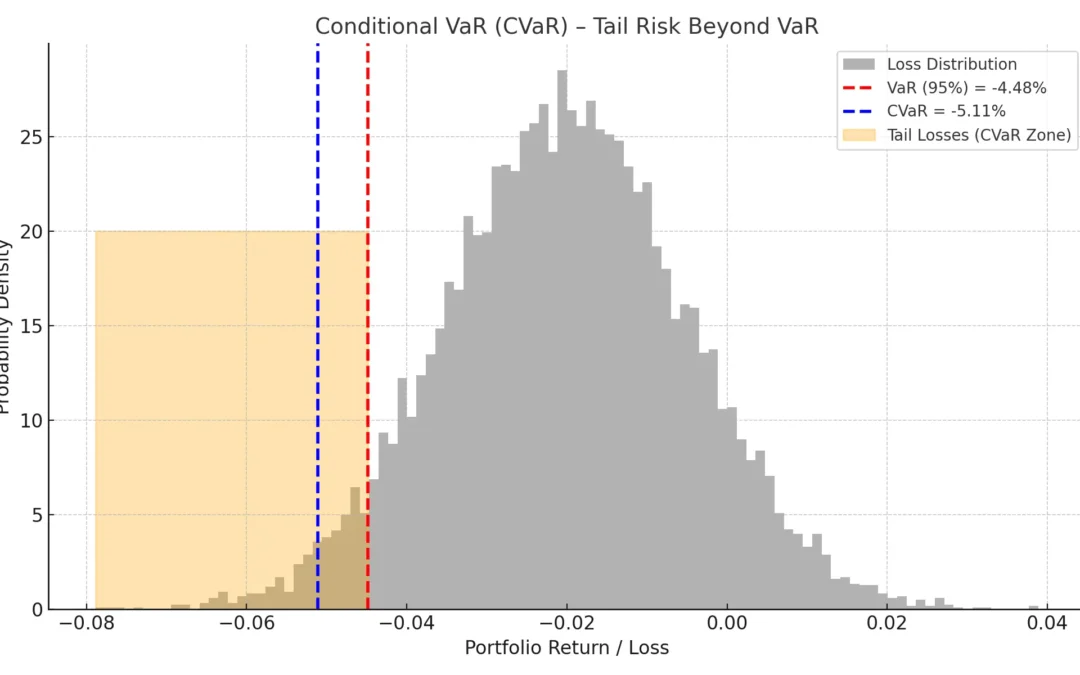

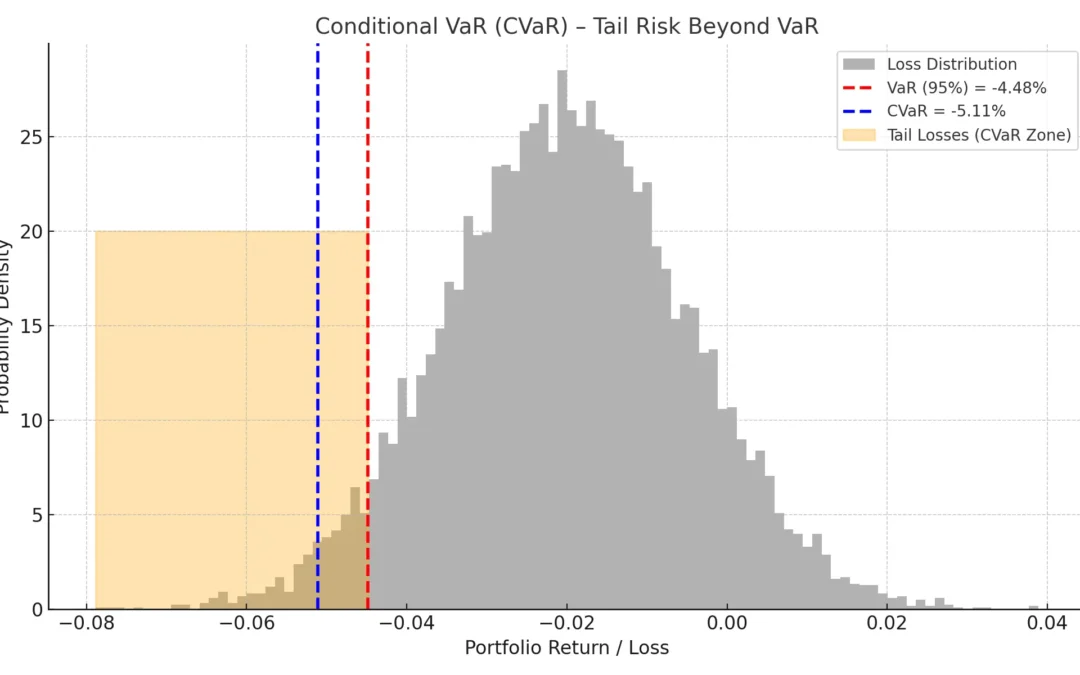

Introduction: Why CVaR Matters More Than You Think Most investors have heard of Value at Risk (VaR), a popular measure used to estimate the maximum expected loss over a given time frame with a specific confidence level. But VaR only tells part of the story. It tells...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

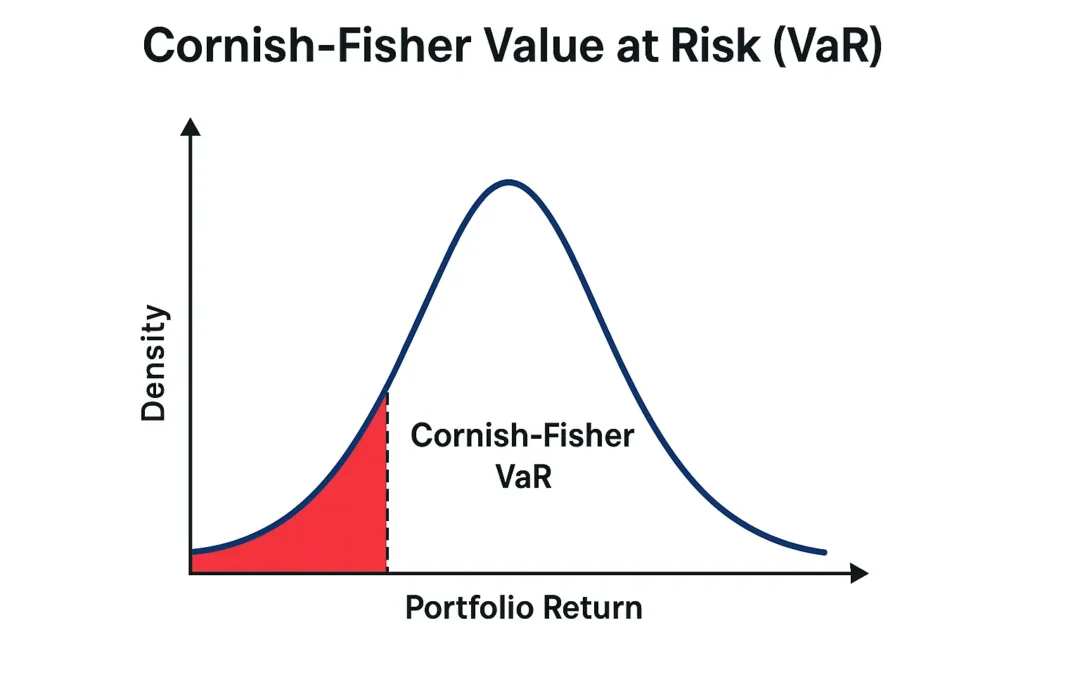

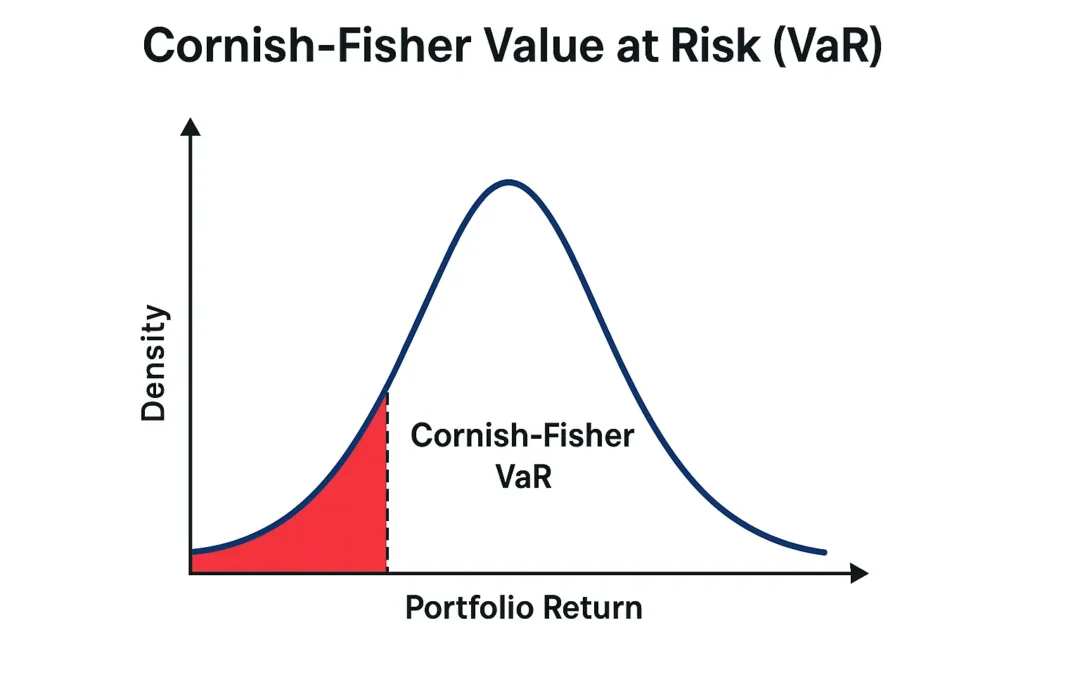

Discover how Cornish-Fisher VaR refines traditional risk assessment by accounting for skewness and kurtosis in financial returns. Introduction Value at Risk (VaR) is a fundamental metric used to estimate potential losses in a portfolio over a given time frame with a...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

Introduction When financial markets grow turbulent, investors seek clarity on one crucial question: What is the worst-case scenario for my portfolio over the next few days or weeks? Value at Risk, or VaR, attempts to answer exactly that.Value at Risk is one of the...