What Is the Treynor Ratio?

The Treynor Ratio is a financial metric used to evaluate the returns of an investment portfolio in relation to its exposure to systematic risk, measured by Beta. It was introduced by Jack Treynor, one of the fathers of modern portfolio theory, and is especially useful for comparing portfolios or funds that operate in efficient markets.

Where the Sharpe Ratio uses total volatility (standard deviation) as a denominator, the Treynor Ratio isolates only market-related risk. This makes it ideal for diversified portfolios where unsystematic risk is minimized.

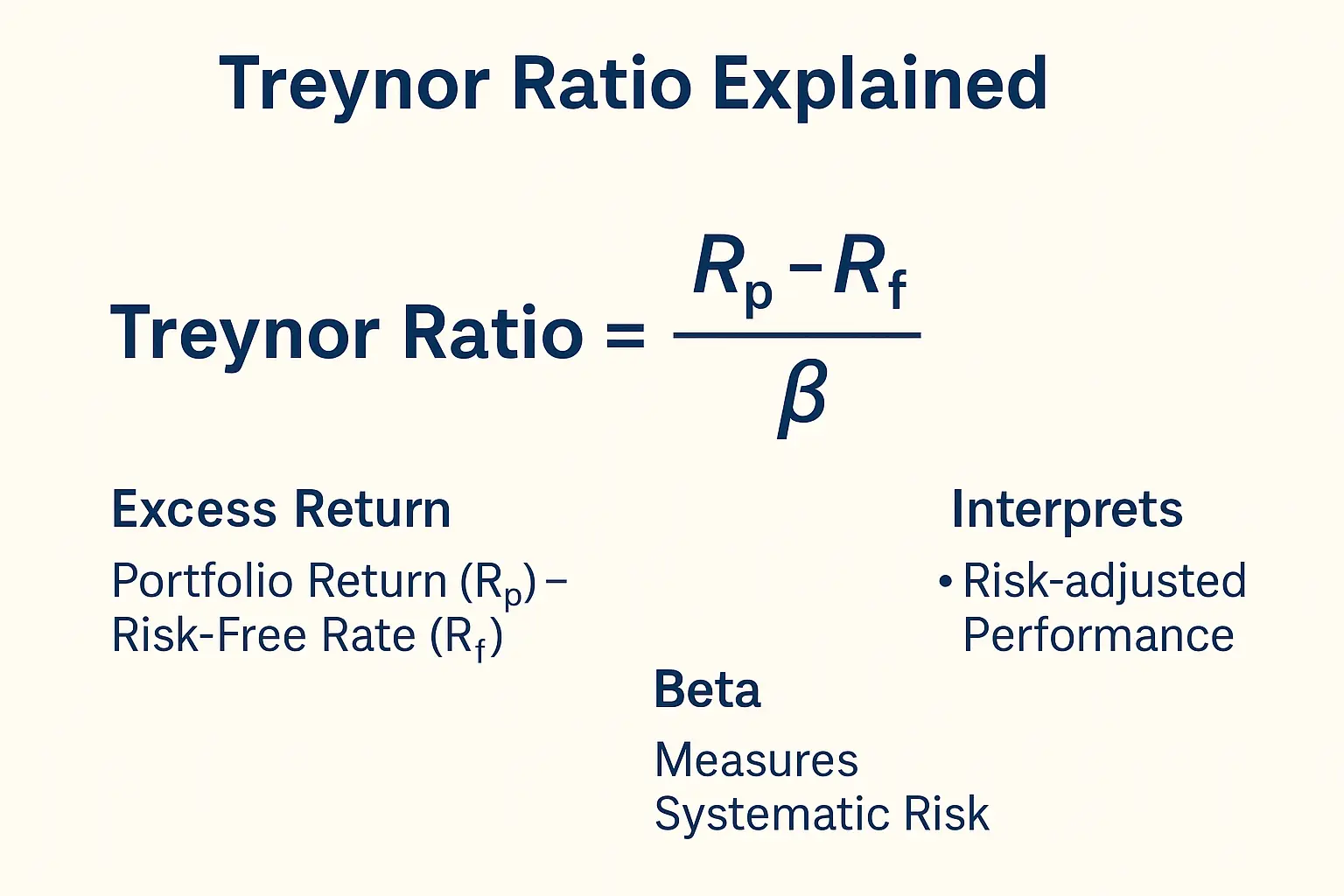

Treynor Ratio Formula

Treynor Ratio = (Rp – Rf) / βp

Where:

– Rp = Return of the portfolio

– Rf = Risk-free rate

– βp = Beta of the portfolio (systematic risk)

This ratio answers the question: ‘How much excess return am I getting per unit of market risk taken?’

Why Does the Treynor Ratio Matter?

1. Rewards Market Risk: It helps distinguish managers who add value by taking calculated exposure to market movements.

2. Better for Diversified Portfolios: Since it assumes unsystematic risk is diversified away, it provides a cleaner comparison of risk-adjusted returns.

3. Supports Strategic Allocation: Useful for institutional investors managing multi-asset portfolios or selecting external managers.

Treynor Ratio vs. Sharpe Ratio

| Metric | Denominator | Best For |

|---|---|---|

| Treynor | Beta (systematic risk) | Diversified portfolios |

| Sharpe | Volatility (total risk) | Portfolios with varying risk exposures |

Use Treynor when you want to isolate market risk, and Sharpe when total portfolio risk matters.

Practical Example

Let’s say you manage a fund with:

– Return Rp = 12%

– Risk-free rate Rf = 2%

– Beta βp = 1.3

Treynor Ratio = (0.12 – 0.02) / 1.3 = 0.0769 or 7.69%

Interpretation: For every unit of market risk (Beta), the portfolio generated 7.69% of excess return.

Another fund:

– Return = 10%, Beta = 0.8

Treynor Ratio = (0.10 – 0.02) / 0.8 = 10%

Although the second fund has a lower return, it generated more return per unit of Beta risk.

When to Use the Treynor Ratio

– Comparing mutual funds or ETFs with similar strategies

– Assessing market timing ability of a fund manager

– Evaluating risk-adjusted returns in a diversified portfolio

Limitations to Keep in Mind

– Assumes a fully diversified portfolio

– Highly sensitive to Beta estimation errors

– Doesn’t capture total volatility or tail risk

Final Thoughts

The Treynor Ratio is a sharp tool in the toolbox of any serious investor. It’s not as widely used as the Sharpe Ratio, but in the right context — especially when comparing diversified portfolios — it provides clear insights into performance relative to market exposure.

It helps answer the ultimate question: ‘Am I being adequately rewarded for the market risk I’m taking?’

📬 Stay Ahead with Our Free Newsletter

If you enjoyed this breakdown, subscribe to our free newsletter. You’ll receive:

- Real-time trading alerts

- Market risk updates

- Expert investment insights

Take control of your investments with data that works for you.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

0 Comments