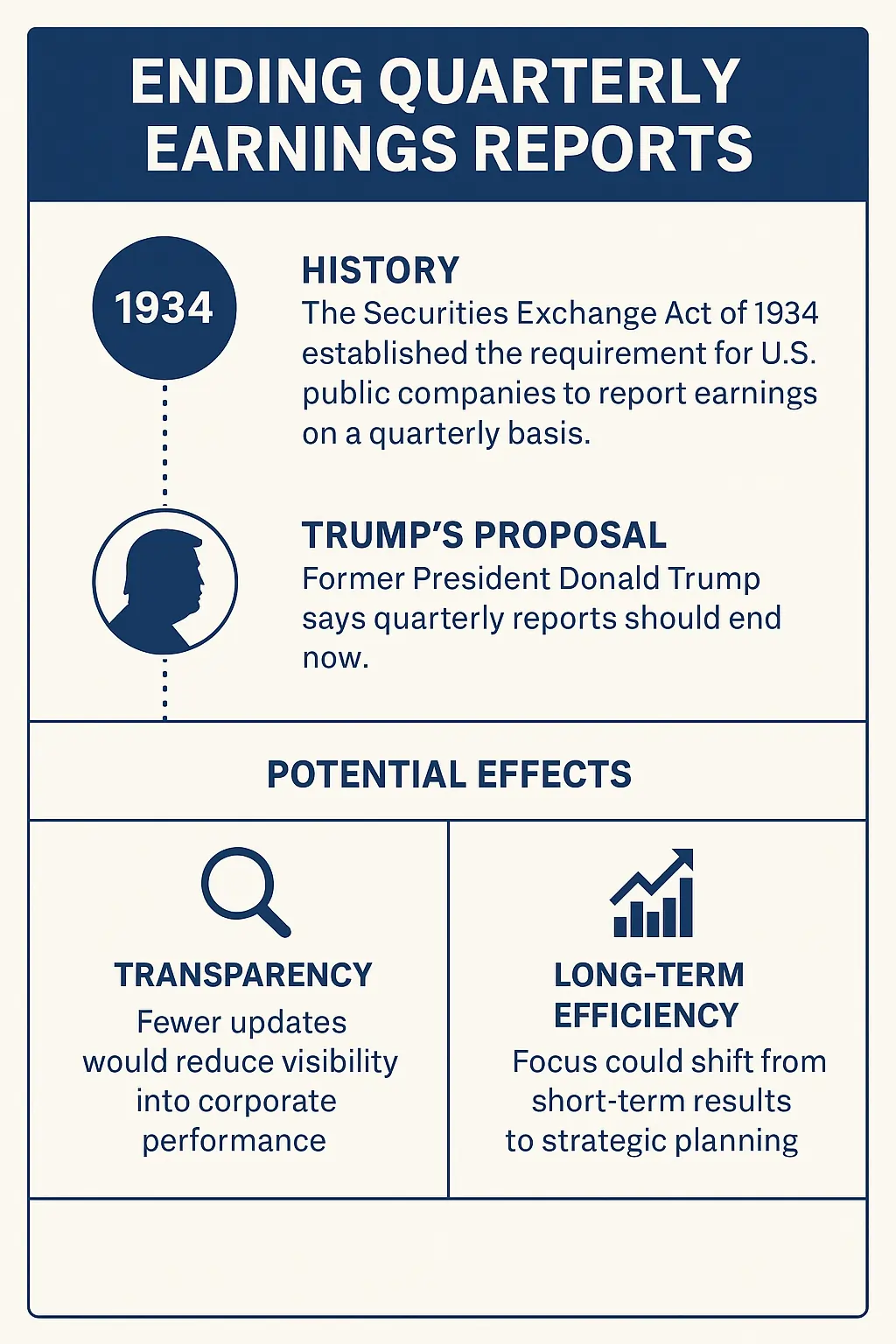

Former U.S. President Donald Trump has reignited a decades-long debate on corporate governance, declaring that quarterly earnings reports must end immediately. His statement targets the foundation of modern investor relations, raising questions about transparency, short-termism, and the future of U.S. financial markets.

While quarterly reporting has been central to Wall Street’s function since the 1930s, Trump’s call adds new urgency to the conversation — with potential consequences for businesses, investors, and regulators worldwide.

Background: The Evolution of Quarterly Reporting

- Origins: Quarterly reporting was introduced under the Securities Exchange Act of 1934 to ensure investor protection and market integrity following the Great Depression.

- Purpose: The system was designed to provide timely updates on corporate health and reduce fraud risk.

- Criticism Over Time:

- Encourages executives to prioritize short-term earnings per share (EPS) at the expense of innovation.

- Increases compliance costs, particularly for smaller firms.

- Fuels volatility, as stocks often swing dramatically after earnings announcements.

Notably, leaders like Warren Buffett and Jamie Dimon have previously argued for less frequent reporting, aligning in principle with Trump’s position.

Trump’s Position and Statement

Trump framed his position as both a pro-business reform and a push for competitiveness:

- End Quarterly Reports Now: He claims frequent reporting is “destroying long-term thinking” in corporate America.

- Reduce Costs: Preparing 10-Q filings requires significant resources — legal, accounting, and investor relations.

- Boost Innovation and Jobs: Without the constant pressure to meet quarterly earnings targets, companies could focus on research, development, and expansion.

“Quarterly reports must end now. They are outdated, expensive, and harmful to American companies,” Trump declared.

International Comparisons

The U.S. is one of the few major markets still strictly tied to quarterly reporting.

- United Kingdom & European Union: Most companies report semiannually, with voluntary quarterly updates.

- Asia: Japan and China maintain frequent reporting, though reforms are being discussed.

- Global Trend: Post-2008, regulators in Europe encouraged longer-term reporting cycles to curb excessive risk-taking.

Trump’s proposal would bring the U.S. closer to European norms, reducing the gap between global reporting standards.

Market and Political Reactions

Investors

- Supporters: Long-term investors argue that fewer reports would stabilize markets, reducing speculative trading.

- Critics: Active traders fear reduced transparency would increase risk and reduce liquidity.

Corporate Leaders

- Pro-Reform: CEOs in tech, energy, and manufacturing support Trump’s call, claiming it would align business strategies with multi-year goals.

- Opposition: Some executives warn that reducing transparency could erode investor trust and hurt capital inflows.

Regulators and Lawmakers

- SEC: Any shift would require regulatory changes. Historically, the SEC has been cautious, citing investor protection as a priority.

- Congress: Lawmakers are split, with pro-business advocates backing Trump’s stance and others warning of reduced oversight.

Implications for Businesses and Investors

- Transparency vs. Efficiency – Investors would receive less frequent updates, but companies may allocate resources more productively.

- Reduced Volatility – Market reactions tied to quarterly earnings calls could diminish.

- Shift in Strategy – CEOs may focus on long-term value creation, such as R&D, instead of quarterly EPS beats.

- Capital Flows – International investors accustomed to semiannual reporting may view U.S. markets more favorably if aligned globally.

- Risk of Abuse – Without frequent oversight, critics argue that management could more easily hide financial weaknesses.

Outlook for Financial Markets

- Short-Term (1–3 months): Trump’s comments could spark political debate and renewed lobbying by corporations seeking relief from compliance burdens.

- Medium-Term (3–6 months): The SEC may consider pilot programs or voluntary alternatives, though wholesale abolition remains unlikely without legislation.

- Long-Term (6–12 months): Even if quarterly reporting is not abolished, the debate could lead to modernized disclosure rules, such as streamlined filings or AI-driven reporting systems.

Lessons for Investors

- Expect Volatility in Debate: Headlines around corporate governance reforms often spark temporary market moves.

- Diversify Holdings: Regardless of reporting frequency, investors should balance exposure across sectors and regions.

- Focus on Fundamentals: With or without quarterly updates, long-term success relies on cash flow, innovation, and sustainable strategy.

Conclusion

Trump’s declaration that quarterly reports must end now intensifies a long-running global debate on corporate transparency and accountability. Supporters view the move as a step toward long-term stability and competitiveness, while critics warn of reduced oversight and investor risk.

Whether the idea gains traction depends on regulators, lawmakers, and the broader balance between short-term transparency and long-term efficiency in the evolving landscape of global finance.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments