Money affects us all. It shapes how we think and act. The psychology of wealth offers key lessons. These insights help us manage money better. They also guide us to build lasting wealth. Let’s explore the top lessons. You’ll learn how to improve your money mindset.

Lesson 1: Money Reflects Your Mindset

Your thoughts about money matter. A positive mindset attracts wealth. People who believe in abundance often find success. They take risks and grab opportunities. Meanwhile, a scarcity mindset holds you back. It makes you fear spending or investing. Shift your thinking. Focus on growth and possibility. This change can lead to bigger financial wins.

Lesson 2: Emotions Drive Money Choices

Emotions play a big role in spending. Fear can stop you from investing. Joy might lead to overspending. Behavioral finance experts study this. They say emotions often beat logic. For example, you might buy things to feel better. Recognize your feelings. Pause before making money decisions. This helps you choose wisely.

Lesson 3: Wealth Needs Delayed Gratification

Building wealth takes patience. You must delay gratification. This means skipping small rewards now for bigger gains later. For instance, save money instead of buying a new phone. Invest that money in stocks or a business. Studies show this habit creates millionaires. Practice waiting. Your future self will thank you.

Lesson 4: Social Pressure Shapes Spending

Friends and family influence your money habits. Social pressure can push you to spend more. You might buy a fancy car to impress others. This often leads to debt. Wealthy people focus on their goals. They ignore outside pressure. Set your own money rules. Stick to them. This keeps your finances on track.

Lesson 5: Knowledge Builds Financial Power

Understanding money gives you control. Learn about budgeting, investing, and saving. Knowledge reduces fear. It helps you make smart choices. For example, knowing how interest works stops you from overspending on credit. Read books or take courses. The more you learn, the more you earn. Wealth grows with education.

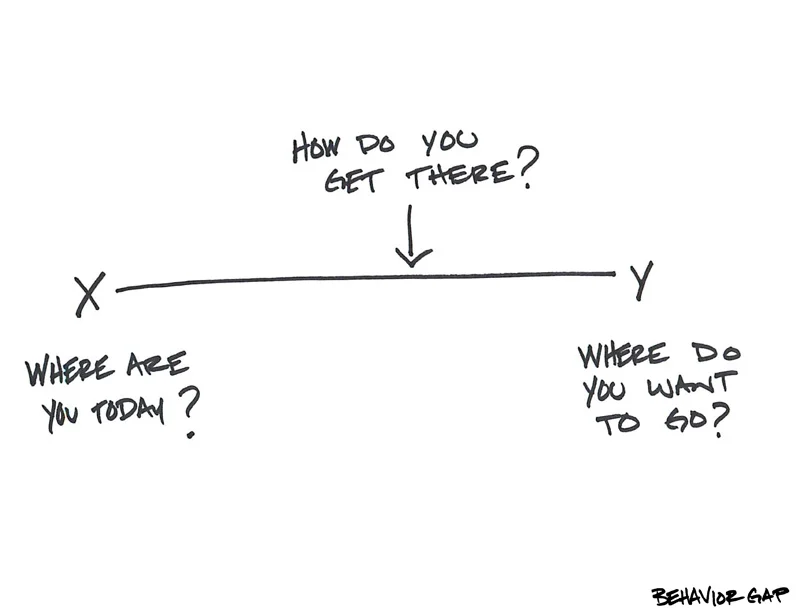

Lesson 6: Goals Keep You Focused

Clear goals guide your money journey. They help you stay on track. Without goals, you might waste money. Wealthy people set specific targets. They aim to save $10,000 in a year. Or they plan to buy a house. Write down your goals. Check them often. This focus leads to financial success.

Why These Lessons Matter

The psychology of wealth shows how your mind shapes money habits. These lessons teach you to think differently. They help you avoid traps like overspending. They also encourage smart habits like saving. Apply these ideas daily. Over time, you’ll build a stronger financial future.

For the latest updates on money tips, visit Bullish Stock Alerts.

0 Comments