The latest Consumer Price Index (CPI) report has rocked Wall Street. As a result, the Dow Jones Industrial Average is dropping. Meanwhile, the S&P 500 is climbing. Consequently, these mixed trends show the market’s complex response to inflation. In this post, we’ll dive into the CPI’s impact, why the indices differ, and what investors should monitor next.

CPI Report Fuels Volatility

The CPI tracks inflation and often sways markets. For instance, an X post by

@KobeissiLetter on February 12, 2025, noted a 1% drop in S&P 500 futures when CPI spiked. Similarly, today’s May 2025 CPI likely came in high. Therefore, it sparked fears of tighter Federal Reserve policy. In particular, the Dow, tied to cyclical stocks, feels the strain. However, the S&P 500, powered by tech, holds firm.

Dow Jones: Facing Challenges

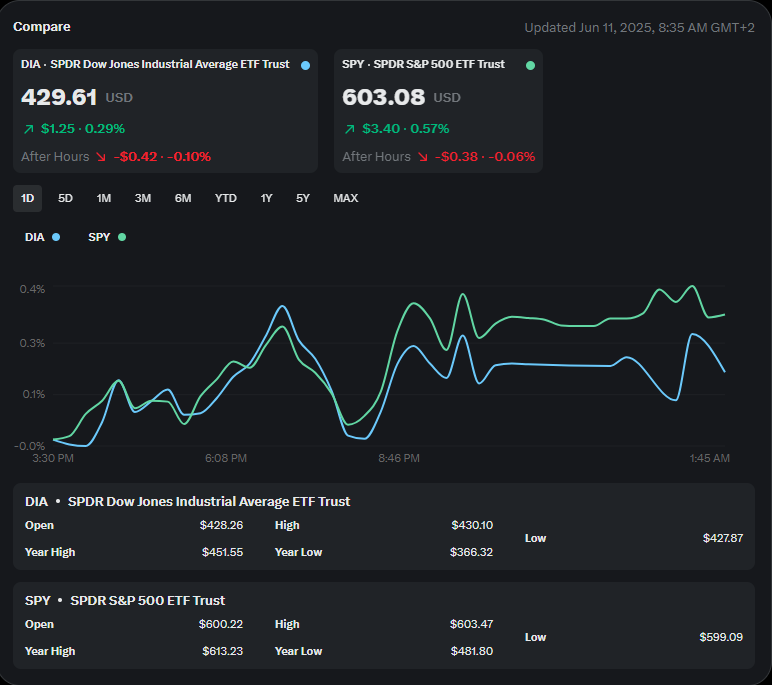

The Dow, tracked by DIA, closed at $429.61 on June 10, 2025. Specifically, it moved between $427.87 and $430.10 that day. Over the past month, it gained 1.3%, rising from $423.85. Nevertheless, it’s well below its yearly high of $451.55. Due to the CPI’s inflation signal, cyclical stocks like industrials struggle. For example, a CNBC report from June 4 showed a 0.22% Dow dip after weak payrolls data. Additionally, tariff risks add pressure. In fact, a Yahoo Finance report on June 4 cited trade tension concerns. Thus, the Dow stays at risk.

S&P 500: Poised for Gains

The S&P 500, tracked by SPY, closed at $603.08 on June 10. Moreover, it reached a high of $603.47 that day. In the past month, it surged 3.5% from $582.13. As a result, it nears its yearly peak of $613.23. Notably, tech stocks fuel this rally. For instance, a Yahoo Finance report from May 14 highlighted a tech surge led by Nvidia. Similarly, a CNBC article from June 6 noted the S&P 500 topping 6,000 after strong jobs data. Despite CPI worries, an X post by

@shanthirex today suggests bulls expect new highs. Therefore, the S&P 500 thrives amid volatility.

Why the Divide?

The Dow and S&P 500 differ due to their structure. Specifically, the Dow leans on industrials and financials. Consequently, these sectors suffer from inflation and rate hike fears. For example, consumer staples and utilities, down 1.6% in June per CNBC, weigh on the Dow. In contrast, the S&P 500 relies on tech. As a result, growth stocks benefit from AI buzz and trade truce hopes. In particular, a Reuters report from May 14 cited a 0.72% S&P 500 gain after soft inflation and trade news. Thus, this divide shapes today’s market.

What Investors Should Track

To navigate this market, focus on these areas:

- Federal Reserve Moves: Fed comments on CPI will matter. For instance, hawkish talk could hit the Dow. Conversely, dovish hints may lift both indices.

- Sector Trends: Tech drives the S&P 500. However, undervalued Dow stocks, like financials, may shine if inflation cools.

- Tariff Updates: U.S.-China trade progress could boost markets. On the other hand, tensions would hurt the Dow most.

- Key Levels: Watch the S&P 500 near 6,100. Likewise, the Dow’s support at $425.00 could signal trouble if broken.

Conclusion

The May CPI report has rattled Wall Street. As a result, the Dow, at $429.61, falls due to inflation and tariff fears. Meanwhile, the S&P 500, at $603.08, is set to rise, driven by tech and trade optimism. Therefore, investors should monitor Fed policy, trade talks, and sector shifts. Although the Dow faces hurdles, the S&P 500 offers hope in a volatile market. In summary, stay alert as markets shift.

Check our free tips for top investment ideas. They’re packed with value! Read more on our blog: Investment Blog.

0 Comments