Introduction

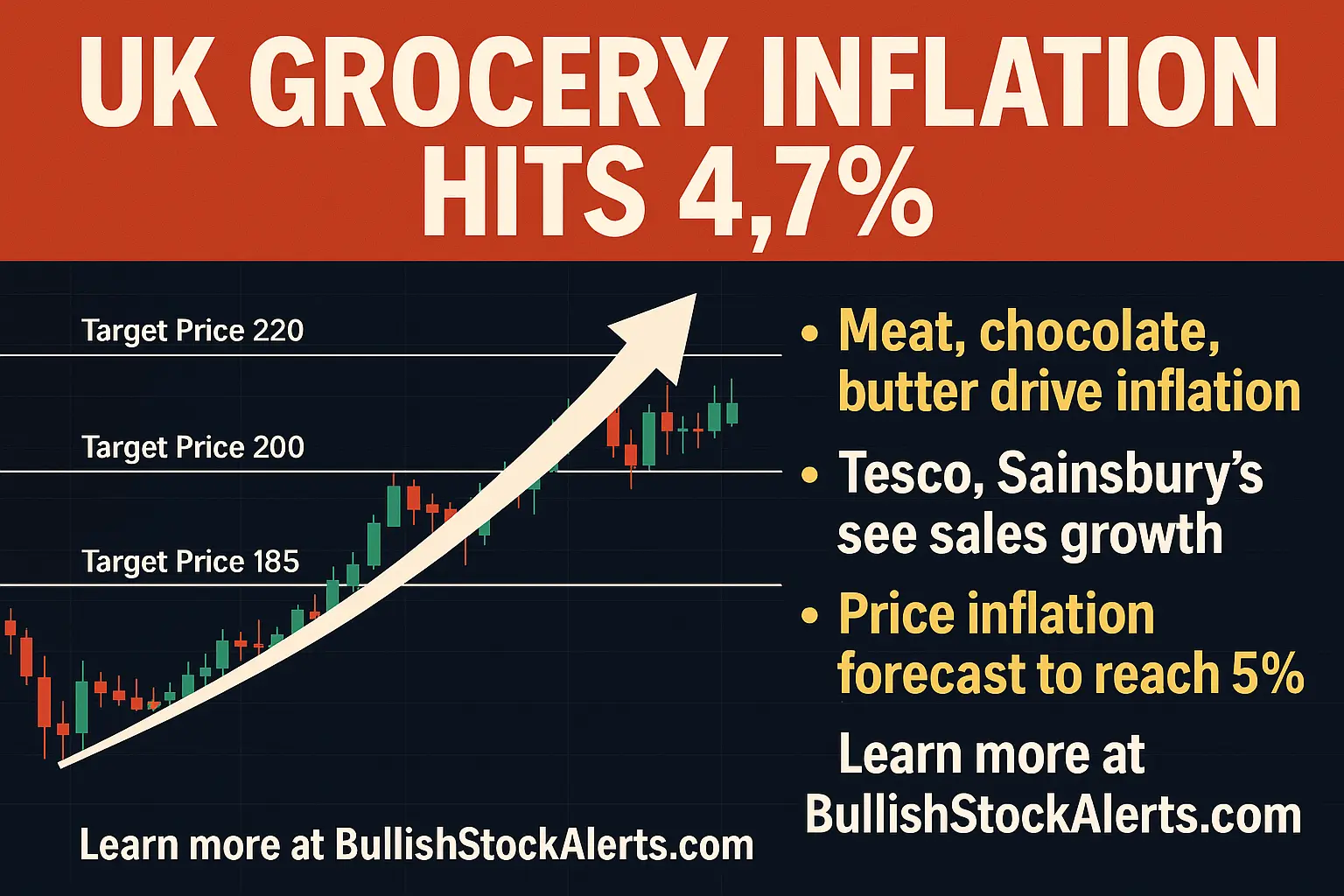

The rising cost of living is a growing concern, and in the UK, it’s hitting grocery prices hardest. As inflation continues to climb, the impact on low-income households becomes more apparent. Grocery price inflation has reached 4.7% for the four weeks leading up to June 15, according to market researcher Kantar. While some grocery chains like Tesco and Sainsbury’s are benefitting from the inflation, the overall market sentiment reveals a shifting landscape. With prices still soaring in categories like meat, butter, and chocolate, it’s vital for investors to stay informed about the impact on the retail sector and food inflation’s long-term effects on growth.

One of the Best Brokers in Europe

When it comes to investing in volatile markets, choosing the right broker is crucial. Europe hosts some of the best brokers offering low-cost, user-friendly platforms designed for both novice and experienced investors. Accessing real-time data, and utilizing effective investment tools, especially in turbulent times, will empower you to capitalize on shifts in market dynamics like the grocery price inflation in the UK.

Financial Performance

Kantar reported a 4.7% increase in grocery price inflation, the highest since March of the previous year. This is a clear signal of increasing pressure on UK households, especially as essential goods like food become more expensive. However, despite this rise in inflation, grocery sales value has risen by 4.1% year-over-year, thanks to favorable weather conditions and consumer habits. The key takeaway for investors is the impact inflation will have on consumer spending behavior, specifically in the grocery sector.

Key Highlights

- Grocery inflation in the UK has reached its highest level in over a year.

- Tesco, Sainsbury’s, Lidl GB, and Ocado saw solid sales growth, indicating the market’s resilience amidst inflation.

- The consumer sentiment is under pressure, but brands like Tesco and Sainsbury’s are thriving due to strong customer loyalty and strategic pricing.

Profitability and Valuation

Despite the inflationary pressures, major grocery chains like Tesco and Sainsbury’s have demonstrated robust profitability. Both companies posted year-on-year sales increases of 7.0% and 5.7%, respectively. These results show that while consumers are spending more, they are also looking for trusted and reliable brands that offer better value for money. Investors should pay attention to these players, as they are positioning themselves well in a challenging market.

Debt and Leverage

Many major UK grocery chains maintain a manageable debt-to-equity ratio. The increasing cost of goods, particularly as inflation continues to outpace wage growth, highlights the importance of strategic financial planning. Companies with a solid balance sheet will be able to weather the storm, making them attractive to long-term investors.

Growth Prospects

Looking ahead, UK grocery sales are expected to continue their upward trajectory, driven by innovation and the growing demand for food delivery services. Investors should keep an eye on the performance of key players and any shifts in consumer behavior as economic conditions evolve. The forecast for food inflation, with a potential rise to nearly 5% this year, will continue to influence grocery chains’ ability to maintain growth.

Technical Analysis

Analyzing key technical indicators for major UK grocery stocks, such as Tesco and Sainsbury’s, shows that the market sentiment is bullish, despite the challenges posed by inflation. Stocks in these companies have shown solid growth, making them attractive for short and medium-term investments. Key support levels for these stocks should be closely monitored to understand potential entry points.

Potential Catalysts

- Continued inflationary pressures on grocery prices.

- Strong demand for delivery services and online grocery shopping.

- Strategic pricing and expansion into new markets by major players.

- Government policies affecting the retail sector and food inflation.

Leadership and Strategic Direction

Tesco and Sainsbury’s leadership teams have been proactive in responding to changing market conditions. Their ability to maintain customer loyalty through competitive pricing and efficient supply chain management will be critical in navigating the current inflationary environment.

Impact of Macroeconomic Factors

The overall economic conditions in the UK, including high inflation, rising interest rates, and wage growth constraints, will continue to influence grocery sector performance. However, the market is showing signs of resilience, and companies are adapting to these macroeconomic factors by diversifying their offerings and focusing on value for consumers.

Total Addressable Market (TAM)

The UK grocery market is vast, with an estimated value of over £200 billion. As inflation continues to affect consumer purchasing power, the focus will shift to value-based grocery chains that offer affordable products while maintaining quality.

Market Sentiment and Engagement

Despite inflation, UK consumers are still engaging with their favorite grocery brands. Market sentiment has been somewhat positive for companies like Tesco, Sainsbury’s, and Lidl, which have all seen significant sales growth in recent months. Understanding consumer sentiment will be essential for predicting how grocery companies will perform in the coming months.

Conclusions, Target Price Objectives, and Stop Losses

- Target Price for Tesco (TSCO.L): Short-Term: £6.50, Medium-Term: £7.00, Long-Term: £8.00

- Target Price for Sainsbury’s (SBRY.L): Short-Term: £2.20, Medium-Term: £2.50, Long-Term: £3.00

- Stop Losses: For Tesco, consider setting a stop-loss around £5.80. For Sainsbury’s, a stop-loss around £2.00 is recommended.

The current market conditions point to a strong long-term outlook for top-performing UK grocery chains. Investors should remain cautious of short-term volatility, particularly due to inflationary pressures and changing consumer behavior.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter.

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter.

0 Comments