In recent years, headlines have hailed China as the new global powerhouse in automobile exports, with some even claiming it has overtaken traditional auto giants like Japan and Germany. But a closer look reveals a troubling pattern: inflated figures, manipulated definitions, and questionable accounting tactics. So the question arises — is China faking its car sales surge?

A Record-Breaking Boom — On Paper

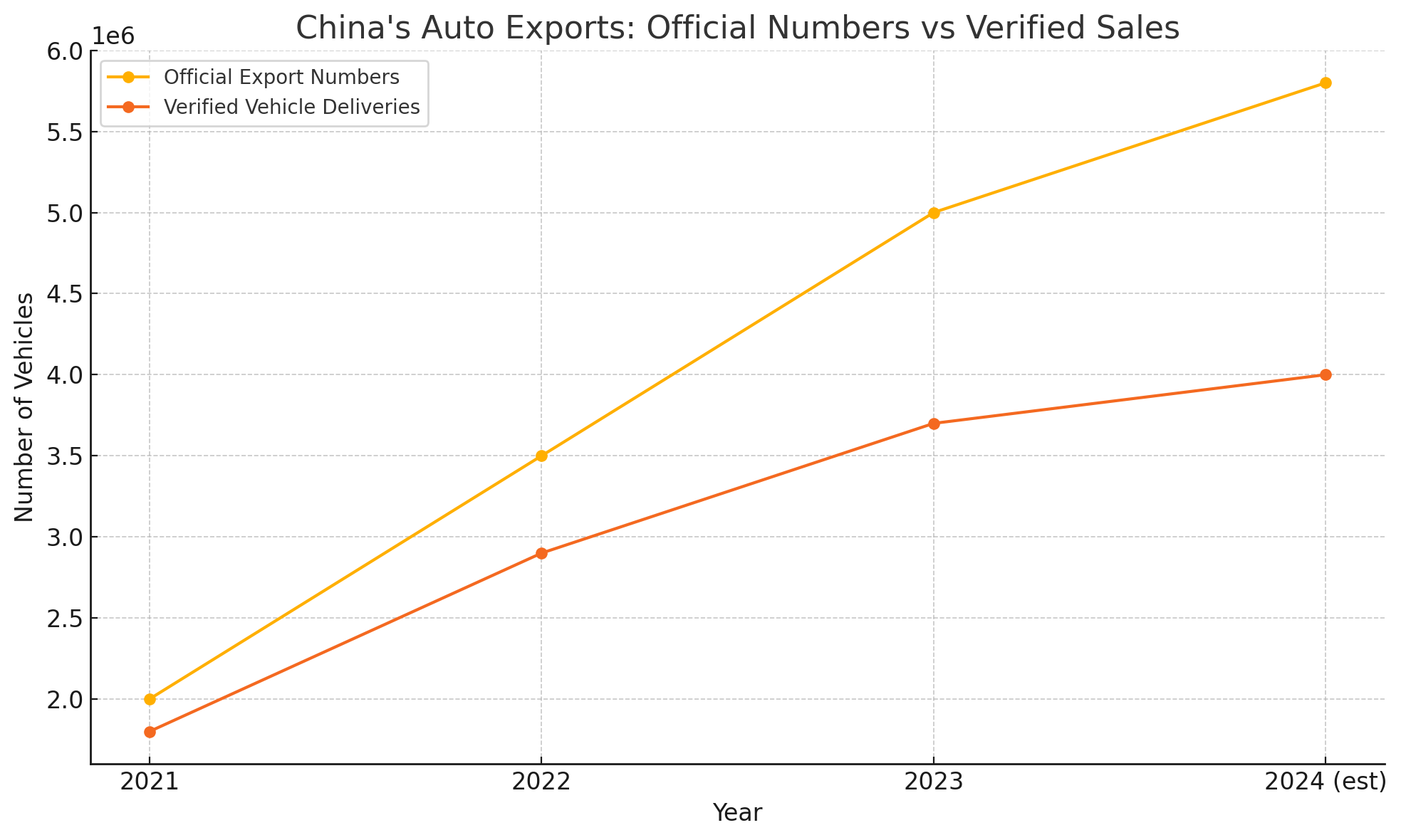

According to customs and trade reports, China exported over 5 million vehicles in 2023, with projections showing even higher numbers in 2024 and 2025. State-owned media have celebrated this achievement as a sign of China’s manufacturing dominance and global competitiveness, particularly in the electric vehicle (EV) sector.

Companies like BYD, SAIC, and Chery have become household names in global trade discussions, often described as the driving force behind this exponential growth. But beneath the surface lies a series of data distortions that challenge the narrative.

The Re-export Loophole

One of the most common tactics used to inflate export numbers is “re-exporting.” In practice, this means that cars are shipped from China to a foreign destination — but instead of being sold to consumers, they are rerouted to bonded zones or third countries. In some cases, vehicles are returned to China or never leave the port facilities of the destination country.

This allows exporters to record the shipment as a successful sale or export, even though the product hasn’t reached an end user. It’s a tactic that boosts short-term figures, but does not reflect true demand.

Unsold Inventory and Phantom Buyers

Another issue is the inclusion of unsold inventory in export reports. Many Chinese automakers classify a vehicle as “sold” the moment it leaves the factory gate — regardless of whether there is a buyer at the other end. This practice inflates quarterly and annual performance reports and creates an illusion of momentum.

In parallel, numerous Chinese vehicles are purchased by state-aligned leasing firms or exported to subsidiaries abroad, where they sit idle or are heavily discounted to clear space for future shipments. These shell companies are not always transparent about final destination sales, making it hard to distinguish between genuine exports and inventory manipulation.

EV Subsidies and Artificial Demand

China’s EV dominance is also partially fueled by generous state subsidies, tax breaks, and policy-driven demand. In many cases, municipal governments purchase large fleets of EVs to meet quotas, not because of local transportation needs. These vehicles are then counted in export tallies or moved through government-backed distributors in other developing countries.

In short: the numbers may be technically correct — but they are structurally misleading.

The Global Implications

This distortion in auto sales data has real economic consequences. It fuels trade tensions, invites scrutiny from global regulators, and creates a false sense of competitiveness that pressures rival automakers to cut corners or flood markets in response.

Moreover, when Chinese automakers aggressively undercut prices abroad based on inflated domestic figures and subsidized production, it threatens fair market dynamics and can distort long-term investment decisions in Europe, Southeast Asia, and South America.

Conclusion: A Mirage of Growth?

There’s no doubt that China has made remarkable strides in automobile production and innovation, especially in the EV space. But the question isn’t whether China is capable — it’s whether the growth narrative is grounded in market reality or inflated through artificial means.

As global stakeholders, analysts, and regulators, we must distinguish between statistical exports and real-world sales. Without transparency and accountability, China’s automotive boom risks becoming a mirage — impressive at first glance, but lacking substance upon closer inspection.

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile ? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments