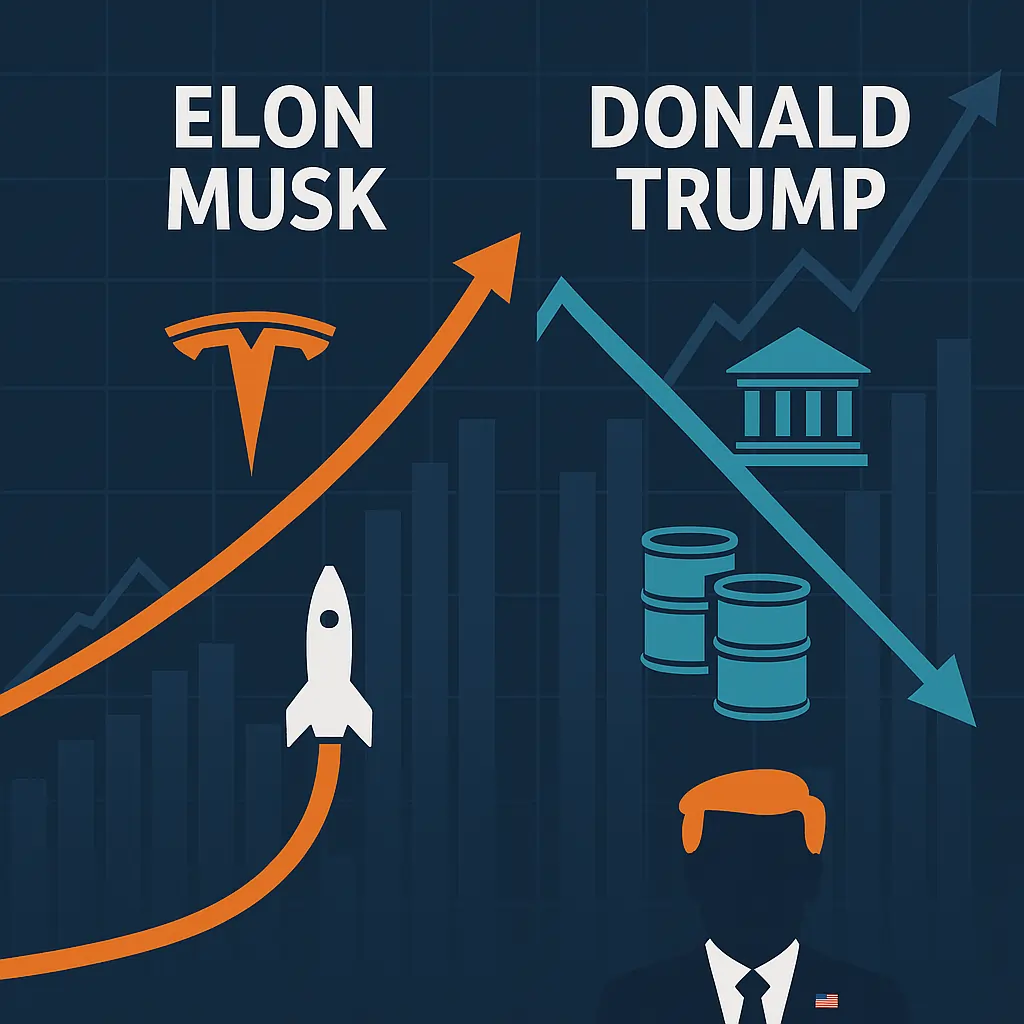

The global billionaire leaderboard may soon witness a dramatic reshuffle. A Trump-linked tycoon is on the cusp of overtaking Elon Musk as the world’s richest man, highlighting the volatile intersection of politics, business, and global markets.

Musk’s Reign at the Top

Elon Musk has long dominated the wealth rankings, thanks to the explosive growth of Tesla, SpaceX, and other ventures.

- Peak Wealth: Over $250 billion at its height.

- Drivers: Electric vehicle adoption, private space exploration, and AI-driven innovation.

- Weakness: Musk’s fortune is heavily tied to Tesla’s share price, making it vulnerable to stock market swings.

The Rise of a Trump-Linked Tycoon

The tycoon’s rapid ascent stems from a mix of traditional and politically driven advantages:

- Energy & Commodities Boom – Rising global demand and constrained supply have inflated asset values.

- Strategic Political Ties – Connections to Trump’s circle have opened doors for lucrative deals and favorable policies.

- Diversification – Investments spread across energy, infrastructure, and finance have reduced dependence on any single sector.

Together, these factors have positioned him within striking distance of overtaking Musk.

Market Implication

- Investor Sentiment: A leadership change would signal stronger market confidence in resource-based wealth over tech-heavy fortunes.

- Political Influence: Trump’s network gains renewed visibility in the global wealth landscape.

- Sector Spotlight: Traditional industries may temporarily eclipse tech as the main drivers of billionaire status.

Wealth Outlook

- Short-Term (1–3 months): Musk’s wealth could rebound if Tesla rallies, but volatility remains high.

- Medium-Term (3–6 months): The tycoon’s commodity-linked fortune provides stability amid global uncertainty.

- Long-Term (6–12 months): Both may trade places multiple times, as innovation-driven and resource-driven wealth cycles collide.

Key Lessons for Investors

- Diversification Wins: The tycoon’s multi-sector portfolio shows resilience compared to Musk’s tech-heavy exposure.

- Politics Matters: Strategic political ties can accelerate business growth — but carry reputational and regulatory risks.

- Wealth Is Volatile: Billionaire rankings are not static; they mirror global macroeconomic and market shifts.

Conclusion

The prospect of a Trump-linked tycoon surpassing Elon Musk underscores a deeper trend: the shifting balance of global wealth between technology innovation and resource-backed influence.

For investors, the story is not just about who sits at the top — but what the race reveals about the future of markets, politics, and power.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments