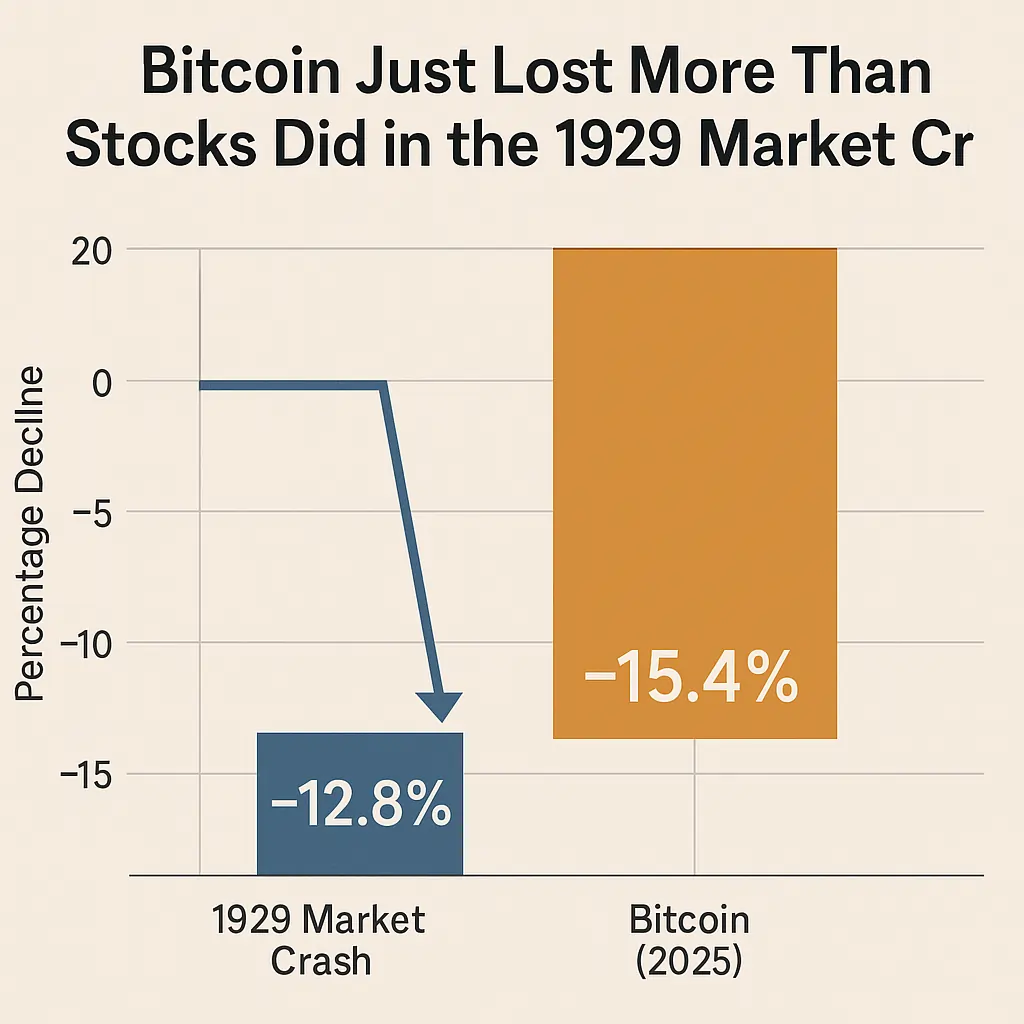

Bitcoin Just Lost More Than Stocks Did in the 1929 Market Crash. It Won’t Be the Last Time.

In a stunning turn of events, Bitcoin’s latest crash erased over 15% of its market value in a single day—a steeper fall than the 12.8% collapse of the Dow Jones on Black Tuesday in 1929. The comparison is striking and symbolic: nearly a century apart, two speculative manias met the same fate—a swift and brutal reckoning.

History Rhymes, Not Repeats

The 1929 crash was the culmination of a decade of speculation, easy credit, and misplaced confidence in perpetual growth. What followed was the Great Depression, an economic catastrophe that reshaped global markets.

Bitcoin’s story differs in its underlying technology and decentralization, but not in its psychology. The fear-greed cycle—the heartbeat of all financial manias—remains unchanged.

Bitcoin’s price has now endured several dramatic collapses: 2013 (–83%), 2018 (–84%), 2022 (–76%), and again in 2025. Each time, the same forces resurface—leverage, speculation, and FOMO. These are not anomalies; they are core features of a young, unregulated market that still depends heavily on sentiment rather than fundamentals.

Volatility Is the Price of Innovation

Unlike the 1929 stock market, Bitcoin is not backed by earnings, dividends, or productivity—it is underpinned by belief and network adoption. This makes its value inherently reflexive: when confidence wanes, selling accelerates.

Institutional adoption has not eliminated volatility; instead, it has linked Bitcoin more closely to global liquidity cycles, making it sensitive to interest rate shifts and risk sentiment—much like equities in the late 1920s.

Why It Won’t Be the Last Crash

- Structural fragility – Crypto markets still lack circuit breakers, regulation, and deep liquidity.

- Leverage contagion – Futures and perpetual swaps amplify both gains and losses.

- Psychological speculation – Retail traders still chase narratives of “digital gold” or “next-gen money,” leading to boom-and-bust extremes.

- Macro correlation – Bitcoin increasingly moves in sync with global equity risk cycles, reducing its appeal as a hedge.

Until crypto markets mature—through clearer regulation, institutional risk controls, and realistic expectations—major drawdowns will recur.

A Lesson in Financial Evolution

The 1929 crash reshaped capitalism, birthing the SEC, modern monetary policy, and long-term investor education. Bitcoin’s repeated collapses could play a similar role: cleansing excess, forcing transparency, and refining infrastructure.

Whether this ends in sustainable digital finance or another lost decade depends on whether lessons are learned before the next crash hits.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments