by Fatih | Jun 2, 2025 | Investing Tools and Regulations

Introduction Interest rate risk is one of the most important financial risks facing investors, especially those holding bonds and other fixed-income assets. Understanding how a bond’s price reacts to interest rate movements is critical for optimizing return and...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

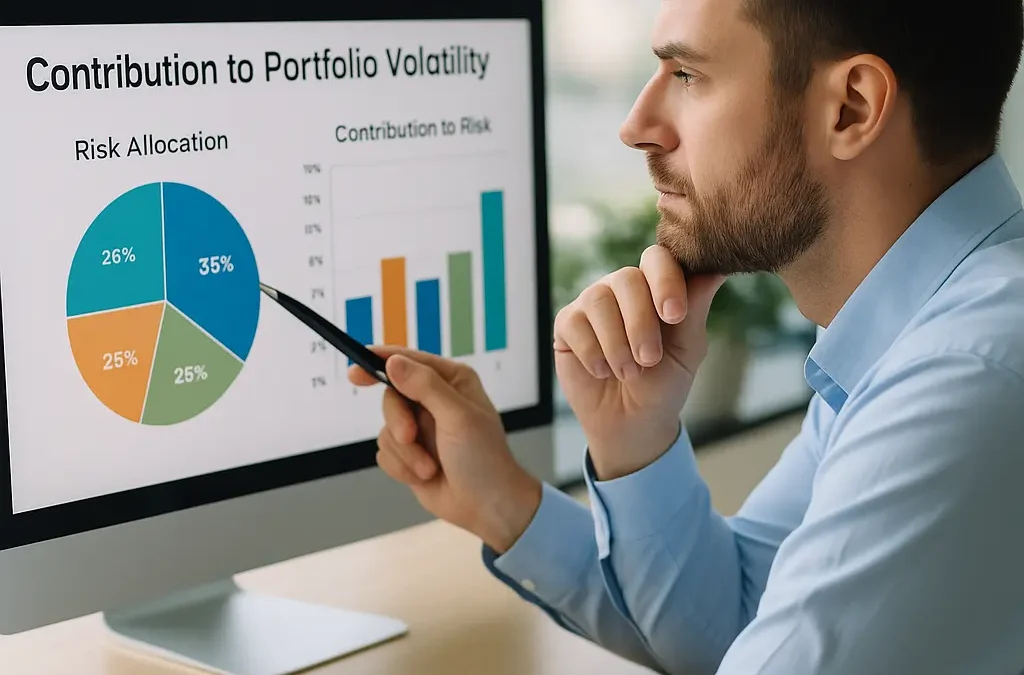

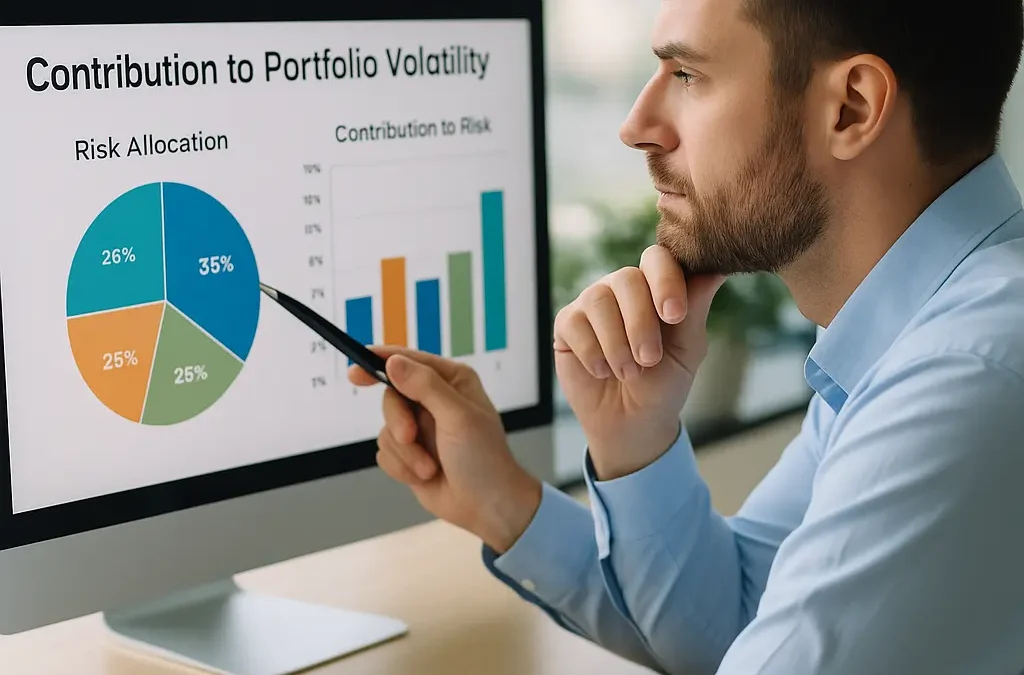

Introduction In modern portfolio theory, managing risk isn’t just about diversification or minimizing volatility. It’s about understanding where the risk comes from. That’s where Contribution to Risk (CTR) and Risk Budgeting come into play. These...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

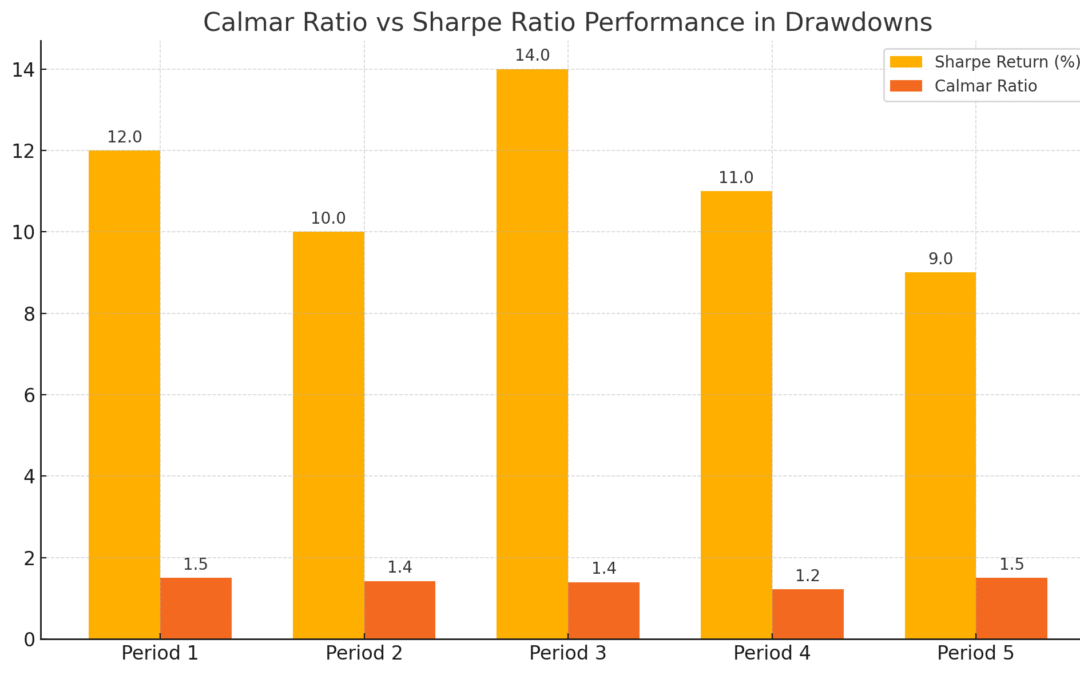

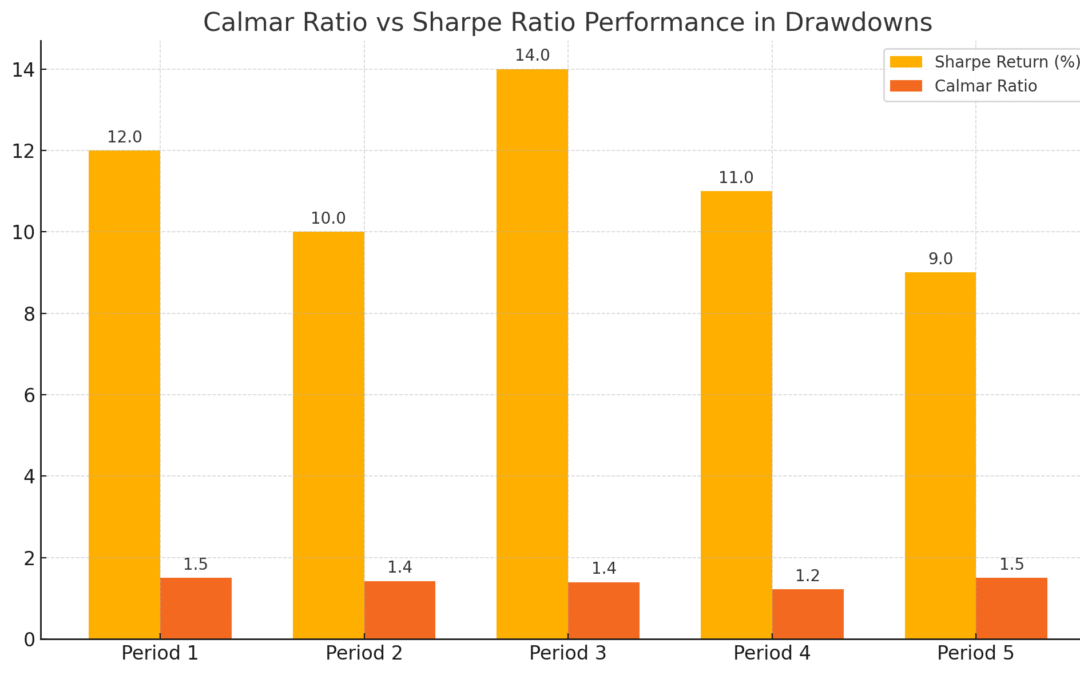

What is the Calmar Ratio? The Calmar Ratio (short for California Managed Account Reports) is a risk-adjusted performance metric used to evaluate the return of an investment relative to its maximum drawdown. It provides investors with insights into how much return they...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

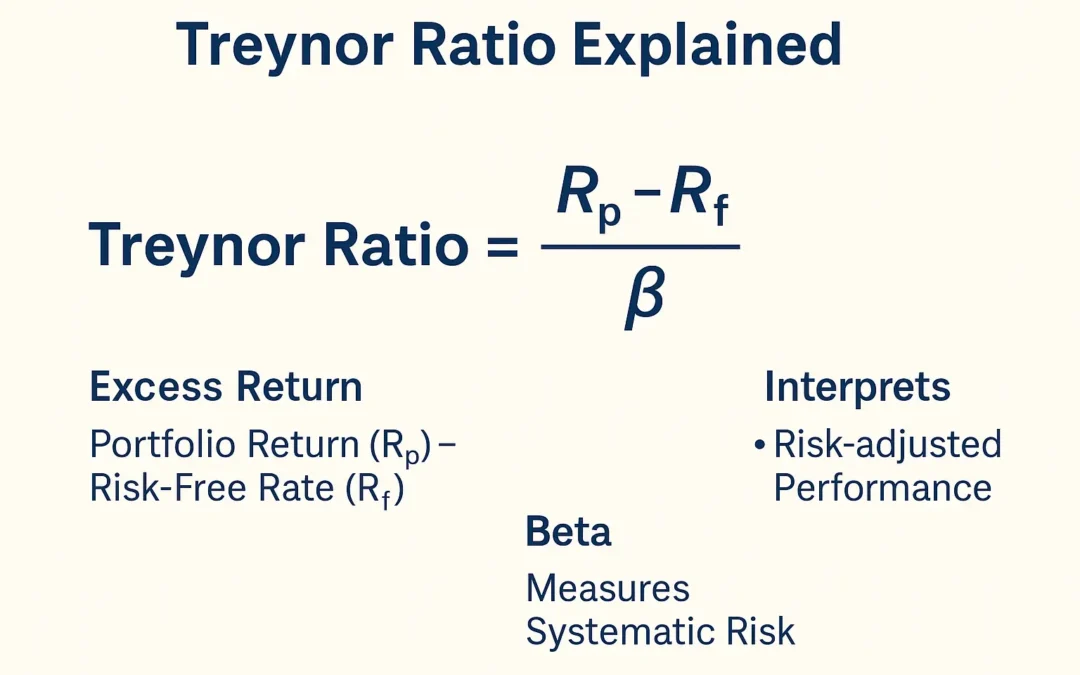

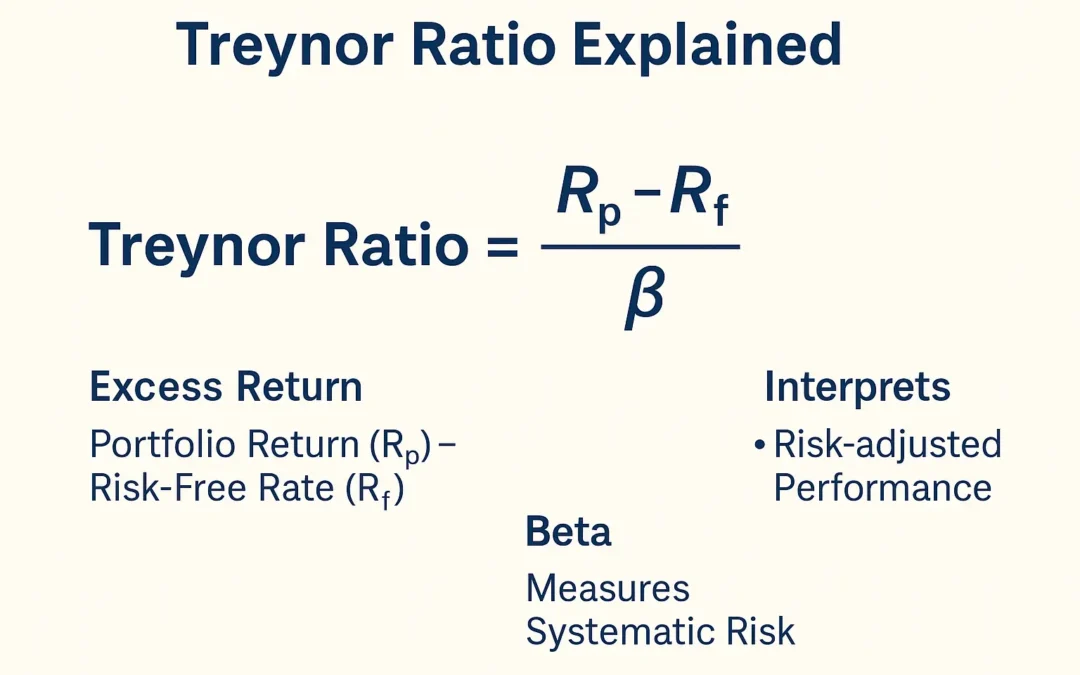

What Is the Treynor Ratio? The Treynor Ratio is a financial metric used to evaluate the returns of an investment portfolio in relation to its exposure to systematic risk, measured by Beta. It was introduced by Jack Treynor, one of the fathers of modern portfolio...

by Fatih | Jun 2, 2025 | Investing Tools and Regulations

Introduction In the world of portfolio management, terms like ‘active management’ and ‘benchmark-beating performance’ are often thrown around. But how do you actually measure how active a fund is, and whether it’s truly adding value? Two...