by Fatih | Jun 1, 2025 | Investing Tools and Regulations

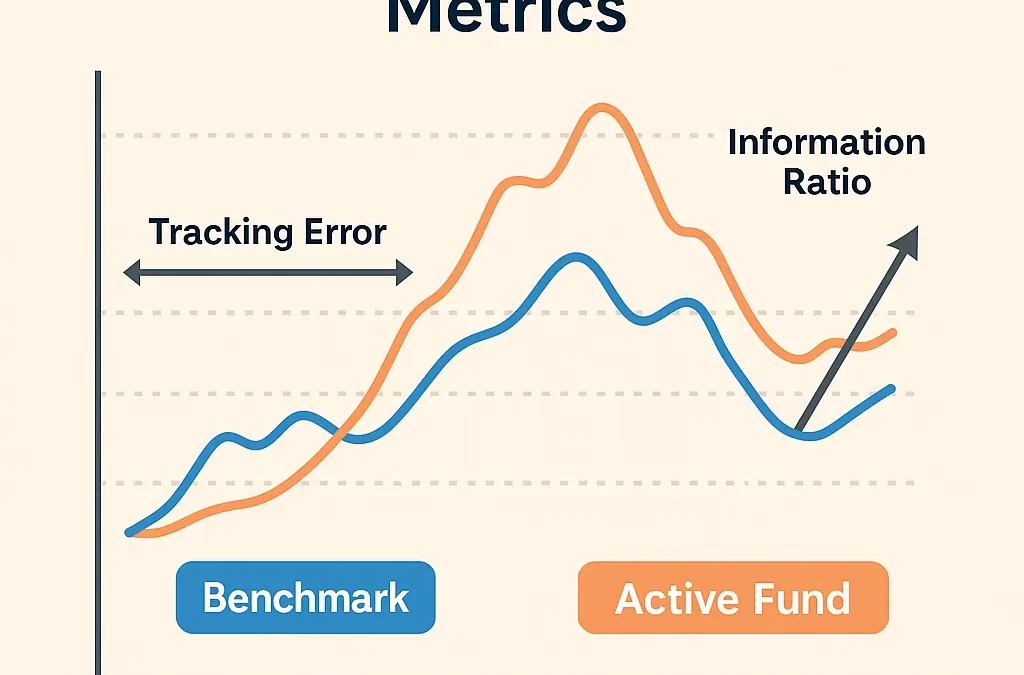

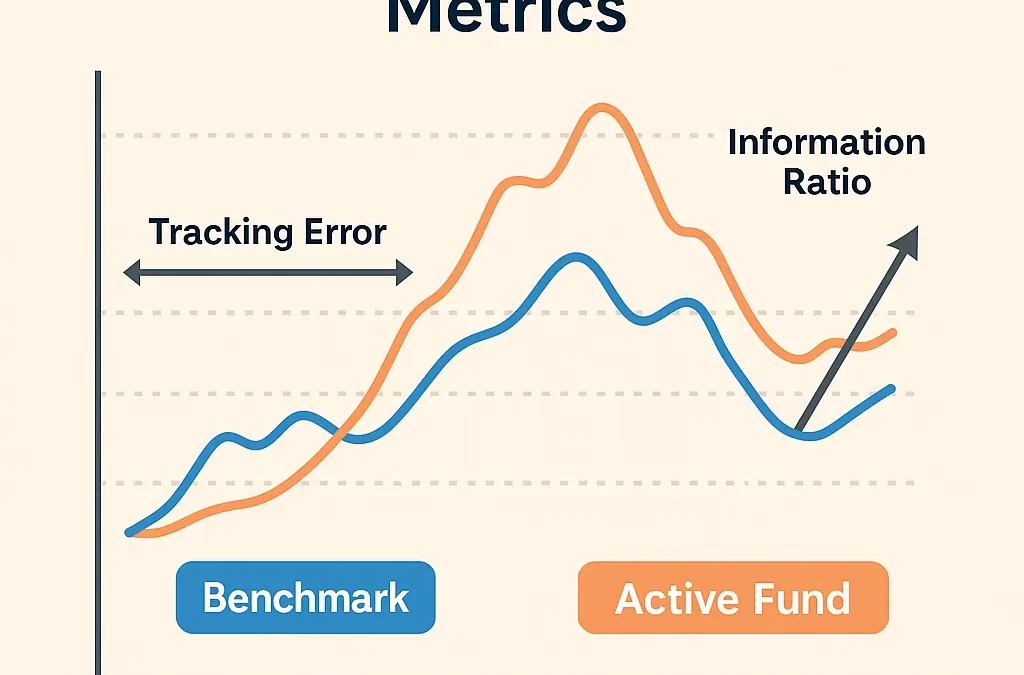

Introduction In the world of active investing, beating the market isn’t just about generating positive returns — it’s about outperforming a relevant benchmark consistently and efficiently. This is where two key performance metrics come into play: Tracking Error and...

by Fatih | Jun 1, 2025 | Investing Tools and Regulations

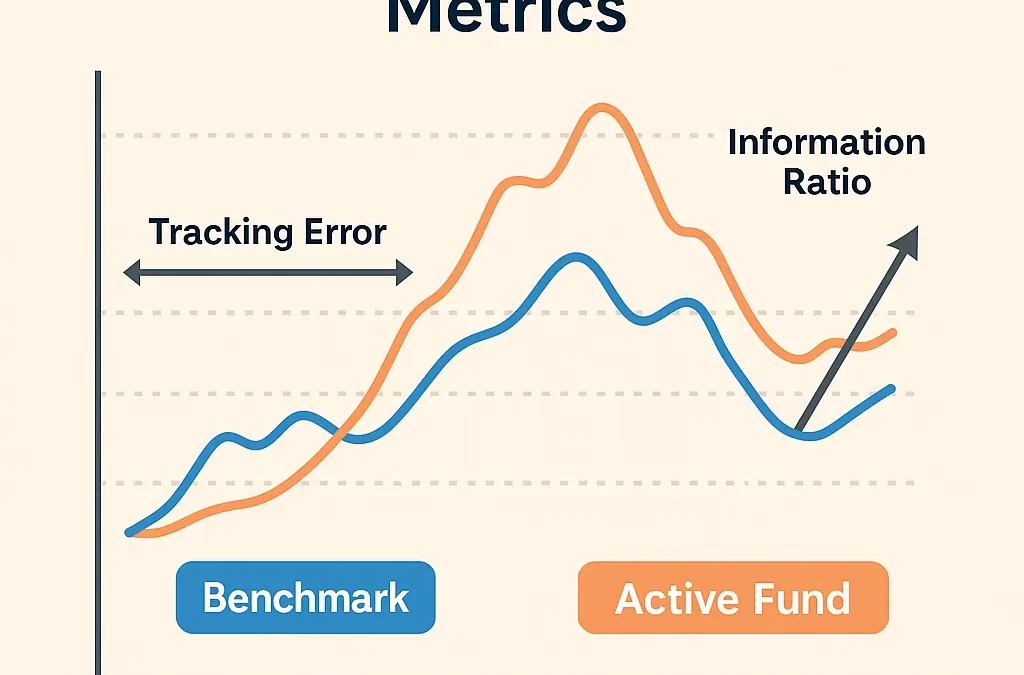

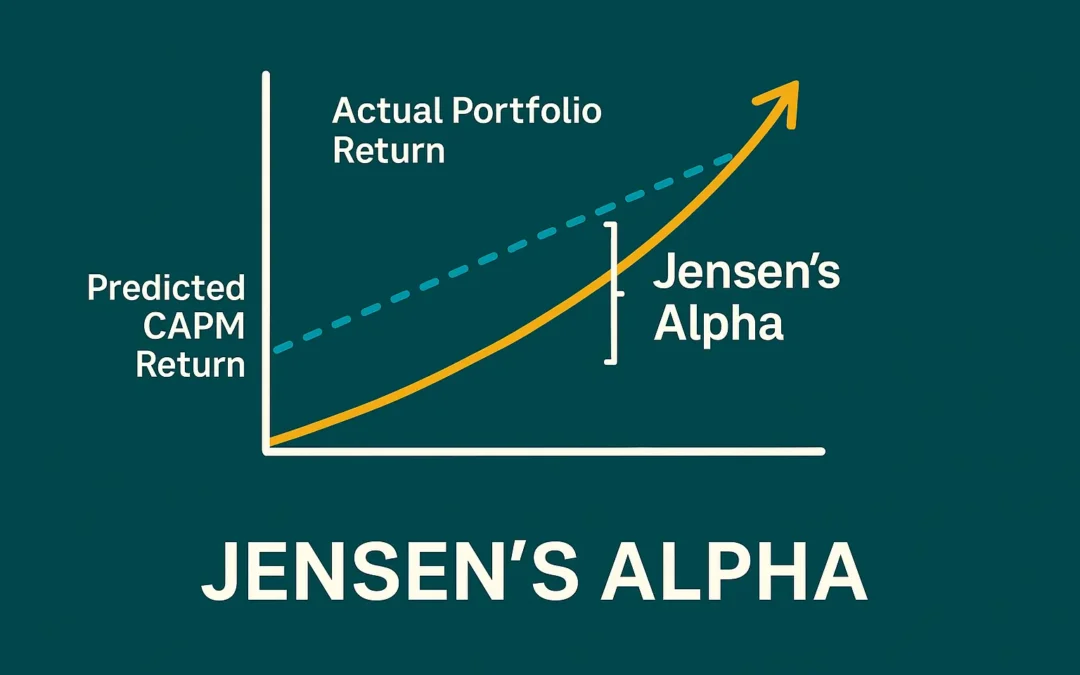

Introduction: Why Measuring Skill Matters In a world where beating the market is the holy grail of investing, how do you determine whether a fund manager is truly skilled—or just lucky? That’s where Jensen’s Alpha comes in. This powerful metric evaluates the...

by Fatih | Jun 1, 2025 | Investing Tools and Regulations

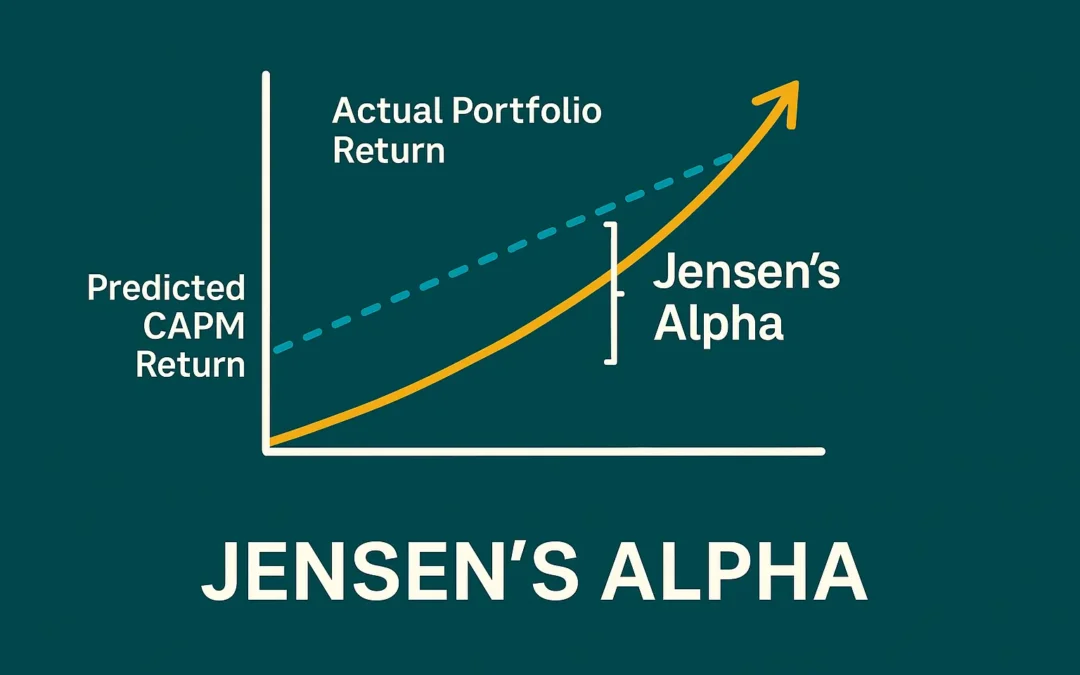

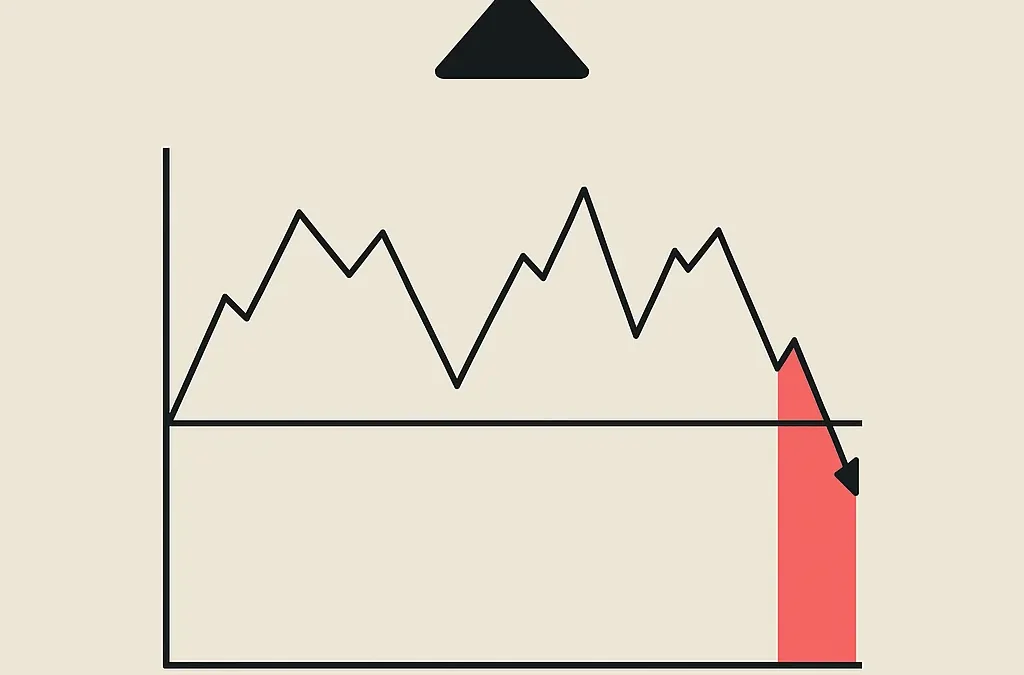

Introduction In the world of portfolio management and risk-adjusted returns, the Sharpe Ratio has long been a go-to metric. But is it truly the best way to measure investment performance? Enter the Sortino Ratio — a more nuanced, downside-focused version that many...

by Fatih | Jun 1, 2025 | Investing Tools and Regulations

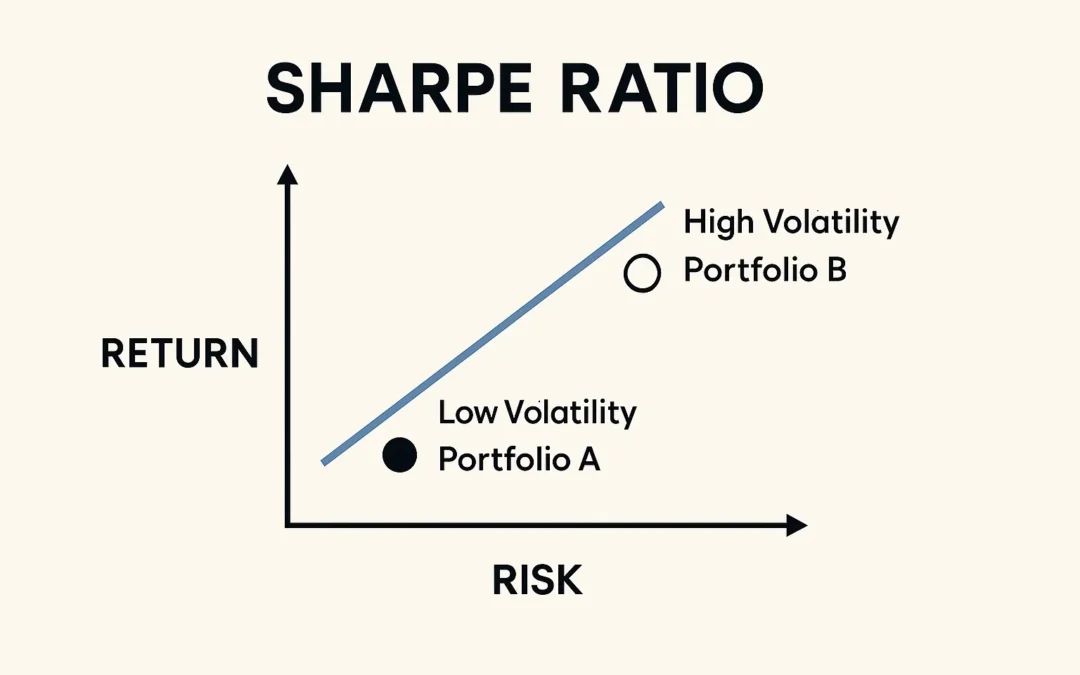

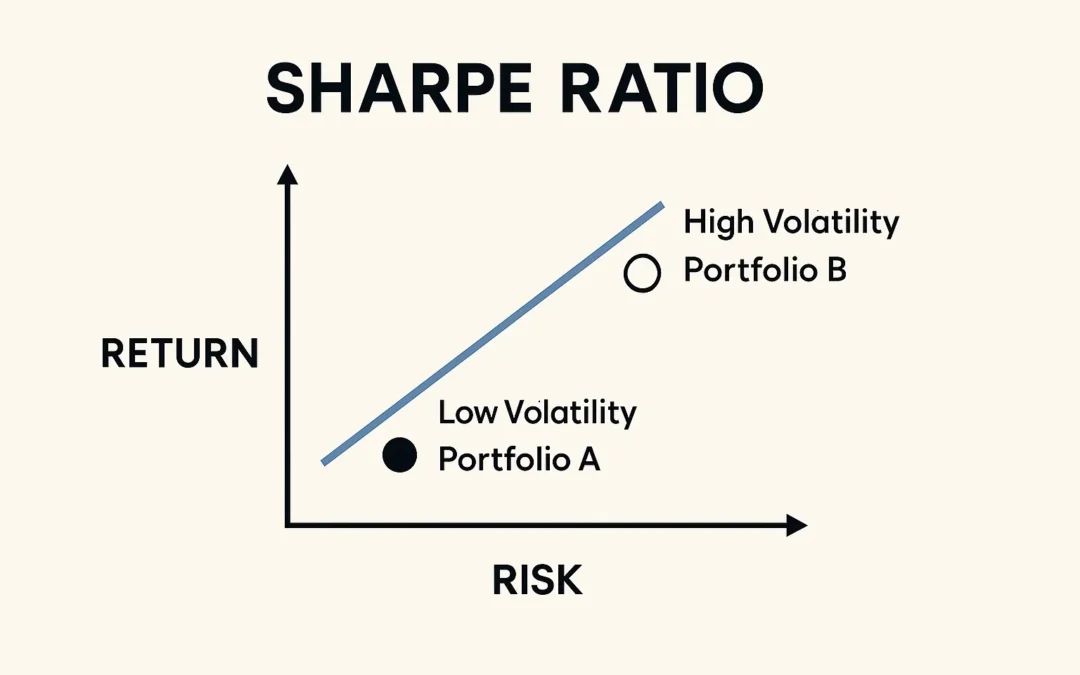

In a world full of noise, volatility, and uncertainty, how do you know if your investment is truly performing well? Is a 10% annual return impressive — or is it just a reward for taking on excessive risk? Enter the Sharpe Ratio, one of the most essential tools in...

by Fatih | Jun 1, 2025 | Investing Tools and Regulations

The Corporate Sustainability Reporting Directive (CSRD) represents a fundamental shift in how companies disclose their impact on Environmental, Social, and Governance (ESG) dimensions. While initially perceived as a compliance burden, CSRD also brings forward an...