Introduction

Investors everywhere are on the lookout for the next big opportunities that can deliver superior returns—whether they’re seeking high-yield dividend plays or fast-growing tech innovators. Staying ahead of market shifts and emerging trends is essential for building a winning portfolio.

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

If you’re ready to begin—or expand—your investment journey, our affiliate link for Trade Republic offers a special bonus: a €30 gift in shares when you complete three purchase transactions within ten days. Don’t miss out on this chance to jump-start your portfolio: trade republic.

PREMIUM STOCKS

Constellation Brands (STZ) – Warren Buffett’s Pick

📍 Buy Zone: $180 – $200

🔴 Stop Loss: $170

🎯 Target Price: $240+

🔹 Current Price: $185.26

🔹 Why?

✅ Recession-proof industry (alcohol sales remain stable)

✅ Dominant brands (Corona, Modelo) = Strong moat

✅ Recent dip = Attractive valuation

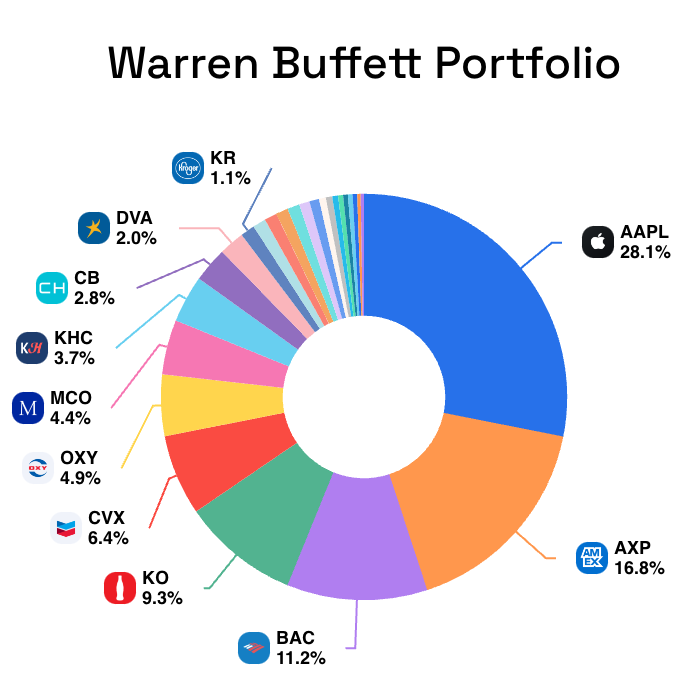

Apple (AAPL) – 28.1% of Buffett’s Portfolio

📍 Buy Zone: $210 – $230

🔴 Stop Loss: $200

🎯 Target Price: $260+

🔹 Current Price: $220.84

🔹 Why?

✅ Consistent revenue growth & strong brand loyalty

✅ High-margin ecosystem (iPhones, Services, Mac, iPads)

✅ Huge cash reserves and share buybacks

American Express (AXP) – 16.8% of Buffett’s Portfolio

📍 Buy Zone: $245 – $265

🔴 Stop Loss: $235

🎯 Target Price: $290+

🔹 Current Price: $255.39

🔹 Why?

✅ Strong brand and premium customer base

✅ Benefiting from high consumer spending and travel recovery

✅ Consistently increasing dividends

Bank of America (BAC) – 11.2% of Buffett’s Portfolio

📍 Buy Zone: $35 – $40

🔴 Stop Loss: $33

🎯 Target Price: $50+

🔹 Current Price: $39.61

🔹 Why?

✅ One of the most stable U.S. banks with strong balance sheets

✅ Rising interest rates boost profitability

✅ Consistent dividend growth

Coca-Cola (KO) – 9.3% of Buffett’s Portfolio

📍 Buy Zone: $65 – $75

🔴 Stop Loss: $60

🎯 Target Price: $85+

🔹 Current Price: $71.04

🔹 Why?

✅ Timeless brand with global dominance

✅ Strong pricing power & recession-proof business

✅ High and stable dividend yield

Chevron (CVX) – 6.4% of Buffett’s Portfolio

📍 Buy Zone: $140 – $160

🔴 Stop Loss: $130

🎯 Target Price: $190+

🔹 Current Price: $154.08

🔹 Why?

✅ Strong cash flow generation

✅ Key player in the energy sector

✅ Attractive dividend and share buyback program

Occidental Petroleum (OXY) – 4.9% of Buffett’s Portfolio

📍 Buy Zone: $40 – $50

🔴 Stop Loss: $38

🎯 Target Price: $70+

🔹 Current Price: $46.28

🔹 Why?

✅ Buffett has been aggressively increasing his stake

✅ Strong exposure to oil price upside

✅ Debt reduction improving financials

Moody’s Corporation (MCO) – 4.4% of Buffett’s Portfolio

📍 Buy Zone: $420 – $460

🔴 Stop Loss: $400

🎯 Target Price: $500+

🔹 Current Price: $443.85

🔹 Why?

✅ Market leader in credit ratings and risk analysis

✅ High barriers to entry in the sector

✅ Steady growth and strong cash flows

Kraft Heinz (KHC) – 3.7% of Buffett’s Portfolio

📍 Buy Zone: $30 – $35

🔴 Stop Loss: $28

🎯 Target Price: $50+

🔹 Current Price: $31.10

🔹 Why?

✅ Defensive consumer staples stock

✅ Improving margins and restructuring efforts

✅ Attractive dividend yield

Chubb Limited (CB) – 2.8% of Buffett’s Portfolio

📍 Buy Zone: $280 – $300

🔴 Stop Loss: $270

🎯 Target Price: $330+

🔹 Current Price: $290.70

🔹 Why?

✅ Leading global insurance provider

✅ Consistent earnings and cash flow generation

✅ Strong pricing power in a rising-rate environment

DaVita Inc. (DVA) – 2.0% of Buffett’s Portfolio

📍 Buy Zone: $140 – $150

🔴 Stop Loss: $135

🎯 Target Price: $180+

🔹 Current Price: $146.63

🔹 Why?

✅ Leader in kidney dialysis services

✅ Stable cash flow from long-term contracts

✅ Aging population = Increasing demand

Kroger (KR) – 1.1% of Buffett’s Portfolio

📍 Buy Zone: $60 – $70

🔴 Stop Loss: $58

🎯 Target Price: $80+

🔹 Current Price: $66.55

🔹 Why?

✅ Defensive grocery sector stock

✅ Strong private-label business

✅ Consistent dividend growth

Don’t Settle for Second Best – Discover Our Premium Stock Portfolio

Looking for even better stock ideas with lifetime access to all our updates and email alerts? Our portfolio is packed with high-conviction picks we believe have strong upside potential—some even stronger than the companies you see above!

Get Exclusive Lifetime Access Now

When you join, you’ll receive:

- Instant Access to our premium portfolio with in-depth analyses on every holding.

- Real-Time Email Alerts whenever we add, trim, or exit a position—so you’ll never miss a beat.

- Lifetime Membership: One subscription, endless updates, no recurring fees.

Seize this opportunity to access our best stock ideas, not just the ones listed above. Click here to subscribe and take your portfolio to the next level!

Final Thoughts

These predictions, based on historical market trends and supply changes, offer a conservative yet insightful outlook.

Stay connected and never miss an opportunity – follow us on our social media channels by clicking on the icon below! We regularly share expert insights, unique investment ideas, and exclusive promotions. Join our community today to get the latest real estate investment strategies delivered right to your feed.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

0 Comments