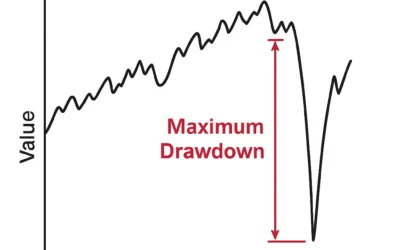

Maximum Drawdown (MDD) is one of the most critical risk metrics for any investor. In this article, we break down what it is, how it works, and how to use it to make smarter investment decisions.

Investing Tools and Regulations

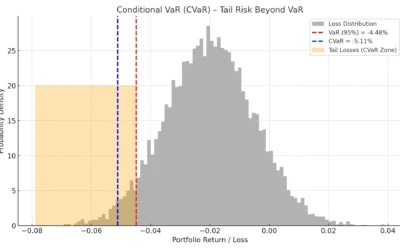

Conditional VaR (CVaR) – Looking Beyond the Worst Case

Conditional VaR (CVaR) helps investors understand how bad losses can get during extreme market downturns. Learn why CVaR matters, how to calculate it, and how to use it in portfolio management.

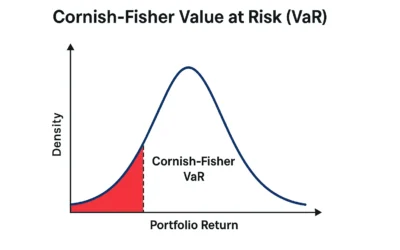

Cornish-Fisher Value at Risk (VaR): A Smarter Way to Estimate Portfolio Losses

Cornish-Fisher VaR enhances traditional risk metrics by including skewness and kurtosis, offering a better view of downside risks in volatile markets.

Value at Risk (VaR) – Estimating the Worst in Uncertain Times

Discover how Value at Risk (VaR) helps investors quantify potential losses in their portfolio. This in-depth guide explores its calculation methods, real-world applications, and its role in risk management.

Tracking Error & Information Ratio: Benchmarking Performance Accurately

Discover how Tracking Error and the Information Ratio work together to assess a portfolio manager’s skill versus a benchmark. Understand the formulas, meaning, and how to use them as an investor.

Jensen’s Alpha: Measuring Skill Beyond Market Return

Jensen’s Alpha goes beyond basic returns to reveal true investment skill. In this article, we explore how it’s calculated, what it means, and how investors can use it to pick outperforming funds.