Tesla has once again placed itself at the center of financial headlines after confirming Elon Musk’s potential to unlock a $1 trillion compensation jackpot. This staggering figure, tied to performance-based stock options, is not only unprecedented in corporate history but also a defining moment for both Tesla’s shareholders and the wider electric vehicle (EV) industry.

The announcement has triggered both admiration and controversy: is this the ultimate reward for visionary leadership, or a dangerous precedent for corporate governance?

Tesla’s Bold Compensation Strategy

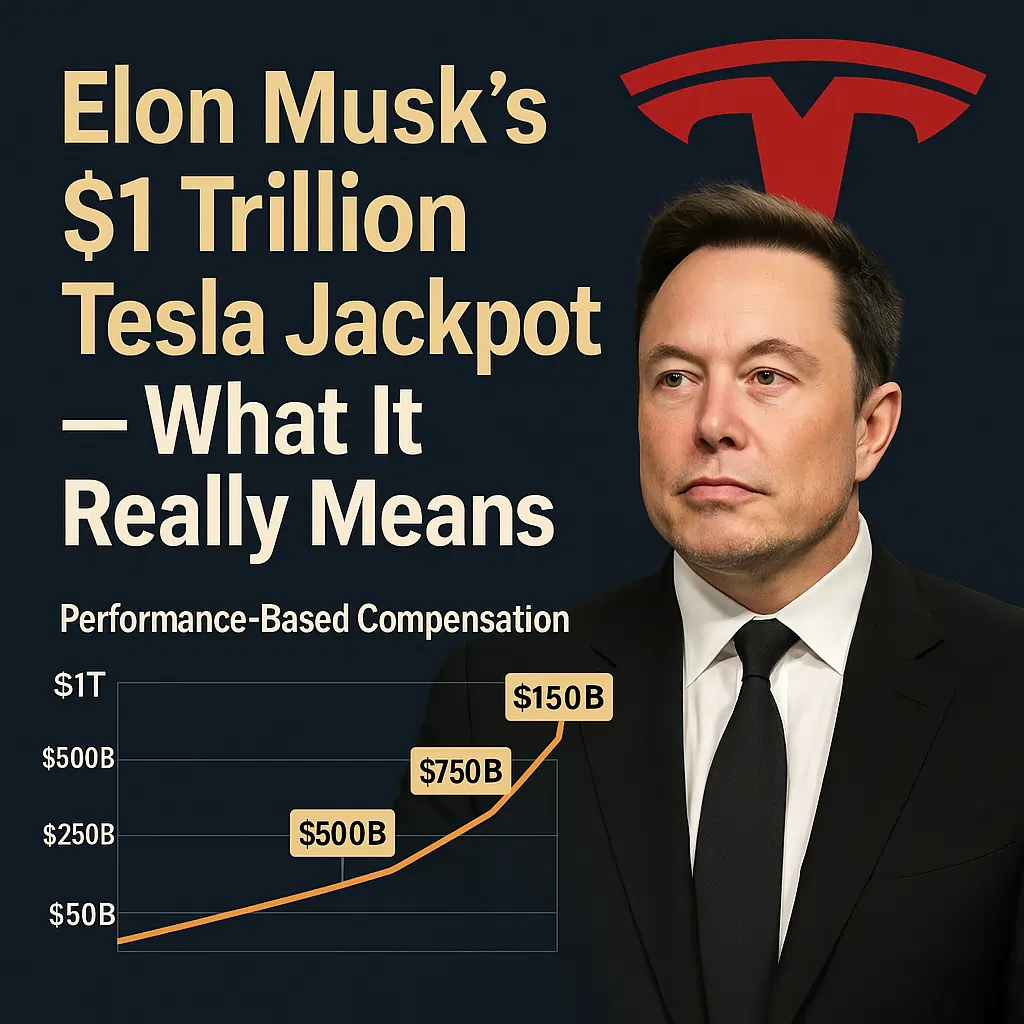

Elon Musk’s compensation packages have always been unconventional. Unlike traditional executive pay, Musk earns nothing in fixed salary. Instead, his rewards are structured entirely around Tesla achieving ambitious milestones in market capitalization, revenue, and profitability.

The trillion-dollar figure is not a lump sum payout. Instead, it represents the theoretical value of Musk’s stock options if Tesla’s share price sustains extraordinary growth. This design aligns Musk’s personal wealth directly with Tesla’s long-term performance — a strategy supporters say incentivizes innovation at a massive scale.

Why $1 Trillion?

Tesla’s valuation has surged in recent years, propelled by:

- Dominance in EV production and expansion into new markets.

- Battery innovation and energy storage initiatives.

- AI-driven technologies, including autonomous driving and robotics.

- Global branding power, with Musk’s persona driving retail investor enthusiasm.

As a result, Musk’s compensation plan has ballooned in theoretical value, crossing the trillion-dollar mark on paper.

Market Reactions

- Investors: Many retail traders see Musk’s payout as a validation of Tesla’s meteoric rise. Shareholders argue that the compensation is justified given the wealth Musk has already created for them.

- Critics: Governance experts warn that such colossal rewards may concentrate too much power in the hands of one individual. Some institutional investors question whether tying so much of Tesla’s strategy to Musk’s persona creates long-term risks.

- Regulators: The sheer size of the package has drawn scrutiny, especially as global regulators push for tighter rules on executive compensation transparency.

What It Means for Tesla

- Commitment to Growth: The package signals Tesla’s belief in its ability to maintain aggressive growth targets.

- Increased Volatility: Tying Tesla’s image to Musk’s compensation may amplify volatility in the stock. Any perceived misstep by Musk could have outsized impact on investor sentiment.

- Industry Benchmark: This deal sets a precedent for other tech giants considering unconventional incentive structures.

Price Target Scenarios for Tesla Stock

While Musk’s jackpot is theoretical, it does provide a framework for evaluating Tesla’s future:

- Short-Term (1–3 months): Tesla may experience speculative rallies as news around Musk’s payout dominates headlines.

Target Range: +5% to +15% upside potential. - Medium-Term (3–6 months): Investors will look for fundamental performance — deliveries, margins, and AI progress. Without concrete results, enthusiasm may fade.

Target Range: –10% to +10%. - Long-Term (6–12 months): Tesla’s ability to diversify revenue streams (energy storage, AI, robotics) will decide whether the trillion-dollar valuation is sustainable.

Target Range: –20% downside risk to +30% upside potential.

Lessons for Investors

- Don’t get distracted by headlines: While Musk’s package is historic, it doesn’t guarantee Tesla’s future stock performance.

- Focus on fundamentals: Deliveries, margins, innovation, and global market penetration remain the real indicators.

- Volatility is inevitable: Tesla is as much a sentiment-driven stock as it is a growth story.

Conclusion

Elon Musk’s $1 trillion Tesla jackpot is a milestone that reflects both Tesla’s extraordinary rise and Wall Street’s appetite for bold, unconventional leadership. But while the payout symbolizes success, it also raises difficult questions about governance, sustainability, and the balance of power between executives and shareholders.

For investors, the real story isn’t the headline number — it’s whether Tesla can continue to justify its sky-high valuation in an increasingly competitive EV and tech landscape.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments