Introduction: Why Measuring Skill Matters

In a world where beating the market is the holy grail of investing, how do you determine whether a fund manager is truly skilled—or just lucky? That’s where Jensen’s Alpha comes in. This powerful metric evaluates the risk-adjusted performance of a portfolio compared to what it should have earned, based on market movements alone. It helps investors identify true value creators among the noise.

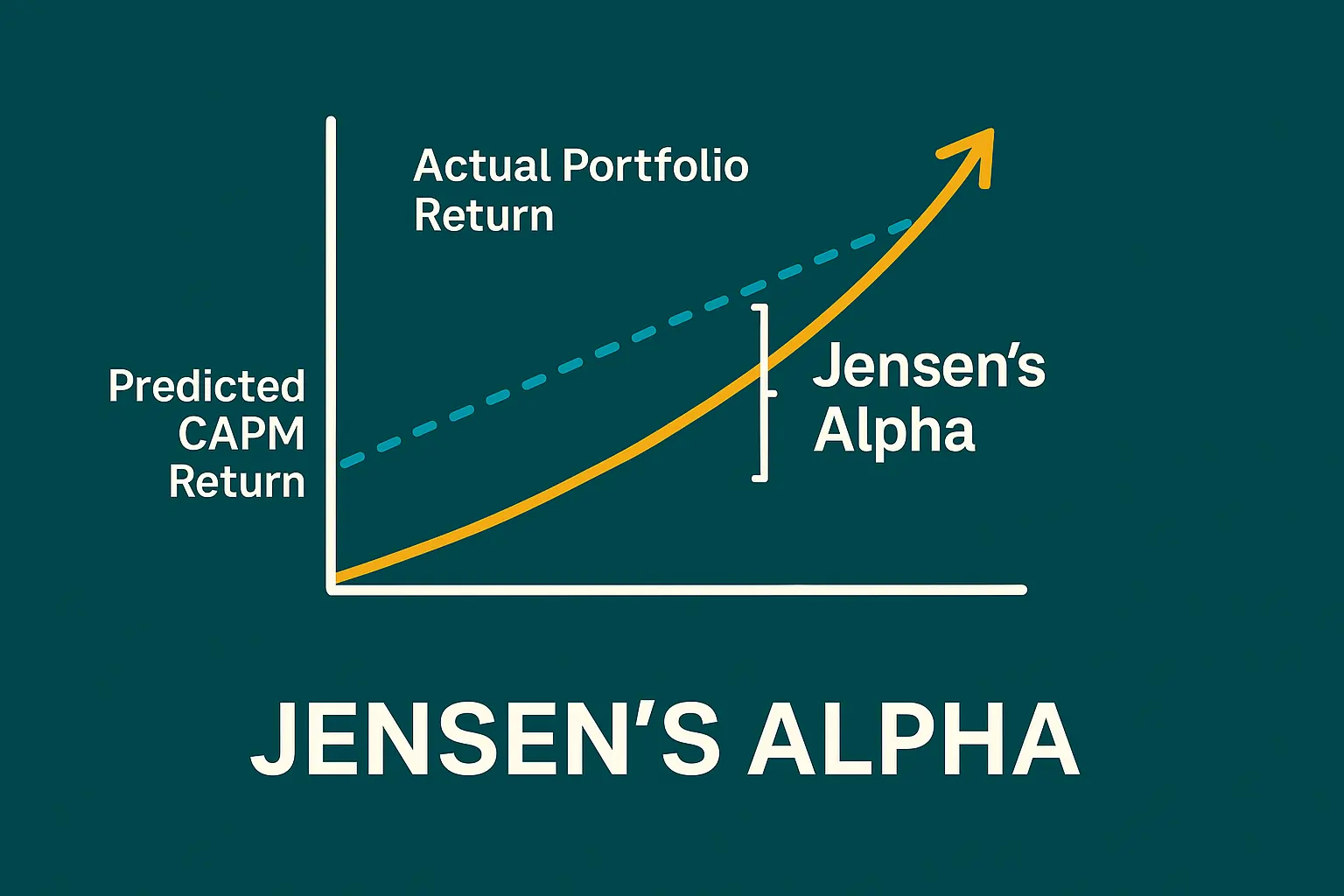

What Is Jensen’s Alpha?

Jensen’s Alpha is a performance indicator developed by Michael Jensen in 1968. It measures the excess return a portfolio generates over the return predicted by the Capital Asset Pricing Model (CAPM). In other words, it tells you if a portfolio manager has outperformed or underperformed, after adjusting for market risk (beta).

Formula: α = Rp – [Rf + β(Rm – Rf)]

Where:

- : Jensen’s Alpha

- : Portfolio return

- : Risk-free rate (e.g., 10-year government bond)

- : Market return (e.g., S&P 500)

- : Portfolio’s beta (sensitivity to market movements)

Interpreting Jensen’s Alpha

- : The portfolio outperformed its risk-adjusted benchmark – sign of potential skill.

- : Performance is in line with market-adjusted expectations.

- : The portfolio underperformed – possible inefficiency or poor management.

Unlike raw return, Jensen’s Alpha separates market movement from manager skill. This is critical for evaluating actively managed funds, hedge funds, and even robo-advisors.

Example: Jensen’s Alpha in Action

Suppose:

- Portfolio return () = 12%

- Market return () = 10%

- Risk-free rate () = 2%

- Portfolio beta () = 1.1

Step-by-Step Calculation: Assume the following:

• Rp = 12%

• Rm = 10%

• Rf = 2%

• β = 1.1

Step 1: Calculate the expected return using CAPM.

Expected return = Rf + β(Rm – Rf)

= 2% + 1.1 × (10% – 2%)

= 2% + 8.8% = 10.8%

Step 2: Subtract the expected return from the actual portfolio return.

Jensen’s Alpha = Rp – Expected return

= 12% – 10.8% = 1.2%

Interpretation: The portfolio outperformed the market-adjusted return by 1.2%. This suggests that the manager added value beyond market exposure.

The portfolio generated 1.2% more than what CAPM would have predicted, indicating positive alpha and likely skill.

How Investors Can Use It

- Fund Selection: Choose mutual funds, ETFs, or hedge funds that consistently show positive alpha.

- Performance Attribution: Distinguish between luck and true management skill.

- Risk Management: Pair Jensen’s Alpha with Sharpe Ratio and Beta to get a full picture of performance.

Caution: Alpha can be distorted by short-term anomalies, leverage, or benchmark misalignment. It works best when applied over long periods with consistent benchmarks.

Tools That Provide Jensen’s Alpha

- Morningstar: Shows alpha over 3, 5, and 10 years

- Portfolio Visualizer: DIY backtests

- Bloomberg Terminal: For institutional investors

- Our Newsletter: We integrate Jensen’s Alpha in our portfolio evaluations – Join here for free!

Conclusion: Alpha Is the Signal, Not the Noise

In a sea of returns, Jensen’s Alpha acts like a lighthouse—highlighting managers and portfolios that truly outperform. By adjusting for market risk, it provides a fair and powerful lens to assess performance. For any serious investor, learning to interpret alpha isn’t just useful—it’s essential.

📥 Want curated insights and outperforming stock alerts? Join our free newsletter and receive trading alerts backed by data, not noise.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore our library or go to Lulu.com for each guide:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

0 Comments