The global oil market is teetering on the brink of uncertainty, with prices surging and volatility spiking as geopolitical tensions in the Middle East escalate. A recent warning from the German Bundesbank has thrust the Iran–Israel conflict into the spotlight, underscoring the potential for a broader crisis that could disrupt oil supplies and send shockwaves through the global economy. As investors, policymakers, and industry leaders grapple with the implications, the stakes for energy markets have rarely been higher.

Bundesbank’s Warning: A Catalyst for Concern

In its latest report, the Bundesbank highlighted the escalating tensions between Iran and Israel as a significant risk to global economic stability, with particular emphasis on the oil market. The central bank noted that any intensification of the conflict—especially if it draws in other regional powers or disrupts critical energy infrastructure—could lead to severe supply shortages and price spikes. This warning comes at a time when oil markets are already grappling with tight supply chains, robust demand, and the lingering effects of OPEC+ production cuts.

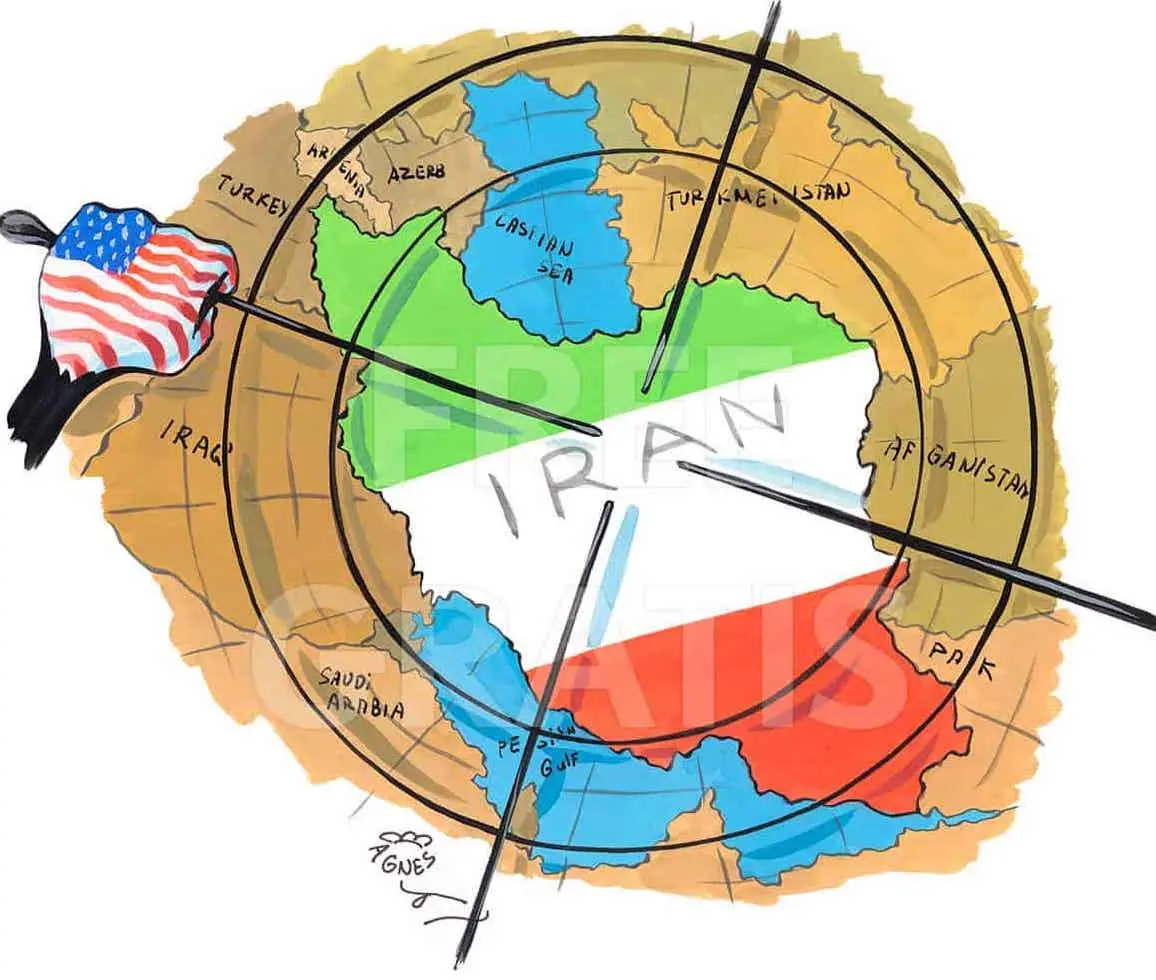

The Bundesbank’s concerns are rooted in the strategic importance of the Middle East, which accounts for roughly 30% of global oil production and a significant portion of exports. Iran, a key OPEC member, produces around 3.2 million barrels per day (bpd), while its regional influence extends to proxy groups that could target energy infrastructure across the Gulf. Israel, though not a major oil producer, is a critical geopolitical player whose actions could trigger a broader conflict, potentially involving major oil producers like Saudi Arabia or the United Arab Emirates.

Why the Iran–Israel Tensions Matter

The Iran–Israel rivalry has long been a source of regional instability, but recent developments have heightened fears of a direct confrontation. Iran’s support for groups like Hezbollah and its advancing nuclear program have drawn sharp responses from Israel, which has conducted airstrikes and covert operations to curb Tehran’s influence. Any escalation—whether through direct military action or attacks on energy infrastructure like pipelines, refineries, or shipping routes—could disrupt oil flows from the Persian Gulf, where 20% of the world’s oil passes through the Strait of Hormuz.

The Bundesbank’s report specifically flagged the risk of a blockade or attack on the Strait of Hormuz, a chokepoint that has been a flashpoint in past conflicts. Even a temporary disruption could cause oil prices to spike by 20–30%, according to some analysts, with cascading effects on inflation, transportation costs, and consumer prices worldwide.

Market Reactions: Volatility and Uncertainty

Oil markets have already begun pricing in the heightened risk. Brent crude, the global benchmark, has climbed above $80 per barrel in recent weeks, with traders citing geopolitical risks as a key driver. West Texas Intermediate (WTI) has followed suit, hovering near $77. The options market reflects growing unease, with a surge in demand for contracts betting on prices exceeding $100 per barrel by early 2026.

Energy stocks have also seen a boost, as investors seek exposure to producers and service companies likely to benefit from higher prices. However, the broader economic implications are less rosy. Rising oil prices could exacerbate inflationary pressures, forcing central banks like the Federal Reserve and the European Central Bank to maintain or tighten monetary policy, potentially stifling growth.

Broader Implications for the Global Economy

The Bundesbank’s warning extends beyond oil markets, highlighting the interconnected nature of geopolitics and economics. Higher energy costs would hit consumers and businesses hard, particularly in energy-intensive sectors like manufacturing, transportation, and agriculture. Developing economies, which often lack the fiscal buffers to absorb price shocks, could face acute challenges, including currency depreciation and rising debt burdens.

Moreover, a prolonged crisis could strain relations among global powers. The United States, which has imposed sanctions on Iran while maintaining strong ties with Israel, faces a delicate balancing act. China, a major importer of Middle Eastern oil, has called for de-escalation but could face economic headwinds if supplies are disrupted. Meanwhile, Europe, already grappling with energy security concerns since the Russia–Ukraine conflict, is particularly vulnerable to further shocks.

Navigating the Uncertainty: What’s Next?

For oil market participants, the immediate focus is on monitoring developments in the Middle East. Key indicators include:

- Geopolitical Flashpoints: Any escalation in hostilities, particularly involving the Strait of Hormuz or Iran’s nuclear facilities, could trigger an immediate market reaction.

- OPEC+ Response: The cartel has maintained production cuts to support prices, but a major supply disruption could prompt a reassessment. Saudi Arabia and other members hold spare capacity, but deploying it would take time and may not fully offset a prolonged outage.

- Alternative Supplies: The U.S., Canada, and other non-OPEC producers could ramp up output, but logistical constraints and investment lags limit their ability to fill a sudden gap.

- Demand Dynamics: Global demand remains robust, driven by recovering economies and seasonal factors. However, a sharp price spike could dampen consumption, particularly in price-sensitive markets.

Policymakers and businesses must also prepare for a range of scenarios. Hedging strategies, such as locking in prices through futures contracts, can help mitigate risks for energy-intensive industries. Governments may need to bolster strategic petroleum reserves and explore alternative energy sources to reduce reliance on volatile regions.

Conclusion: A Fragile Balance

The Bundesbank’s warning serves as a stark reminder of the fragility of global oil markets in the face of geopolitical risks. While the Iran–Israel tensions have not yet erupted into a full-blown crisis, the potential for disruption looms large. For now, markets remain on edge, with every headline scrutinized for signs of escalation or de-escalation.

As the world watches the Middle East, the oil market’s fate hangs in the balance. Stakeholders must navigate this uncertainty with vigilance, balancing the need for stability with the reality of a region fraught with complexity. In an interconnected world, the ripple effects of a crisis could extend far beyond the oil fields, shaping the economic landscape for years to come. Read more on our blog: Investment Blog.

0 Comments