Introduction

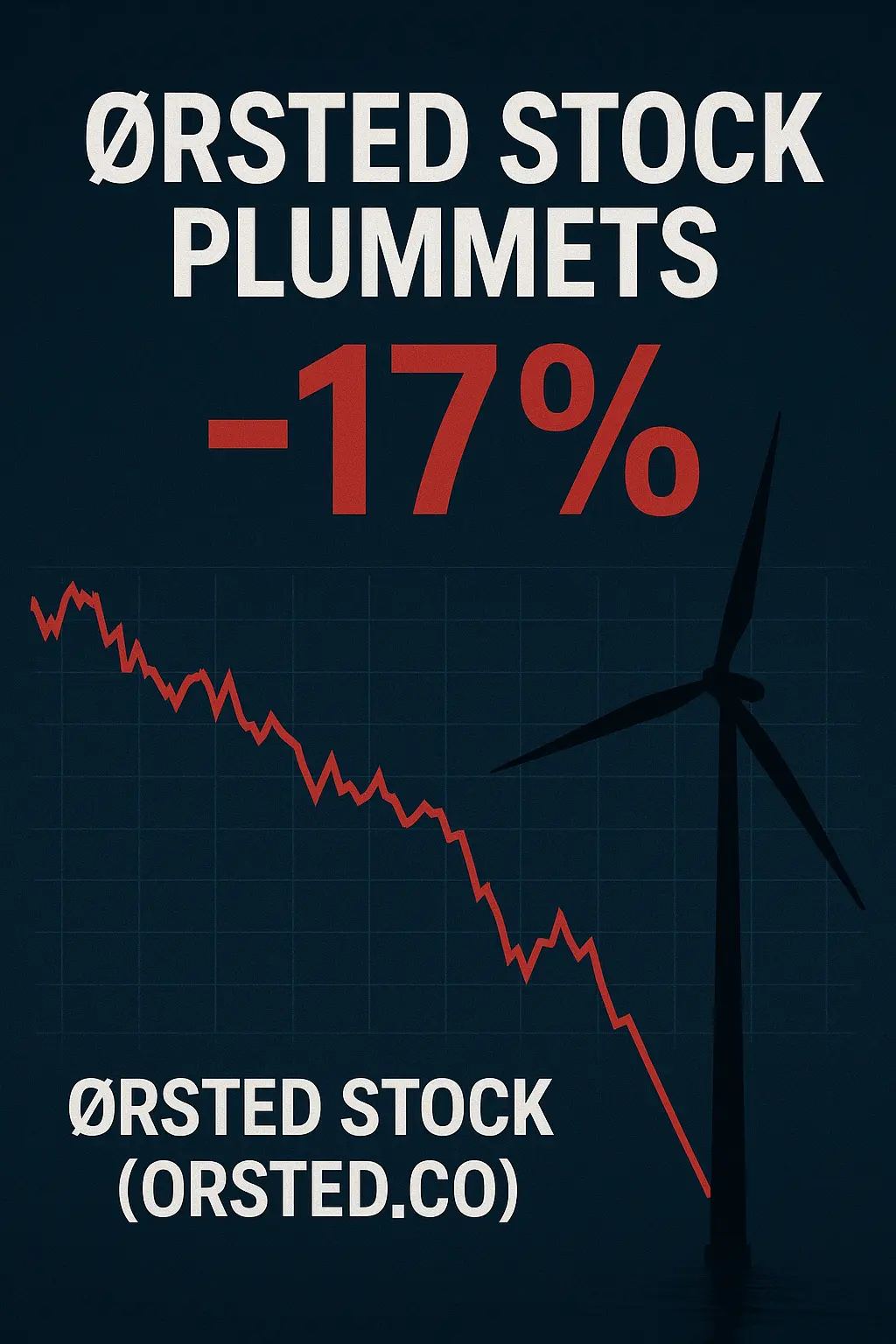

Shares of Ørsted A/S (ORSTED.CO), one of the world’s largest offshore wind developers, plummeted more than 17% after the U.S. government unexpectedly ordered the company to halt construction on a nearly completed offshore project. The move has cast immediate doubt on Ørsted’s financing plans, including its proposed 60 billion DKK ($9.4 billion) rights issue, leaving investors questioning whether this is a temporary roadblock—or a structural blow to the global renewable energy leader.

One of the Best Brokers in Europe

For European investors looking to capture opportunities in renewable energy stocks, top brokers provide access to U.S. and EU-listed equities, competitive fees, and advanced risk-management tools to navigate volatility like this.

Financial Performance

- Market Reaction: Ørsted shares fell 17% within 30 minutes of Monday’s open.

- Capital Plans: Proposed 60B DKK rights issue still moving forward, backed by the Danish state.

- Revenue Base: Annual revenues above 100B DKK, but recent quarters have shown margin compression due to high costs and project delays.

Key Highlights

- U.S. halts nearly completed offshore project.

- Ørsted share price collapses to multi-year lows.

- Rights issue raises dilution concerns.

- Danish government majority stake offers partial stability.

Profitability and Valuation

Ørsted’s forward P/E ratio was already under pressure compared to renewable peers. The project halt, combined with high capital costs, may push valuation lower in the near term. The discount could, however, attract contrarian investors betting on long-term clean energy growth.

Debt and Leverage

With leverage already high, the rights issue aims to shore up the balance sheet. Yet if project delays persist, rising debt levels could further erode investor confidence.

Growth Prospects

Despite the setback, global offshore wind remains a multi-trillion-dollar growth industry. Ørsted’s international footprint across Europe, Asia, and the U.S. still positions it as a long-term leader—if it can navigate regulatory and financial hurdles.

Technical Analysis

- Ørsted Stock (ORSTED.CO):

- Support: 330 DKK (critical zone)

- Resistance: 395 DKK (short-term bounce target)

- RSI oversold, suggesting a potential technical rebound.

- Short-term view: Relief rally possible.

- Medium-term view: Uncertainty until U.S. clarity and rights issue completion.

Potential Catalysts

- Updates on U.S. project negotiations.

- Investor demand for the 60B DKK rights issue.

- Government subsidies or regulatory relief.

- Global energy policy shifts favoring renewables.

Leadership and Strategic Direction

Management must now demonstrate crisis agility. CEO Mads Nipper faces pressure to balance regulatory uncertainty with financing needs while defending Ørsted’s reputation as a global clean energy leader.

Impact of Macroeconomic Factors

- Rising interest rates increase financing costs for capital-intensive projects.

- U.S. trade and regulatory policy can dramatically shift project economics.

- Strong dollar impacts European cash flows.

Total Addressable Market (TAM)

The offshore wind industry TAM is projected to surpass $1 trillion by 2040, fueled by government commitments to net-zero targets. Ørsted remains a top-tier player in this global race.

Market Sentiment and Engagement

Investor sentiment has turned sharply bearish after the news, but value hunters may see opportunity in oversold conditions. Social media chatter highlights both “collapse fears” and “long-term bargain hunting.”

Conclusions, Target Price Objectives, and Stop Losses

- Ørsted Stock (ORSTED.CO):

- Short-term target: 390 DKK (technical bounce)

- Medium-term target: 450 DKK (if financing stabilizes)

- Long-term target: 600 DKK (if global wind demand accelerates)

- Stop-loss: 320 DKK

For bold investors, the crash offers an entry point with clear risk levels. For cautious investors, waiting for rights issue clarity may be prudent.

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter.

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter.

0 Comments