Introduction

The U.S. electric vehicle (EV) landscape could shift dramatically if proposed GOP legislation removes federal tax credits, placing Tesla (TSLA) in the crosshairs. With Elon Musk vocally opposing the bill, investor uncertainty is rising—but so is opportunity.

One of the Best Broker in Europe

Investors seeking to navigate this volatility are increasingly turning to top-tier European brokers offering seamless access to Tesla stock, options, and clean energy ETFs.

Financial Performance

Tesla posted robust earnings in Q1 2025 despite cost headwinds and political risk. Its strong margins and growing free cash flow are reassuring investors.

Key Highlights

- Q1 2025 revenue: $28.7B

- Net income: $3.4B

- Operating margin: 12.1%

- Free cash flow: $2.6B

Profitability and Valuation

Tesla’s current P/E ratio of ~55x might seem steep, but investors are betting on long-term growth and AI integration. The removal of tax credits may lead to multiple compression in the short term.

Debt and Leverage

With net cash on hand and low leverage ratios, Tesla has the flexibility to adjust pricing, scale manufacturing, and absorb temporary macro shocks.

Growth Prospects

Tesla continues to expand internationally, with major developments in India and Indonesia. Long-term growth lies in AI-driven full self-driving (FSD), energy storage, and robotics.

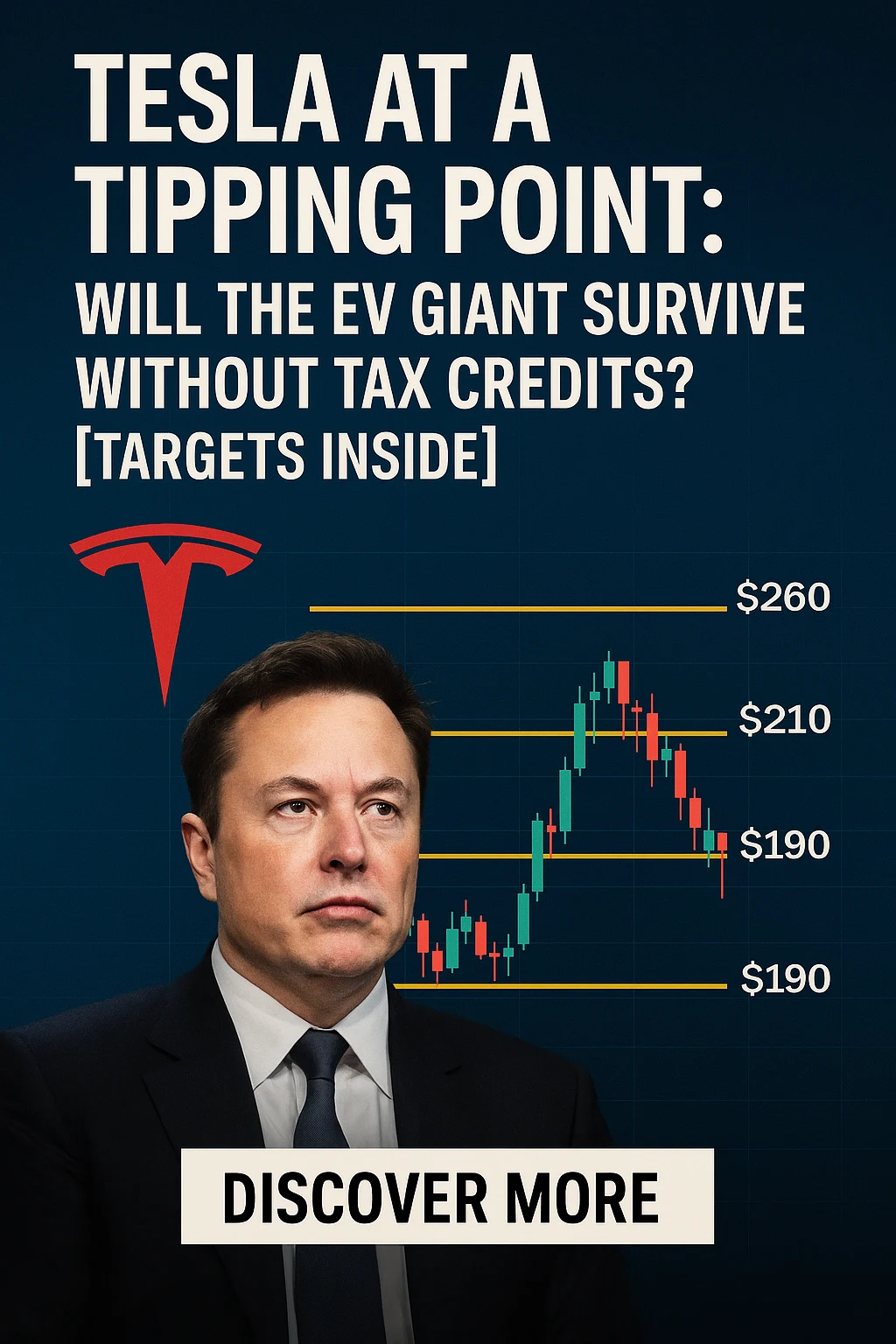

Technical Analysis

- Support: $165

- Resistance: $205

- 200-day MA: $182

- RSI: 42 (neutral)

Potential Catalysts

- Reinstatement or retention of partial EV tax credits

- Strong Q2 delivery numbers

- Expansion into new global markets

- Updates on FSD licensing model

Leadership and Strategic Direction

Elon Musk’s recent criticism of the GOP bill underscores his awareness of affordability challenges. Tesla’s shift toward high-efficiency production and lower-cost models signals a defensive yet agile strategy.

Impact of Macroeconomic Factors

Rising interest rates and political uncertainty are dampening discretionary consumer spending. However, demand for used EVs and leasing options remains strong, aided by EV tax incentives.

Total Addressable Market (TAM)

With EV adoption still below 10% globally, Tesla’s TAM continues to expand. Tesla Energy, charging infrastructure, and FSD technologies offer massive cross-industry opportunities.

Market Sentiment and Engagement

Social sentiment is cautiously bullish. Musk’s social media presence continues to drive high engagement, and institutional investors maintain large positions, signaling confidence in Tesla’s adaptability.

Conclusions, Target Price Objectives, and Stop Losses

While the political backdrop adds uncertainty, Tesla’s fundamentals remain solid. Investors should prepare for short-term volatility but long-term upside.

- 6-Month Target: $215

- 12-Month Target: $240

- 3-Year Target: $330

- Suggested Stop-Loss: $165

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

0 Comments