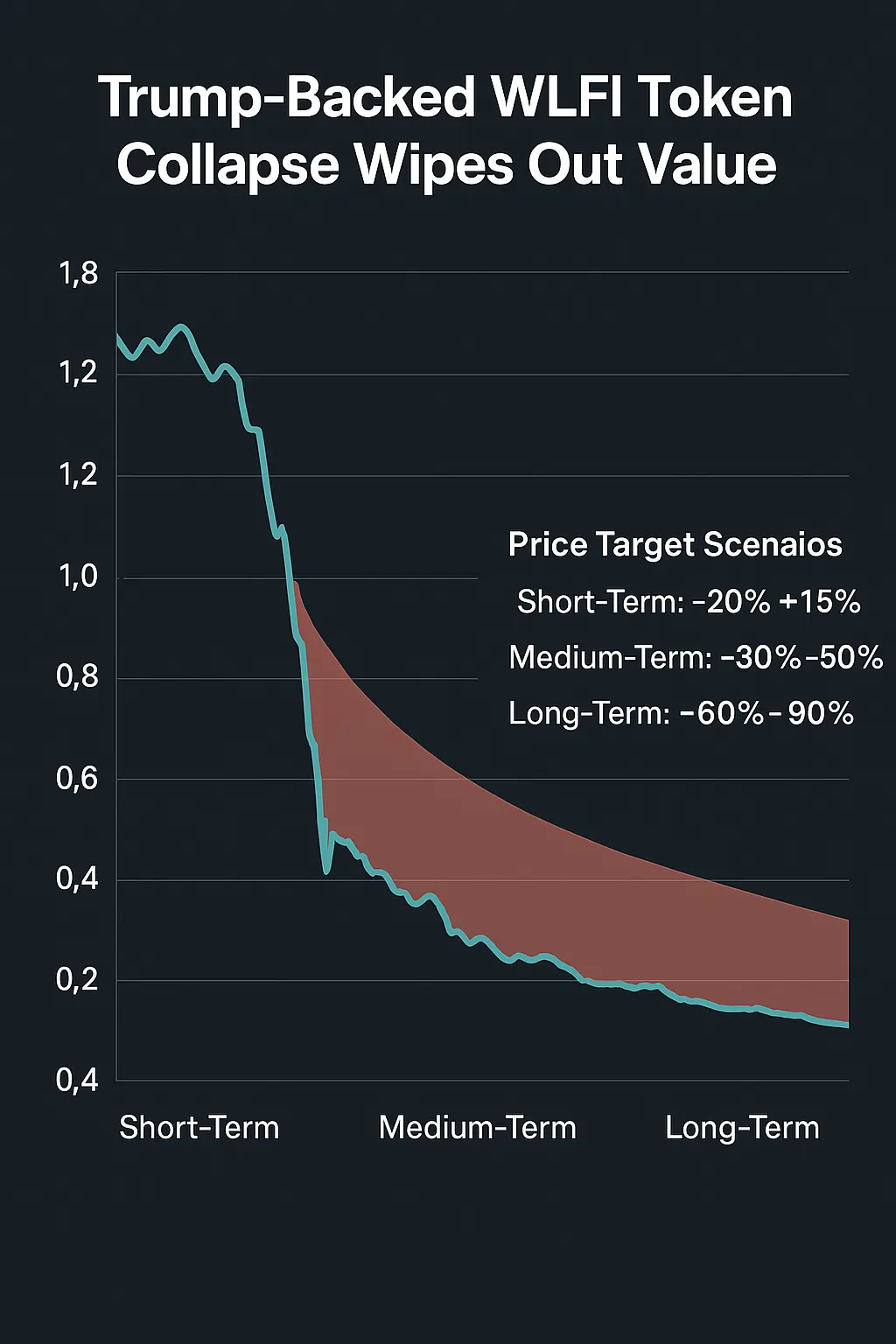

The highly publicized World Liberty Financial (WLFI) token, promoted as part of a Trump-backed initiative, has suffered a dramatic collapse in recent days. Once heralded by supporters as a symbol of financial independence and blockchain innovation, the token’s sharp decline has wiped out a significant portion of its market value, leaving investors unsettled and markets questioning the credibility of politically-linked crypto ventures.

The Rise of WLFI

WLFI launched with strong branding, tying its identity to themes of liberty, economic empowerment, and national pride. The project quickly gained traction among retail investors drawn to both its political associations and its promise of high returns. Early rallies saw the token’s price surge, fueled by promotional campaigns and speculative interest.

Key drivers of its early momentum included:

- Political endorsement: A Trump-aligned narrative that attracted a loyal base.

- Retail enthusiasm: Social media hype and community-driven promotion.

- Speculative trading: Rapid inflows from traders hoping to capitalize on early gains.

The Crash: From Hype to Collapse

The market downturn was swift. Within a short period, WLFI experienced a sharp sell-off that erased much of its value. Contributing factors include:

- Overvaluation and speculation – A rapid run-up in price created unsustainable expectations.

- Liquidity issues – Thin trading volumes amplified volatility during sell-offs.

- Whale movements – Large holders reportedly liquidated positions, accelerating the downward spiral.

- Credibility concerns – Skepticism around governance, transparency, and the sustainability of politically branded tokens further eroded confidence.

Market Reactions

- Investors: Many retail holders faced steep losses, with online forums showing frustration and anger over the sudden downturn.

- Broader crypto market: While Bitcoin and major altcoins remained relatively stable, the WLFI collapse reignited concerns about speculative “celebrity” or “politically backed” tokens.

- Regulators: The crash is likely to attract scrutiny, as regulators have already signaled increased interest in crypto projects that leverage political or celebrity endorsements.

Lessons for Investors

The WLFI collapse highlights important lessons:

- Do not invest on hype alone: Political backing or celebrity association does not guarantee project fundamentals.

- Diversify holdings: Exposure to high-risk assets like politically linked tokens should remain limited.

- Evaluate fundamentals: Strong technology, transparent governance, and sustainable tokenomics matter more than branding.

Outlook

Although WLFI could attempt a rebound through restructuring, strategic partnerships, or renewed marketing campaigns, the damage to investor confidence is significant. Unless the project demonstrates transparency and a sustainable long-term vision, it risks being remembered as another cautionary tale in the volatile world of crypto assets.

Conclusion

The crash of the Trump-backed WLFI token underscores the inherent risks in speculative, politically branded cryptocurrencies. For investors, the episode serves as a stark reminder that hype and endorsements cannot replace due diligence. In an industry already marked by volatility, the WLFI collapse reinforces the importance of sound fundamentals and cautious investing.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile ? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments