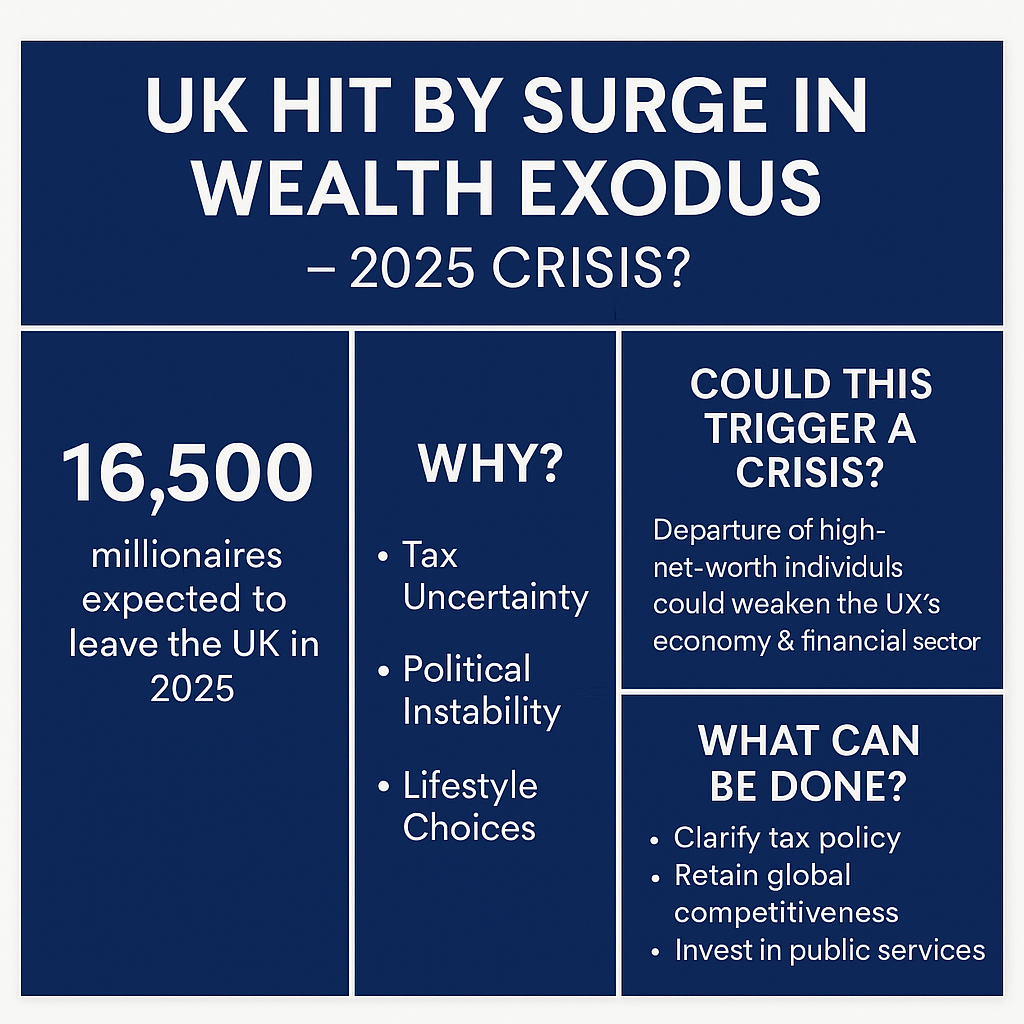

In 2025, the United Kingdom is facing an alarming trend that could have lasting economic and geopolitical consequences: a record-breaking outflow of high-net-worth individuals (HNWIs). According to the latest data from Henley & Partners and other global mobility tracking firms, an estimated 16,500 millionaires are expected to leave the UK this year, marking one of the largest wealth migrations in modern British history.

What’s driving this exodus? And what does it mean for the future of the UK economy?

A Historic Wealth Flight

The UK has long been considered a financial haven for global wealth. London, in particular, has served as a magnet for entrepreneurs, investors, and family offices from around the world. But in 2025, that narrative is shifting.

Recent figures suggest that the number of ultra-wealthy individuals relocating out of the UK has surged by over 30% compared to the previous year. Many are choosing alternative jurisdictions such as the United Arab Emirates, Singapore, Monaco, and Switzerland, which offer more favorable tax regimes and political stability.

Why Are Millionaires Leaving?

Several key factors are contributing to this trend:

Tax Uncertainty

There is growing concern over future tax policy, particularly surrounding wealth, inheritance, and capital gains. With discussions around wealth taxes and tighter anti-avoidance rules, many HNWIs are seeking more predictable environments for wealth preservation.

Political Instability

Ongoing debates over the future of Scotland, trade friction post-Brexit, and uncertainty surrounding party leadership have all created an environment of political unpredictability. Wealthy individuals, known for prioritizing certainty, are choosing to relocate where long-term planning is safer.

Lifestyle and Global Mobility

The rise of remote work, digital nomad visas, and second citizenship programs means affluent individuals are no longer geographically tied to a financial center like London. Many now prioritize personal security, education options, climate, and healthcare when choosing where to reside.

Economic Impact: Why It Matters

The departure of 16,500 millionaires may seem symbolic to some — but the real concern lies in capital flight. These individuals are often tied to investment portfolios, real estate purchases, philanthropic giving, and early-stage business funding.

The UK could experience:

- Reduced tax revenue from capital gains and property taxes

- Weaker domestic investment in startups and SMEs

- Lower luxury and high-end property consumption

- Loss of financial sector competitiveness

According to the Institute for Fiscal Studies, even a 10% loss in high-net-worth tax contributions can put pressure on public services, especially in a tightening fiscal environment.

Could This Trigger a Crisis?

The word “crisis” may sound alarmist, but a sustained trend of wealth outflow — combined with stagnating productivity, rising interest rates, and global economic uncertainty — could amplify existing structural weaknesses in the UK economy.

If the country fails to retain or replace its wealthy taxpayers, the ripple effects could influence not only fiscal policy, but also its attractiveness as a global investment hub.

What Can Be Done?

Policy analysts and business leaders are urging the UK government to take action:

- Clarify long-term tax policy to restore confidence

- Reinforce London’s position as a global capital for innovation and finance

- Invest in infrastructure, talent, and public services to improve quality of life

- Modernize visa and residency programs to attract and retain global talent and wealth

Conclusion

The 2025 millionaire exodus from the UK is more than a headline — it’s a warning signal. As global mobility increases and wealthy individuals become more agile, the UK must adapt to remain competitive. Failing to do so may result in long-term economic challenges that extend well beyond tax revenue.

In a world where capital follows confidence, the UK’s ability to reassure its wealth base could be the key to navigating what is shaping up to be a pivotal economic turning point.

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile ? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments