Financial Performance and Market Position

Interactive Brokers (IBKR) stands out as an electronic brokerage firm that provides sophisticated trading platforms for both professional and retail traders. Renowned for its low commissions and extensive market access, Interactive Brokers offers a comprehensive trading experience that appeals to a wide range of investors. The company’s platform is tailored for those who seek efficiency, advanced tools, and broad market opportunities. GuruFocus is an exceptional screener for value investors, providing insights and analytics that can make a significant difference in investment strategies.

For those who prefer to select individual stocks for the medium to long term, it is crucial to first understand what type of investor you are. To help with this, we have created three articles summarizing the three main types of investors: Value Investors, Growth Investors, and GARP Investors. Additionally, for those interested in passive investment strategies over a very long term (20-30 years), our guide on building a robust ETF portfolio offers comprehensive insights. Furthermore, you can learn more about investing in commodities. Also, check out our article on swing trading, which is an excellent strategy for both individual investors and professional fund managers.

In addition, we invite you to explore our latest article on how to invest in cryptocurrency. This comprehensive guide covers everything you need to know to navigate the exciting world of digital assets.

Lastly, you can access our other parabolic growth strategy called biotech strategy. Additionally, you can access our article on the special strategy called Dividend Capture Strategy.

Why Interactive Brokers is a Strong Investment ?

The growing importance of investing has significantly benefited Interactive Brokers. More people recognize the value of investing, and Interactive Brokers is well-positioned to capture this expanding market. The company’s efficiency and competitive low-cost structure make it one of the most attractive brokers available. Over the past decade, Interactive Brokers’ Owner’s Earnings have surged by an impressive 20.6%. This growth is a testament to the company’s robust business model and operational excellence.

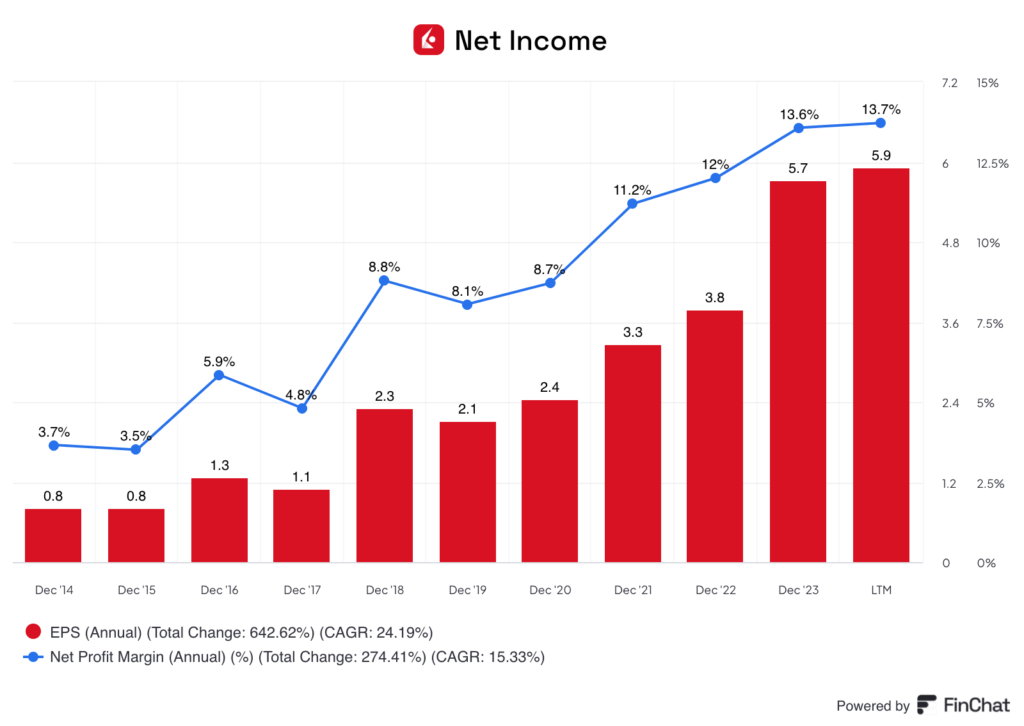

For the fiscal year ending in 2023, Interactive Brokers reported strong financial results, with total revenue reaching $8.31 billion. Key financial metrics include a Market Cap of $13.62 billion, a P/E Ratio of 21.70, and an EPS (TTM) of $5.86. The company boasts a Gross Margin of 94.14% and an Operating Margin of 84.20%, underscoring its profitability and efficiency. The Net Margin stands at 7.55%, reflecting its ability to convert revenue into net income effectively.

For those who want to move faster and benefit from our trading positions, consult our constantly updated portfolios. You can simply follow our ideas or take up our positions. You will also receive reports, analyses, and alerts by email via the following link: Subscription.

Profitability and Valuation

Interactive Brokers’ profitability metrics highlight its solid financial foundation. The Return on Assets (ROA) is 0.50%, while the Return on Equity (ROE) is 18.62%. These figures indicate the company’s efficient use of its assets and equity to generate profits. The Price to Earnings (P/E) ratio of 21.70 reflects a balanced valuation relative to its earnings. Additionally, the company’s Price to Sales (P/S) ratio is 1.64, and the Price to Book (P/B) ratio is 3.65, showcasing its strong market position. Investors can leverage GuruFocus to delve deeper into these financial metrics and identify value opportunities.

Growth Prospects

Interactive Brokers is poised for continued growth, consistently outperforming its peers in the brokerage industry. The company’s strategic initiatives and expanding market reach contribute significantly to its strong growth outlook. For the upcoming year, the expected Earnings Per Share (EPS) growth is 15.96%, and year-over-year sales growth is projected at 58.66%. These metrics highlight the company’s ability to sustain growth and adapt to changing market dynamics.

Technical Analysis

From a technical analysis perspective, Interactive Brokers’ stock demonstrates resilience and upward momentum. As of July 2, 2024, the stock is trading at $127.12, reflecting a remarkable year-to-date performance of 53.39%. The stock’s 52-week range of $72.60 – $129.19 underscores its substantial growth over the past year. Key technical indicators include a 20-day Simple Moving Average (SMA20) of 3.60%, a 50-day Simple Moving Average (SMA50) of 4.53%, and a 200-day Simple Moving Average (SMA200) of 27.50%. These indicators suggest strong market confidence and a bullish trend.

Potential Catalysts

Several factors could drive further growth for Interactive Brokers:

- Expansion of Trading Platforms and Services: Interactive Brokers continues to enhance its trading platforms, providing users with advanced tools and features.

- Increased Market Access and Extended Trading Hours: By offering extended trading hours and broader market access, the company caters to a diverse range of investors.

- Innovations in Financial Products and Services: Ongoing innovation in financial products keeps Interactive Brokers at the forefront of the industry.

- Strategic Partnerships and Collaborations: Collaborations with financial institutions and other partners enhance the company’s market presence and service offerings.

Leadership and Strategic Direction

Under the leadership of CEO Thomas Peterffy, Interactive Brokers has demonstrated strong strategic direction and growth. Peterffy’s vision and leadership have been pivotal in steering the company towards innovation and market expansion. The strategic focus on enhancing customer experience, expanding market access, and introducing new financial products positions Interactive Brokers well for sustained success.

Impact of Macroeconomic Factors

Interactive Brokers’ performance is influenced by various macroeconomic trends, including changes in investment patterns, global economic conditions, and regulatory developments. These factors can significantly impact the company’s operations and market position. Staying informed about these trends is crucial for anticipating the company’s future trajectory. Investors can engage with the investment community on StockTwits to gauge market sentiment and exchange insights with other investors.

Total Addressable Market (TAM)

Interactive Brokers operates within the global brokerage market, which is poised for significant growth. The increasing popularity of investing and trading among retail investors contributes to a substantial Total Addressable Market. The brokerage industry’s projected growth supports a favorable outlook for Interactive Brokers, reinforcing its market potential and strategic advantages.

Conclusions and Target Price Objectives

Interactive Brokers presents a compelling investment opportunity, backed by strong financials, innovative trading platforms, and a growing market presence. The company’s consistent performance and strategic initiatives position it well for future growth. Investors should consider Interactive Brokers as a valuable addition to their portfolios, leveraging tools like GuruFocus for in-depth analysis and StockTwits for real-time investor sentiment.

These are the target prices:

- 2024: $140

- 2025: $160

- 2026: $180

- 2027: $200

These target prices reflect the company’s growth potential, market conditions, and strategic initiatives. Investors are encouraged to monitor market trends and adjust their expectations accordingly.

However, there are more promising investment opportunities than Interactive Brokers, offering significantly higher returns with lower risk. To discover these top picks, visit the following link: Bullish Stock Alerts.

For those interested in starting their investment journey, consider using our affiliate link for Trade Republic. By using this link, you will receive a €10 bonus in shares as a gift: Trade Republic.

For a detailed and precise framework (quantitative, qualitative, technical, fundamental), readers can explore our other articles and the following book, which is probably one of the most concise on the topic: The Art of Unearthing Gems in the Stock Market. This resource is perfect for investors of all levels and offers in-depth insights into proven strategies for achieving true success in the stock market. Please note that this is an affiliate link, and we will earn a commission if you purchase the book through it.

Stay tuned for more expert advice and join our community of informed investors by subscribing to our newsletter. To join us, simply click the “Join our newsletter” button at the top right for free analyses, ideas, and lessons.

0 Comments