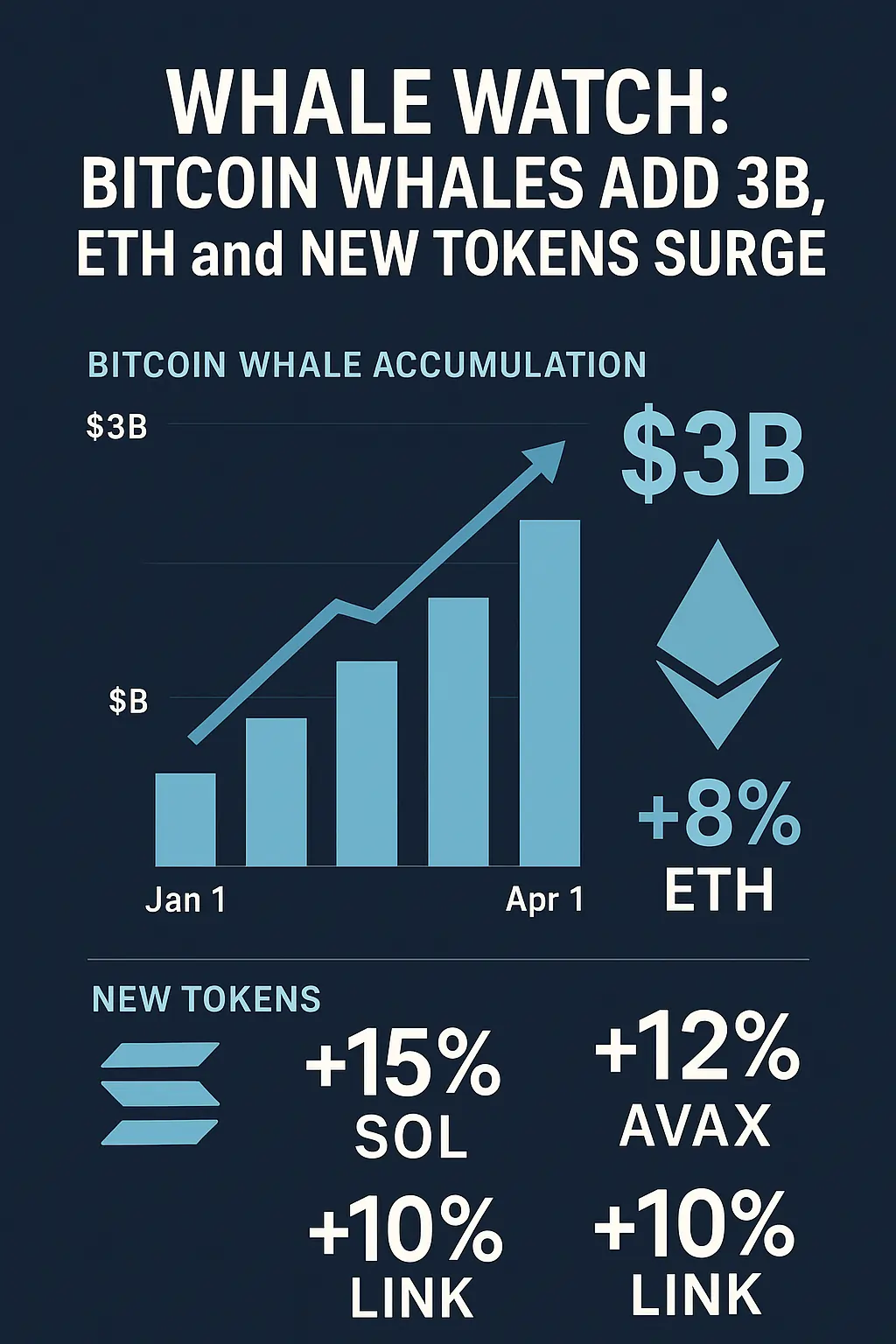

Bitcoin’s largest holders — often referred to as “whales” — have quietly accumulated an additional $3 billion worth of BTC in recent weeks. This massive buying activity has rippled across the crypto market, sparking renewed optimism for Ethereum (ETH) and a group of rising star altcoins.

The move underscores growing institutional confidence in digital assets, even as global markets navigate uncertainty and investors weigh opportunities in alternative tokens.

Bitcoin Whale Accumulation: $3 Billion in Play

Blockchain data shows that wallets holding more than 1,000 BTC have significantly increased their positions. Analysts estimate that whale inflows exceeded $3 billion, marking one of the most aggressive accumulation phases since early 2021.

Key factors driving whale buying:

- Halving cycle anticipation: With the next Bitcoin halving approaching, whales may be front-running supply shocks.

- Institutional inflows: Spot Bitcoin ETFs and custody solutions have improved liquidity and confidence.

- Macro hedge: Bitcoin continues to attract capital as a hedge against inflation and currency volatility.

Ethereum Gains Momentum

Ethereum has also benefited from this wave of market confidence. As Bitcoin consolidates under whale support, ETH is experiencing stronger inflows due to:

- Staking yields continuing to attract investors.

- Layer-2 adoption expanding ETH’s network utility.

- Speculation on ETH ETF approvals, which could mirror Bitcoin’s institutional boost.

Rising Star Tokens Ride the Wave

Beyond Bitcoin and Ethereum, several altcoins have enjoyed sharp rallies as investor sentiment improves:

- Solana (SOL): Increased developer activity and network upgrades.

- Avalanche (AVAX): Growing DeFi ecosystem and enterprise partnerships.

- Chainlink (LINK): Rising demand for oracle solutions in DeFi protocols.

These “rising star” tokens have outperformed the broader market, as traders look for higher-beta plays while whales stabilize Bitcoin.

Market Implications

- Short-Term: Whale accumulation provides a price floor for Bitcoin, reducing downside risk.

- Medium-Term: Capital rotation into ETH and altcoins could drive multi-asset rallies.

- Long-Term: Institutional adoption and halving dynamics suggest a structurally bullish backdrop.

Price Target Scenarios

- Bitcoin (BTC):

- Short-Term (1–3 months): $62K–$68K if whale buying persists.

- Medium-Term (3–6 months): $70K–$80K with ETF inflows.

- Long-Term (12 months): $90K–$120K if halving supply shock plays out.

- Ethereum (ETH):

- Short-Term: $3,000–$3,400.

- Medium-Term: $3,500–$4,000 on ETF speculation.

- Long-Term: $4,500–$5,500 if adoption trends continue.

- Altcoins (SOL, AVAX, LINK):

- High beta potential: +20–40% upside in short bursts, but also subject to sharp corrections.

Conclusion

The addition of $3 billion in Bitcoin whale accumulation signals renewed institutional and high-net-worth conviction in crypto markets. Ethereum and leading altcoins have been clear beneficiaries, enjoying both liquidity flows and speculative momentum.

For investors, the message is clear: while volatility remains inherent, whale accumulation highlights a long-term bullish foundation for digital assets.

📖 Read them on our blog: Investment Blog

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter

0 Comments