Introduction

Toyota Motor Corp., the world’s largest car manufacturer by volume, just shocked markets by cutting its annual profit forecast by 600 billion yen after absorbing nearly $3 billion in losses tied to aggressive U.S. tariffs. Despite the short-term hit, Toyota still posted record global sales for the first half of the year.

With a revised outlook, weakening yen, and tariffs expected to fall from 25% to 15% in coming quarters, investors are asking: Is this just short-term turbulence, or the ultimate buying opportunity?

One of the Best Broker in Europe

European investors looking to take advantage of Toyota’s potential rebound should consider platforms like DEGIRO, Interactive Brokers, or Saxo Bank. These brokers provide access to Japanese and US-listed shares, competitive fees, and tools for macro-driven strategies—ideal for acting fast on international equity plays.

Financial Performance

Revenue for Q2 came in at 12.25 trillion yen, slightly ahead of expectations. Operating profit, however, fell 11% year-over-year to 1.17 trillion yen. Net income dropped a staggering 37% to 841.3 billion yen due to the impact of U.S. tariffs and yen fluctuations.

Toyota revised its full-year operating income forecast to 3.2 trillion yen, down from 3.8 trillion, citing increased costs and exchange rate headwinds.

Key Highlights

- U.S. tariffs led to 450 billion yen in direct profit losses

- June quarter results still beat analyst expectations on revenue

- Net income sharply down but sales volume remains historically high

- Japan-to-U.S. vehicle export value down 25% YoY, but volume up 4.6%

- Trump-Japan deal signals tariff rate to fall from 25% to 15%

Profitability and Valuation

Despite short-term margin compression, Toyota remains highly profitable at scale. Its forward P/E is around 10, well below U.S. peers like Tesla or GM. Operating margins are under pressure but expected to stabilize as tariffs ease and currency movements normalize.

Toyota’s valuation appears compelling, especially for long-term value investors seeking global exposure at a discount.

Debt and Leverage

Toyota maintains a conservative balance sheet, with robust cash flows supporting capex and R&D despite tariff-related setbacks. Debt ratios remain healthy, and the company is actively investing in electric vehicles and hydrogen tech, indicating long-term confidence in its growth strategy.

Growth Prospects

Toyota continues to scale aggressively in EVs, hybrids, and next-gen powertrains. Its focus on diversified drivetrains (electric, hybrid, hydrogen) provides resilience in a changing regulatory environment. In parallel, Toyota is expanding its U.S. manufacturing footprint to localize production and minimize future tariff exposure.

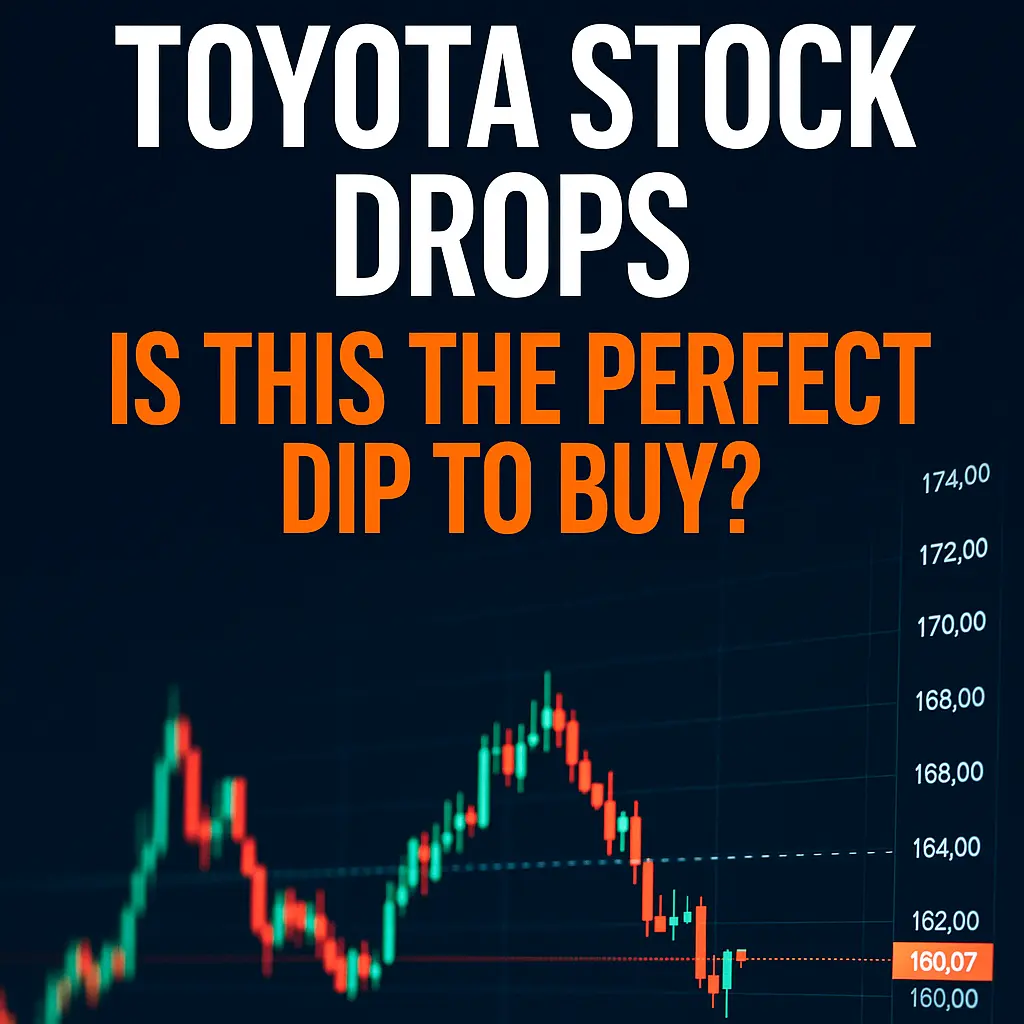

Technical Analysis

As of August 7, 2025, Toyota ADRs (TM) trade near $168.

- Key support: $162

- Short-term resistance: $172

- 200-day moving average: $164

- RSI: 45 (neutral zone, post-selloff)

A hold above $162 could signal a base forming. A breakout above $172 would target higher resistances at $185 and $195.

Potential Catalysts

- Formal tariff reduction from 25% to 15%

- Renewed buying interest on oversold conditions

- Weakening yen improves overseas profit margins

- U.S. and EU demand remains stable despite macro headwinds

- Toyota’s localization efforts offsetting geopolitical friction

Leadership and Strategic Direction

Toyota’s management has shown strong adaptability through the crisis. With consistent messaging around cost control, localization, and EV leadership, the company appears focused on long-term shareholder value. Unlike some peers, Toyota has resisted short-term panic and continues to invest in future tech.

Impact of Macroeconomic Factors

Toyota’s results remain highly sensitive to tariffs, yen-dollar exchange rates, and trade negotiations. Inflation and interest rates have also impacted input costs and consumer financing conditions. However, ongoing trade realignments—like the Trump-Japan agreement—are helping to provide clearer visibility for 2026.

Total Addressable Market (TAM)

Toyota operates in a global automotive market estimated to reach over $3.8 trillion by 2030. Within that, its push into EVs, autonomous driving, and mobility services opens new growth verticals. The transition to cleaner energy vehicles remains a multi-decade theme, and Toyota has the infrastructure and capital to play a dominant role.

Market Sentiment and Engagement

Recent sentiment has been cautious but not overly bearish. Analysts expect a rebound in margins from late 2025. Retail forums and institutional reports are beginning to highlight the valuation gap. Options markets show increased activity around $180 and $200 calls for Q4.

Conclusions, Target Price Objectives, and Stop Losses

Toyota is facing short-term pain, but much of it appears priced in. For investors with a medium to long-term outlook, the current weakness could represent a strategic entry.

Target Price Objectives:

Short-Term (1–2 weeks): $172

Medium-Term (2–3 months): $185

Long-Term (6–12 months): $210

Stop Loss Suggestion: $160

Risk/Reward Ratio: Approx. 3:1 based on technical levels

Discover More

For more insights into analyzing value and growth stocks poised for sustainable growth, consider this expert guide. It provides valuable strategies for identifying high-potential value and growth stocks.

We also have other highly attractive stocks in our portfolios. To explore these opportunities, visit our investment portfolios.

This analysis serves as information only and should not be interpreted as investment advice. Conduct your own research or consult with a financial advisor before making investment decisions.

Looking to Educate Yourself for More Investment Strategies?

Check out our free articles where we share our top investment strategies. They are worth their weight in gold!

📖 Read them on our blog: Investment Blog

For deeper insights into ETF investing, trading, and market strategies, explore these expert guides:

📘 ETF Investing: ETFs and Financial Serenity

📘 Technical Trading: The Art of Technical & Algorithmic Trading

📘 Stock Market Investing: Unearthing Gems in the Stock Market

📘 Biotech Stocks (High Risk, High Reward): Biotech Boom

📘 Crypto Investing & Trading: Cryptocurrency & Blockchain Revolution

Did you find this article insightful? Subscribe to the Bullish Stock Alerts newsletter so you never miss an update and gain access to exclusive stock market insights: https://bullishstockalerts.com/#newsletter.

Avez-vous trouvé cet article utile? Abonnez-vous à la newsletter de Bullish Stock Alerts pour recevoir toutes nos analyses exclusives sur les marchés boursiers : https://bullishstockalerts.com/#newsletter.

0 Comments